Will Gold take a breather after a three-week rally?

Gold opened neutral around Friday’s closing price of 3,023 as the final trading week of March kicked off. The precious metal moved to the sidelines as investors speculated that Trump’s reciprocal tariffs would be less punitive than previously expected – likely excluding some countries and avoiding sector-specific barriers.

However, the bounce near the psychological 3,000 mark revealed that demand for safe-haven assets remains intact, while expectations of further rate cuts in the US also helped support prices.

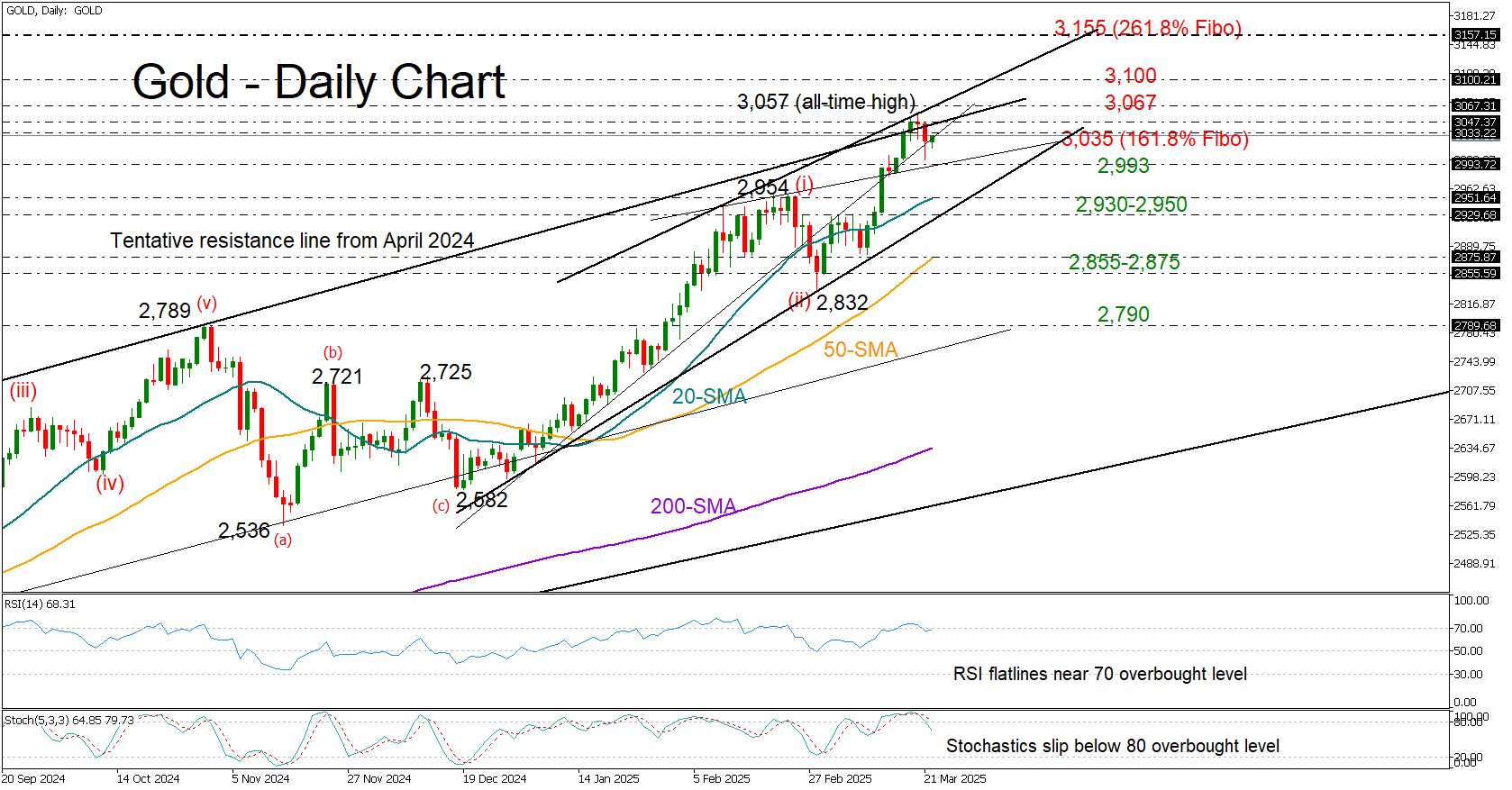

Still, with the RSI and the stochastic oscillator tilting south after peaking in the overbought zone, questions arise about how long gold can maintain its footing after a strong three-week bullish streak.

The constraining line from February at 2,993 could provide protection in the coming sessions if downside pressures resurface. If not, the bears could push the price toward the crucial 2,930-2,950 zone, where the 20-day simple moving average (SMA) and the tentative support trendline from January are positioned. A break below this level would weaken the short-term outlook and likely trigger a stronger selling wave toward the 50-day SMA, currently at 2,875.

On the upside, a sustainable move above 3,067 may activate fresh buying orders, bringing the 3,100 round level next into view. A continuation higher could then challenge the 261.8% Fibonacci extension of the previous decline at 3,155.

Summing up, gold’s positive momentum may take a breather in the coming sessions. However, only a drop beneath 2,930-2,950 would make the current uptrend less credible.

.jpg)