US PCE data in focus ahead of next week’s Fed decision

PCE inflation numbers enter the spotlight

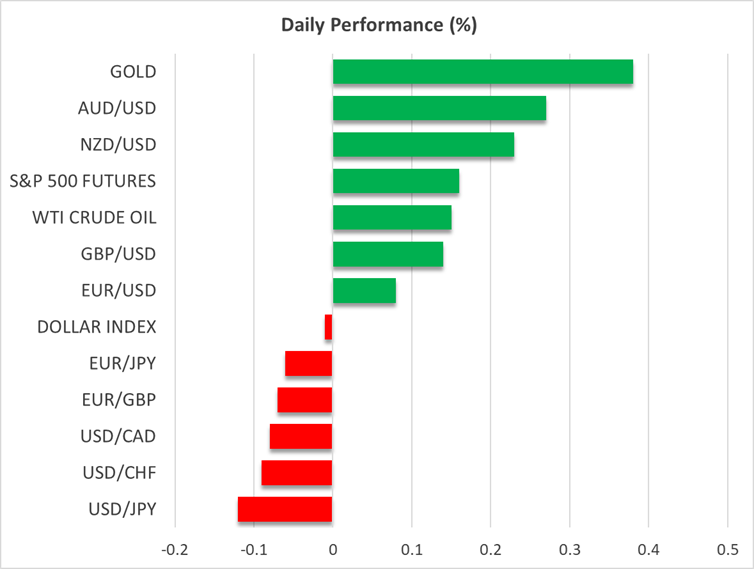

The US dollar rebounded against most of its major peers on Thursday but failed to recover Wednesday’s losses. Today, it is on the back foot again.

