Edit Your Comment

Can forex trading make you rich ?

Jan 12, 2018 at 17:46

會員從Nov 26, 2017開始

14帖子

AniLorak posted:drwei posted:

i don't understand why there are so few people trading forex in china. back in 2009,there were a lot of people on chinese forex bbs .i feel some regret.

What’s the problem actually in there?

I don't know, maybe it's more difficult to make money.

Jan 14, 2018 at 06:39

會員從Jan 12, 2018開始

8帖子

I do not think ... Although you can get a good benefit if you know how to advise me with good agents and especially with all the great information found on the web, it can be advantageous and not so much, but finally with advice maybe this can serve as a good extra income.

Jan 14, 2018 at 14:27

(已編輯Jan 14, 2018 at 14:27)

會員從Dec 11, 2015開始

1462帖子

drwei posted:mlawson71 posted:

What's the situation with Chinese Forex regulation?

foreign exchange control is very strong,Each person limits the purchase of $50,000 a year.

I see. Is it possible that has an effect on the popularity of Forex trading in China?

Jan 15, 2018 at 17:23

會員從Apr 18, 2017開始

700帖子

Pikasso posted:Have you ever seen any successful trader with the automatic trading system? I’m asking because, I see all of successful Forex traders trade manually!

forex can make you rich if you will trade systmatically with low risks and it is better if your trading system is automated. It will exclude human factor to break the rules.

Jan 18, 2018 at 09:57

會員從Feb 22, 2011開始

4573帖子

AniLorak posted:Pikasso posted:Have you ever seen any successful trader with the automatic trading system? I’m asking because, I see all of successful Forex traders trade manually!

forex can make you rich if you will trade systmatically with low risks and it is better if your trading system is automated. It will exclude human factor to break the rules.

I do on contrary make profit only with EAs or algos.

automatic system will trade

- without emotions

- without delay

- without rest all the time

- can be backtested not like manual trading

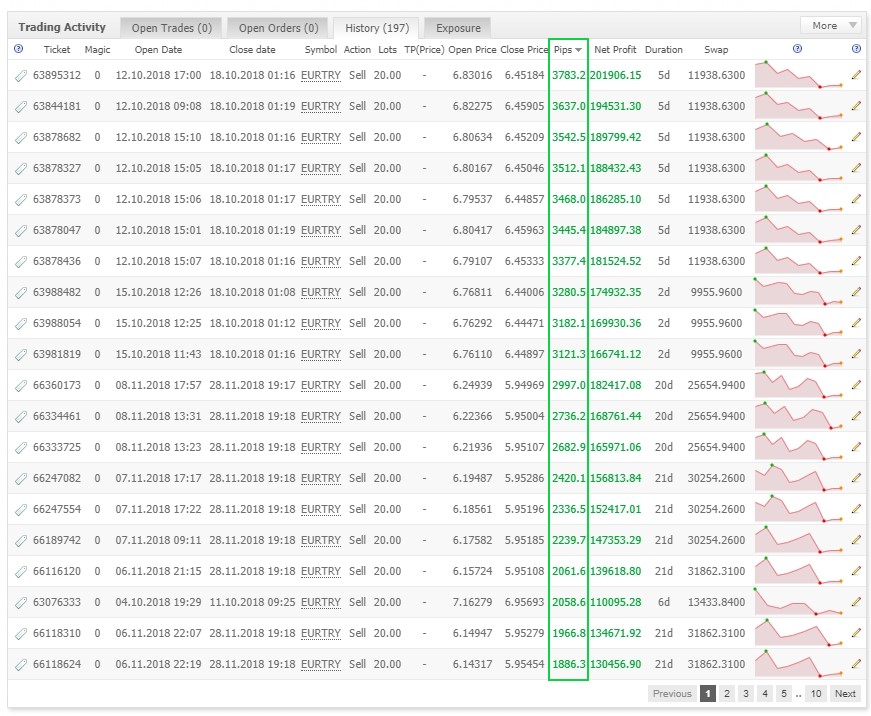

e.g. fully automated system

https://www.myfxbook.com/members/togr/advanced/2044496

會員從Dec 28, 2017開始

2帖子

Jan 19, 2018 at 08:42

會員從Dec 28, 2017開始

2帖子

As far as I know, 75% of the trading done by institutional traders is done automatically. The traders just overview the EAs and change the algorithm parameters depending on market conditions, sentiment, economic calendar, etc. And it should be like that, when you trade large volumes you need EAs to keep you mentally healthy. Imagine opening each position with a volume of 100 lots for 8 hours/day every day.....It's just impossible not to go down emotion avenue.

Personally I trade manual because I couldn't find a good and stable EA yet and, I have to admit, I'm a bit addicted to the trading adrenaline :))))

Personally I trade manual because I couldn't find a good and stable EA yet and, I have to admit, I'm a bit addicted to the trading adrenaline :))))

會員從Jan 25, 2010開始

1288帖子

Jan 19, 2018 at 18:38

(已編輯Jan 19, 2018 at 18:39)

會員從Jan 25, 2010開始

1288帖子

Ciprian_Moraru posted:

As far as I know, 75% of the trading done by institutional traders is done automatically. The traders just overview the EAs and change the algorithm parameters depending on market conditions, sentiment, economic calendar, etc. And it should be like that, when you trade large volumes you need EAs to keep you mentally healthy. Imagine opening each position with a volume of 100 lots for 8 hours/day every day.....It's just impossible not to go down emotion avenue.

