Edit Your Comment

Can forex trading make you rich ?

Jan 11, 2018 at 15:07

Member Since Nov 26, 2017

14 posts

togr posted:drwei posted:

i don't understand why there are so few people trading forex in china. back in 2009,there were a lot of people on chinese forex bbs .i feel some regret.

Isnt it prohibited by goverment?

i think that is one of the reasons.

Jan 12, 2018 at 17:46

Member Since Nov 26, 2017

14 posts

AniLorak posted:drwei posted:

i don't understand why there are so few people trading forex in china. back in 2009,there were a lot of people on chinese forex bbs .i feel some regret.

What’s the problem actually in there?

I don't know, maybe it's more difficult to make money.

Member Since Dec 11, 2015

1462 posts

Jan 13, 2018 at 15:47

Member Since Dec 11, 2015

1462 posts

What's the situation with Chinese Forex regulation?

Jan 14, 2018 at 06:39

Member Since Jan 12, 2018

8 posts

I do not think ... Although you can get a good benefit if you know how to advise me with good agents and especially with all the great information found on the web, it can be advantageous and not so much, but finally with advice maybe this can serve as a good extra income.

Member Since Dec 11, 2015

1462 posts

Jan 14, 2018 at 14:27

(edited Jan 14, 2018 at 14:27)

Member Since Dec 11, 2015

1462 posts

drwei posted:mlawson71 posted:

What's the situation with Chinese Forex regulation?

foreign exchange control is very strong,Each person limits the purchase of $50,000 a year.

I see. Is it possible that has an effect on the popularity of Forex trading in China?

Jan 15, 2018 at 17:23

Member Since Apr 18, 2017

700 posts

Pikasso posted:Have you ever seen any successful trader with the automatic trading system? I’m asking because, I see all of successful Forex traders trade manually!

forex can make you rich if you will trade systmatically with low risks and it is better if your trading system is automated. It will exclude human factor to break the rules.

Member Since Feb 22, 2011

4573 posts

Jan 18, 2018 at 09:57

Member Since Feb 22, 2011

4573 posts

AniLorak posted:Pikasso posted:Have you ever seen any successful trader with the automatic trading system? I’m asking because, I see all of successful Forex traders trade manually!

forex can make you rich if you will trade systmatically with low risks and it is better if your trading system is automated. It will exclude human factor to break the rules.

I do on contrary make profit only with EAs or algos.

automatic system will trade

- without emotions

- without delay

- without rest all the time

- can be backtested not like manual trading

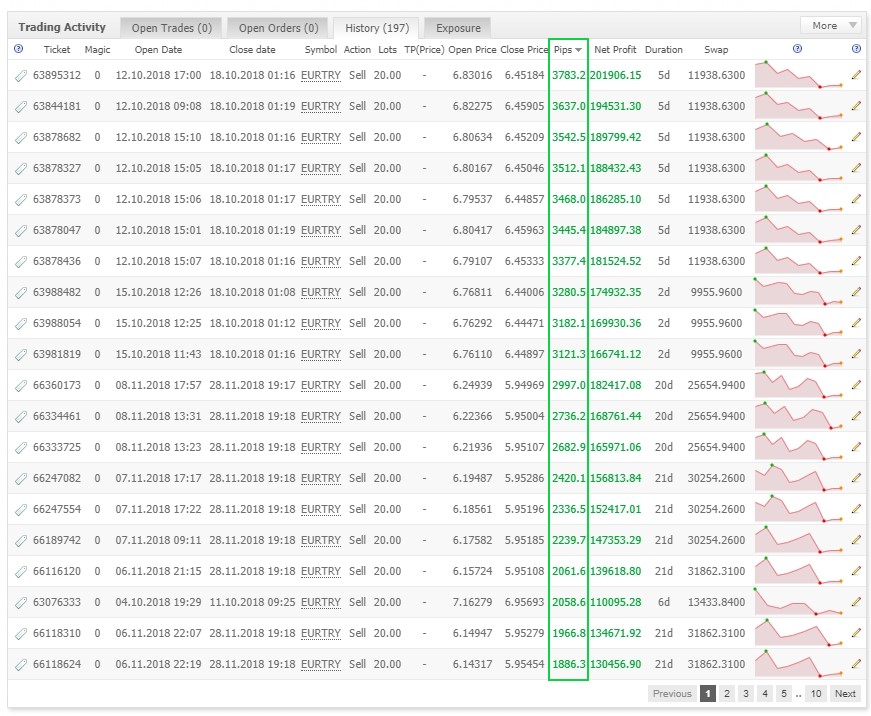

e.g. fully automated system

https://www.myfxbook.com/members/togr/advanced/2044496

Member Since Dec 28, 2017

2 posts

Jan 19, 2018 at 08:42

Member Since Dec 28, 2017

2 posts

As far as I know, 75% of the trading done by institutional traders is done automatically. The traders just overview the EAs and change the algorithm parameters depending on market conditions, sentiment, economic calendar, etc. And it should be like that, when you trade large volumes you need EAs to keep you mentally healthy. Imagine opening each position with a volume of 100 lots for 8 hours/day every day.....It's just impossible not to go down emotion avenue.

