New Zealand cut the rate, but not the kiwi

New Zealand cut the rate, but not the kiwi

As expected, the Reserve Bank of New Zealand cut its key rate by 25 basis points to 3.25%. This cycle was the sixth easing since August last year, totalling 125 b. p.

In an accompanying statement, the central bank said inflation accelerated to 2.5% y/y and inflation expectations among companies and households have risen. On the other hand, the decline in core inflation gives confidence that inflation will return to the middle of the 1-3 per cent target range in the medium term. Separately, the RBNZ noted the beginning of the economic recovery from the contractionary period.

From higher actual and expected inflation to GDP growth, this is all bullish news supporting the New Zealand dollar against the US dollar despite the widening spread between the key rate in New Zealand and the US.

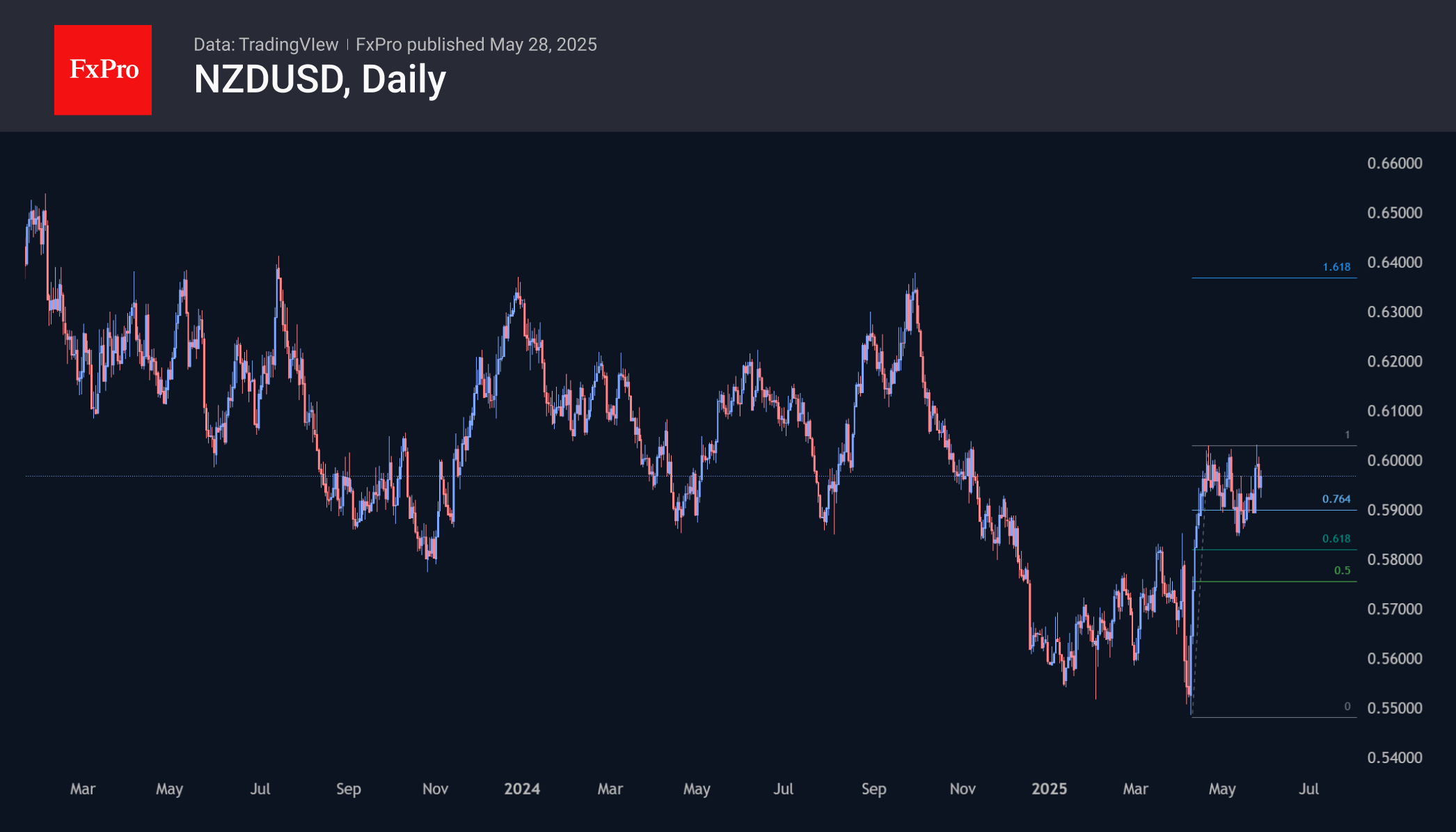

NZDUSD added 0.9% to the lows before the rate decision, rising to 0.5970. These levels near the area of highs since late April and a sequence of increasingly shallower local lows over the last couple of weeks are setting up imminent fresh attempts to break 0.6030.

The decline within this month looks like a temporary correction after a 10% rally off the April lows. A move above 0.6000 would give a range entry with resistance at 0.6360, which has remained impregnable since early 2023.

The New Zealand and Australian dollar trade near year-end levels, behind the three-year highs of the euro and pound against the dollar. However, recent softening in US and Asian tariff rhetoric is inflating the sails of the NZD and AUD.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)