- Beranda

- Komunitas

- Experienced Traders

- Safe-Haven Demand Weakens: Gold Faces Near-Term Downside Pre...

Advertisement

Safe-Haven Demand Weakens: Gold Faces Near-Term Downside Pressure

As geopolitical tensions ease and global trade negotiations progress, risk appetite in the financial markets is steadily improving, leading to a short-term decline in demand for safe-haven assets such as gold.

As geopolitical tensions ease and global trade negotiations progress, risk appetite in the financial markets is steadily improving, leading to a short-term decline in demand for safe-haven assets such as gold.

On the trade front, the U.S. and U.K. have reached a preliminary agreement setting a 10% minimum tariff baseline, signaling positive momentum in international trade relations. More importantly, the U.S. and China have agreed to establish a bilateral economic and trade consultation mechanism, with a joint statement expected to be released on May 12. This reduction in tariff-related uncertainty could further dampen investor interest in gold.

Meanwhile, geopolitical risks are showing signs of de-escalation. India and Pakistan have agreed to a temporary ceasefire, and dialogue efforts between Russia and Ukraine are progressing under EU mediation. Additionally, indirect talks between the U.S. and Iran are reportedly moving forward, further reducing the likelihood of conflict in key regions.

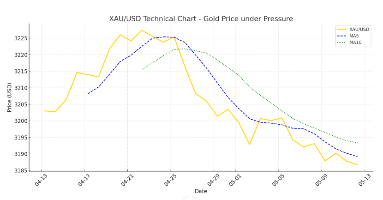

From a technical perspective, gold (XAU/USD) opened lower with a downward gap today, reflecting weakening market demand for hedging. If this trend continues, gold prices are likely to remain under pressure in the near term.

Suggested Trade Strategy:Sell at market priceTake profit target: 3222Stop loss: 3282

In summary, gold bulls are currently lacking strong fundamental support, and the stabilization of both trade and geopolitical dynamics may continue to limit upside potential. Unless an unexpected global event triggers renewed uncertainty, gold may remain on a corrective path in the short run.

This analysis is provided by a financial analyst at "Tradia Capital" and is intended for reference only. Investors should make decisions based on their individual risk tolerance. Markets are risky—proceed with caution.