Personally I trade manual because I couldn't find a good and stable EA yet and, I have to admit, I'm a bit addicted to the trading adrenaline :))))

You raise two good points; I concur:

1. Emotions when trading large lots.

2. Lack of a good and stable EA.

Perhaps keeping your account small is the answer? Or expanding the mind to better cope with large sums?

Manual trading can get me better results than automated... if only I could be consistently profitable too:

forex_trader_486496

會員從Jan 03, 2018開始

4帖子

Jan 21, 2018 at 07:14

會員從Jan 03, 2018開始

4帖子

Ciprian_Moraru posted:

As far as I know, 75% of the trading done by institutional traders is done automatically. The traders just overview the EAs and change the algorithm parameters depending on market conditions, sentiment, economic calendar, etc. And it should be like that, when you trade large volumes you need EAs to keep you mentally healthy. Imagine opening each position with a volume of 100 lots for 8 hours/day every day.....It's just impossible not to go down emotion avenue.

Personally I trade manual because I couldn't find a good and stable EA yet and, I have to admit, I'm a bit addicted to the trading adrenaline :))))

How do you know about that? I heard that too but I want to know if that is true. Thanks.

Jan 21, 2018 at 07:27

會員從Feb 22, 2011開始

4573帖子

Ciprian_Moraru posted:

As far as I know, 75% of the trading done by institutional traders is done automatically. The traders just overview the EAs and change the algorithm parameters depending on market conditions, sentiment, economic calendar, etc. And it should be like that, when you trade large volumes you need EAs to keep you mentally healthy. Imagine opening each position with a volume of 100 lots for 8 hours/day every day.....It's just impossible not to go down emotion avenue.

Personally I trade manual because I couldn't find a good and stable EA yet and, I have to admit, I'm a bit addicted to the trading adrenaline :))))

I know what you mean. But such adrenaline could be pretty costly :)

Jan 21, 2018 at 07:50

會員從Apr 18, 2017開始

700帖子

Ciprian_Moraru posted:

As far as I know, 75% of the trading done by institutional traders is done automatically. The traders just overview the EAs and change the algorithm parameters depending on market conditions, sentiment, economic calendar, etc. And it should be like that, when you trade large volumes you need EAs to keep you mentally healthy. Imagine opening each position with a volume of 100 lots for 8 hours/day every day.....It's just impossible not to go down emotion avenue.

Personally I trade manual because I couldn't find a good and stable EA yet and, I have to admit, I'm a bit addicted to the trading adrenaline :))))

That’s not true ! Most of the institutional Forex traders are trading manually! Yes, they are!

Jan 22, 2018 at 09:31

會員從Feb 22, 2011開始

4573帖子

BluePanther posted:Ciprian_Moraru posted:

As far as I know, 75% of the trading done by institutional traders is done automatically. The traders just overview the EAs and change the algorithm parameters depending on market conditions, sentiment, economic calendar, etc. And it should be like that, when you trade large volumes you need EAs to keep you mentally healthy. Imagine opening each position with a volume of 100 lots for 8 hours/day every day.....It's just impossible not to go down emotion avenue.

Personally I trade manual because I couldn't find a good and stable EA yet and, I have to admit, I'm a bit addicted to the trading adrenaline :))))

You raise two good points; I concur:

1. Emotions when trading large lots.

2. Lack of a good and stable EA.

Perhaps keeping your account small is the answer? Or expanding the mind to better cope with large sums?

Manual trading can get me better results than automated... if only I could be consistently profitable too:

https://www.myfxbook.com/files/BluePanther/Clipboard01_jF.jpg

The point is very simple

You should have well defined trading plan (or dont trade at all)

Such well defined trading plan can be always transformed to EA.

EA will always execute trades more efficiently than you

EA is always easy to backtest and even forward test than manual trading.

會員從Jan 25, 2010開始

1288帖子

Jan 22, 2018 at 10:58

(已編輯Jan 22, 2018 at 11:01)

會員從Jan 25, 2010開始

1288帖子

theHand posted:

Made Soros a billionare.

Forex can make anyone a billionaire if you know which way market will move:

Soros is on the INSIDE. He gets INSIDE knowledge on future market moves and government decisions. How do u think he nearly broke the Bank of England? Trading like a normal trader or taking EXCESSIVELY LARGE positions?

He knows what the market will do... u can be rich if u knew too.

@togr : not a publicly available EA. None of the common EAs sold for $100 will make a person rich. They are just "sales for a marketer", not "trade secrets of a rich trader".

Rich traders use their brains. They have no need of an EA because they are not lazy, and can make good money without programming an EA.

*商業用途和垃圾郵件將不被容忍,並可能導致帳戶終止。

提示:發佈圖片/YouTube網址會自動嵌入到您的帖子中!

提示:鍵入@符號,自動完成參與此討論的用戶名。