Nosedive in Eurozone economic activity

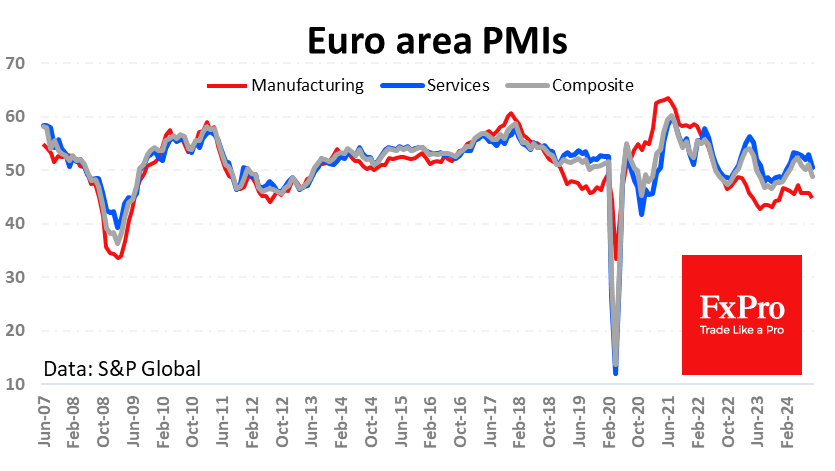

Preliminary Eurozone PMI estimates sent the EURUSD down 0.67% over the hour, as they were much weaker than expected and increased pressure on the ECB to continue easing monetary policy.

This is not the first time that a significant divergence of preliminary PMIs from expectations has become a driver of the European currency market. In terms of impact on the EURUSD, they rival the US employment data.

France's economic boom did not last long, as the composite PMI estimate for September fell to 47.4 from 53.1 the previous month and well below the expected 52.7. The manufacturing PMI has been hovering around 44 for the past three months and has only been above 50 once in the past two years. The services sector fell below the 50 mark to 48.3, its lowest level since March.

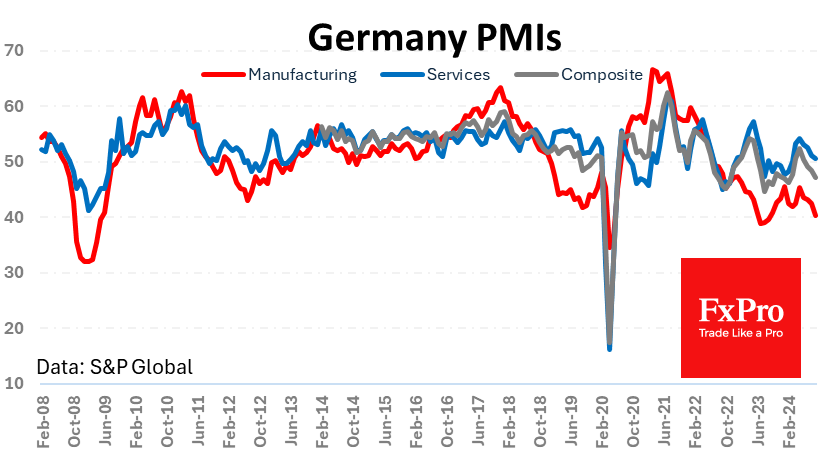

Estimates of business activity for September suggest that German manufacturing activity slowed at the fastest pace in 12 months, continuing its decline since May and falling to 40.3. The services sector also reversed the decline of four months ago, although it remains formally in expansion territory above 50.

Manufacturing activity is contracting at the fastest pace since last December. At 50.5, the services sector is expanding at its slowest pace since February this year, but it's still growing.

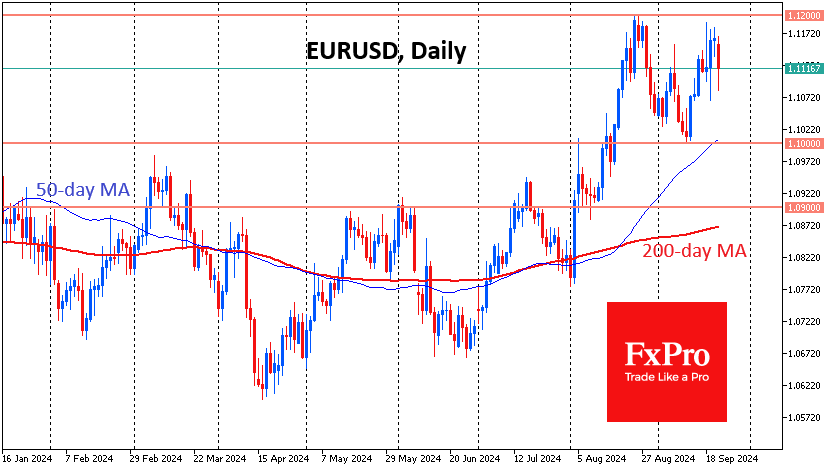

The negative surprise in the data triggered a new downward momentum in the EURUSD and a temporary dip below 1.11. The pair has failed to consolidate above 1.12 for the past month, and the current decline, if sustained, would look like a double top formation with a potential near-term downside target of 1.10 and a more distant one of 1.09. The obstacle to a longer-term weakening of the euro against the dollar is Fed policy. The FOMC cut rates by 0.5% last week, and current forecasts point to more active easing than the ECB.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)