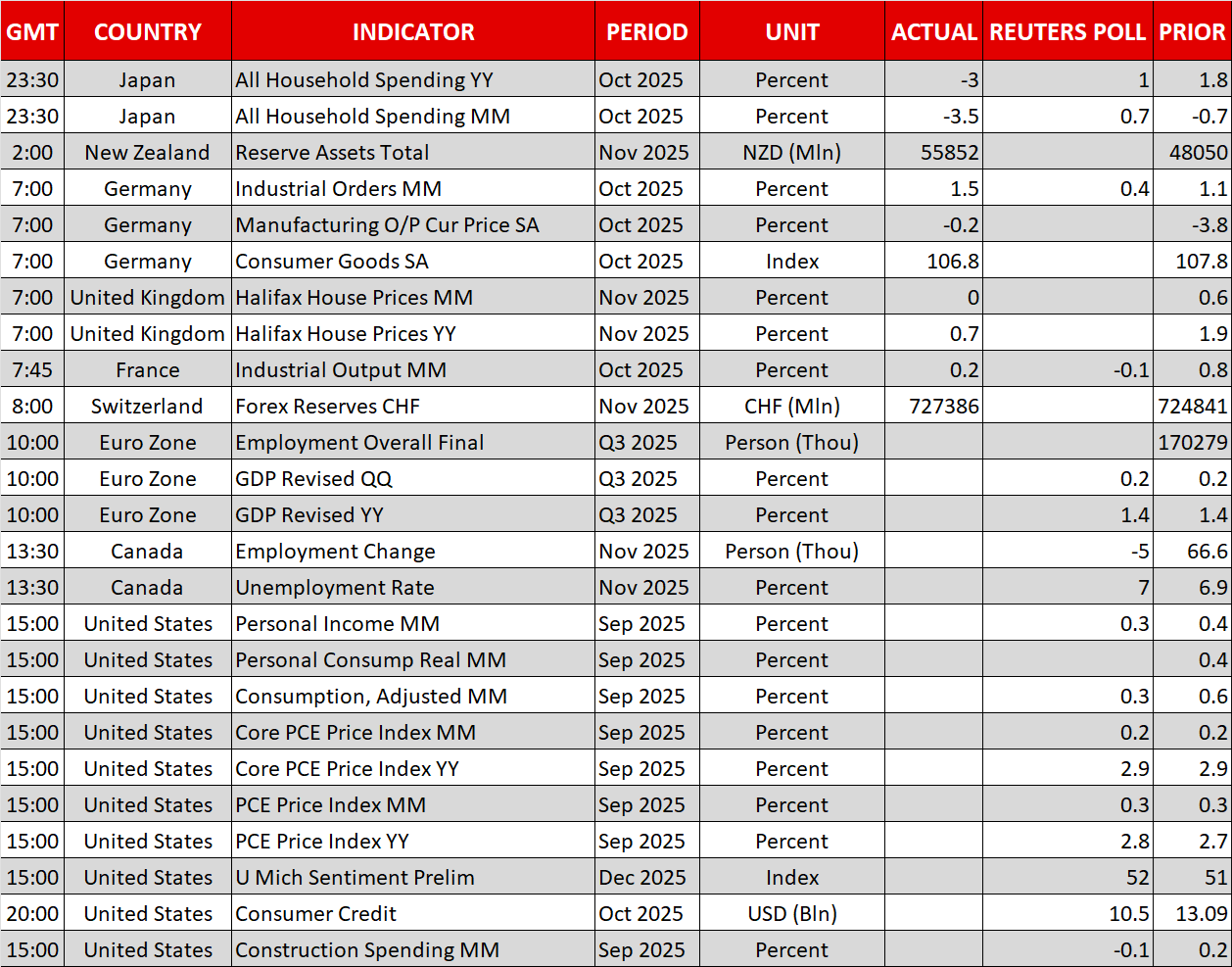

Yesterday’s agenda did not include any major US economic releases and thus, it likely gave dollar traders the opportunity to cover some of their short positions. However, with shutdown-delayed PCE inflation data for September on today’s schedule, the selling resumed.

The headline PCE rate is expected to have risen to 2.8% y/y from 2.7%, while the core one is forecast to have held steady at 2.9%. Should this be the case, investors may scale back some Fed rate cut bets, but expectations of a 25bps rate reduction next week are unlikely to be affected. Investors may decide to reduce the basis points worth of reductions for next year.

After all, Fed officials seem to be more focused on the weakness of the labor market instead of inflation, and with Wednesday’s ADP revealing a 32k job loss for the private sector, there is a strong 85% chance of a 25bps rate cut next week, with investors penciling in nearly another three for next year.

This means that even if potentially sticky inflation data support temporarily the dollar, the prevailing short-term downtrend may resume at least until next week’s FOMC decision. The risk surrounding the decision is for the new dot plot to indicate two rate cuts for next year instead of three. Even with a rate cut being delivered, this could support the dollar as the rate cut is already nearly fully baked into the cake.

Yen rallies on BoJ rate hike bets, aussie gains on RBA poll

The yen recovered more ground yesterday and is extending its advance today as bets of a BoJ rate hike at the upcoming December 19 gathering are piling up. From around 30% the probability of such a move jumped to around 75%, following reports that add credence to recent remarks by Governor Ueda about pressing the rate hike button soon.

A Bloomberg report noted today that BoJ policymakers are ready to raise rates this month in the absence of any major economic shocks, while yesterday, Reuters cited three sources as saying that a December hike was likely.

The aussie is extending its steep rally today after a Reuters poll revealed that now economists expect the RBA to hold its cash rate at 3.60% through 2026. This comes in contrast to a November poll that showed at least one quarter-point cut for next year.

Investors bets of another rate cut faded after the latest monthly CPI data revealed that inflation rose to 3.2%, above the RBA’s 2-3% target range, and should the RBA maintain a hawkish stance at next week’s gathering, the Australian dollar is likely to continue marching north.

Stocks and gold await US PCE inflation numbers

On Wall Street, the Nasdaq and the S&P 500 rose somewhat, with the Dow Jones finishing the session virtually unchanged. Stock futures are painting a similar picture today ahead of the PCE data, with any signs of inflation stickiness having the potential to trigger a pullback.

Gold rebounded somewhat yesterday, and it is extending its gains today as Fed rate cut bets are one of the main supportive factors for the precious metal. That said, for the outlook to become brighter, a break above the $4,265 zone may be needed, a move that could pave the way for another test near the record high of $4,381.46, achieved on October 20.