Personally I trade manual because I couldn't find a good and stable EA yet and, I have to admit, I'm a bit addicted to the trading adrenaline :))))

Personally I trade manual because I couldn't find a good and stable EA yet and, I have to admit, I'm a bit addicted to the trading adrenaline :))))

Member Since Jan 25, 2010

1288 posts

Jan 19, 2018 at 18:38

(edited Jan 19, 2018 at 18:39)

Member Since Jan 25, 2010

1288 posts

Ciprian_Moraru posted:

As far as I know, 75% of the trading done by institutional traders is done automatically. The traders just overview the EAs and change the algorithm parameters depending on market conditions, sentiment, economic calendar, etc. And it should be like that, when you trade large volumes you need EAs to keep you mentally healthy. Imagine opening each position with a volume of 100 lots for 8 hours/day every day.....It's just impossible not to go down emotion avenue.

Personally I trade manual because I couldn't find a good and stable EA yet and, I have to admit, I'm a bit addicted to the trading adrenaline :))))

You raise two good points; I concur:

1. Emotions when trading large lots.

2. Lack of a good and stable EA.

Perhaps keeping your account small is the answer? Or expanding the mind to better cope with large sums?

Manual trading can get me better results than automated... if only I could be consistently profitable too:

forex_trader_486496

Member Since Jan 03, 2018

4 posts

Jan 21, 2018 at 07:14

Member Since Jan 03, 2018

4 posts

Ciprian_Moraru posted:

As far as I know, 75% of the trading done by institutional traders is done automatically. The traders just overview the EAs and change the algorithm parameters depending on market conditions, sentiment, economic calendar, etc. And it should be like that, when you trade large volumes you need EAs to keep you mentally healthy. Imagine opening each position with a volume of 100 lots for 8 hours/day every day.....It's just impossible not to go down emotion avenue.

Personally I trade manual because I couldn't find a good and stable EA yet and, I have to admit, I'm a bit addicted to the trading adrenaline :))))

How do you know about that? I heard that too but I want to know if that is true. Thanks.

Member Since Feb 22, 2011

4573 posts

Jan 21, 2018 at 07:27

Member Since Feb 22, 2011

4573 posts

Ciprian_Moraru posted:

As far as I know, 75% of the trading done by institutional traders is done automatically. The traders just overview the EAs and change the algorithm parameters depending on market conditions, sentiment, economic calendar, etc. And it should be like that, when you trade large volumes you need EAs to keep you mentally healthy. Imagine opening each position with a volume of 100 lots for 8 hours/day every day.....It's just impossible not to go down emotion avenue.

Personally I trade manual because I couldn't find a good and stable EA yet and, I have to admit, I'm a bit addicted to the trading adrenaline :))))

I know what you mean. But such adrenaline could be pretty costly :)

Jan 21, 2018 at 07:50

Member Since Apr 18, 2017

700 posts

Ciprian_Moraru posted:

As far as I know, 75% of the trading done by institutional traders is done automatically. The traders just overview the EAs and change the algorithm parameters depending on market conditions, sentiment, economic calendar, etc. And it should be like that, when you trade large volumes you need EAs to keep you mentally healthy. Imagine opening each position with a volume of 100 lots for 8 hours/day every day.....It's just impossible not to go down emotion avenue.

Personally I trade manual because I couldn't find a good and stable EA yet and, I have to admit, I'm a bit addicted to the trading adrenaline :))))

That’s not true ! Most of the institutional Forex traders are trading manually! Yes, they are!

Member Since Feb 22, 2011

4573 posts

Jan 22, 2018 at 09:31

Member Since Feb 22, 2011

4573 posts

BluePanther posted:Ciprian_Moraru posted:

As far as I know, 75% of the trading done by institutional traders is done automatically. The traders just overview the EAs and change the algorithm parameters depending on market conditions, sentiment, economic calendar, etc. And it should be like that, when you trade large volumes you need EAs to keep you mentally healthy. Imagine opening each position with a volume of 100 lots for 8 hours/day every day.....It's just impossible not to go down emotion avenue.

Personally I trade manual because I couldn't find a good and stable EA yet and, I have to admit, I'm a bit addicted to the trading adrenaline :))))

You raise two good points; I concur:

1. Emotions when trading large lots.

2. Lack of a good and stable EA.

Perhaps keeping your account small is the answer? Or expanding the mind to better cope with large sums?

Manual trading can get me better results than automated... if only I could be consistently profitable too:

https://www.myfxbook.com/files/BluePanther/Clipboard01_jF.jpg

The point is very simple

You should have well defined trading plan (or dont trade at all)

Such well defined trading plan can be always transformed to EA.

EA will always execute trades more efficiently than you

EA is always easy to backtest and even forward test than manual trading.

Member Since Jan 25, 2010

1288 posts

Jan 22, 2018 at 10:58

(edited Jan 22, 2018 at 11:01)

Member Since Jan 25, 2010

1288 posts

theHand posted:

Made Soros a billionare.

Forex can make anyone a billionaire if you know which way market will move:

Soros is on the INSIDE. He gets INSIDE knowledge on future market moves and government decisions. How do u think he nearly broke the Bank of England? Trading like a normal trader or taking EXCESSIVELY LARGE positions?

He knows what the market will do... u can be rich if u knew too.

@togr : not a publicly available EA. None of the common EAs sold for $100 will make a person rich. They are just "sales for a marketer", not "trade secrets of a rich trader".

Rich traders use their brains. They have no need of an EA because they are not lazy, and can make good money without programming an EA.

*Commercial use and spam will not be tolerated, and may result in account termination.

Tip: Posting an image/youtube url will automatically embed it in your post!

Tip: Type the @ sign to auto complete a username participating in this discussion.