- Beranda

- Komunitas

- Experienced Traders

- USD/JPY

Advertisement

Edit Your Comment

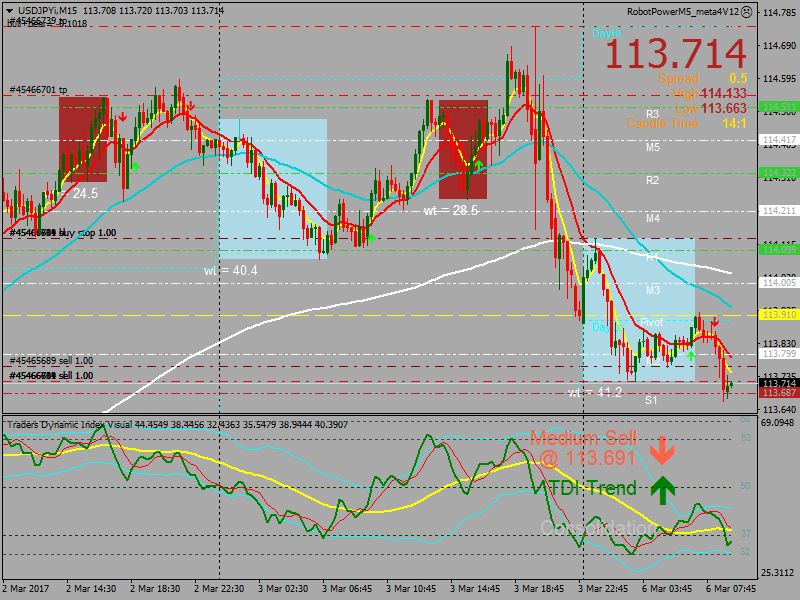

USD/JPY

forex_trader_338100

Member Since Jun 21, 2016

287 posts

Mar 03, 2017 at 07:51

Member Since Jun 21, 2016

287 posts

While USD is holding just below the expected 112.00/114.20 consolidation range indicated yesterday, the rapid pace of the rebound suggests that extension towards 114.95 would not be surprising. This is a rather strong resistance and is unlikely to yield so easily. All in, the current positive under tone is expected to stay intact unless there is a move back below 112.70 (minor support at 113.35)

Mar 03, 2017 at 18:22

Member Since Apr 09, 2016

419 posts

The dollar changed unsignificantly near a seven-week high against other major currencies. Traders are taking profits after the recent rise of the dollar. The dollar has a growing against the probability of a US interest rate hike this month.

Currency pair USD/JPY was down by 0.12% to 114.42.

Currency pair USD/JPY was down by 0.12% to 114.42.

Member Since Oct 02, 2014

905 posts

Mar 06, 2017 at 07:18

Member Since Apr 09, 2010

7 posts

forex_trader_338100

Member Since Jun 21, 2016

287 posts

Mar 07, 2017 at 13:21

Member Since Jun 21, 2016

287 posts

USD/JPY is gaining 0.02% at 113.91 facing the initial hurdle at 114.47 (55-day sma) ahead of 114.97 (high Feb.15) and then 115.09 (50% Fibo of the 2017 drop). On the flip side, a breakdown of 113.53 (low Mar.6) would aim for 113.35 (20-day sma) and finally 113.23 (23.6% Fibo of the 2017 drop).

Mar 08, 2017 at 11:24

Member Since Nov 16, 2015

708 posts

USD/JPY marked neutral session on Tuesday. The dollar added only 9 pips at a closing price of 113.97. Daily extreme values were reached respectively at 113.72 and 114.14. Given the prevailing positive attitude in the short term to overcome the next level will be indicative of further growth.

forex_trader_338100

Member Since Jun 21, 2016

287 posts

Mar 08, 2017 at 11:42

Member Since Jun 21, 2016

287 posts

USD/JPY is gaining 0.07% at 114.06 facing the initial hurdle at 114.41 (55-day sma) ahead of 114.97 (high Feb.15) and then 115.09 (50% Fibo of the 2017 drop). On the flip side, a breakdown of 113.53 (low Mar.6) would aim for 113.46 (20-day sma) and finally 113.23 (23.6% Fibo of the 2017 drop).

forex_trader_338100

Member Since Jun 21, 2016

287 posts

Mar 10, 2017 at 12:22

Member Since Jun 21, 2016

287 posts

The clear break above 114.95 yesterday serves an early indication that USD is about to enter a bullish phase. Upward momentum continues to improve at a rapid pace and from here, the immediate pressure is for a move towards the key resistance at 115.60. A clear break above this level would indicate that a move to 116.85 has started. All in, this pair is expected to stay underpinned with 114.15 acting as a key support. On a shorter-term note, 114.50 is already a strong level.

Member Since Oct 02, 2014

905 posts

forex_trader_338100

Member Since Jun 21, 2016

287 posts

Mar 13, 2017 at 09:28

Member Since Jun 21, 2016

287 posts

A follow through retracement below 114.40-35 immediate support is likely to accelerate the slide towards 50-day SMA support near the 114.00 handle. Below 114.00 mark, the corrective slide could get extended towards 113.75-70 area ahead of 113.20 important support. On the upside, the 115.00 mark now seems to act as immediate resistance, above which the pair is likely to aim back towards 115.50 resistance area. Momentum above multi-week highs resistance now seems to pave way for additional up-move for the pair towards 115.75 intermediate resistance, en-route the 116.00 handle.

forex_trader_338100

Member Since Jun 21, 2016

287 posts

Mar 14, 2017 at 08:39

Member Since Jun 21, 2016

287 posts

Momentum above the 115.00 handle could get extended towards multi-week highs resistance near mid-115.00s, above which the pair seems all set to surpass 115.80 resistance area and head towards reclaiming 116.00 round figure mark. On the downside, 114.65 level now becomes immediate support to defend, which if broken is likely to accelerate the slide towards 114.30 support ahead of 50-day SMA support near the 114.00 handle.

Mar 16, 2017 at 11:24

Member Since Nov 16, 2015

708 posts

The dollar tumbled against the yen on Wednesday. The session starts relatively quietly at a price of 114.73. After the Fed's statement, however, the price went down sharply and the pair hit bottom for the day at 113.17, breaking the first support at 113.53. If bearish sentiment continue to prevail, the pair will test the level at 112.54. The finale on Wednesday was put at 113.46.

Member Since Oct 02, 2014

905 posts

Member Since Nov 02, 2016

1 posts

forex_trader_338100

Member Since Jun 21, 2016

287 posts

Mar 17, 2017 at 13:59

Member Since Jun 21, 2016

287 posts

USDJPY is losing 0.17% at 113.12 and a breakdown of 112.89 (low Mar.16) would aim for 111.67 (low Feb.28) and finally 111.57 (low Feb.7). On the upside, the next hurdle aligns at 113.69 (20-day sma) ahead of 114.03 (55-day sma) and then 114.91 (high Mar.15).

Mar 19, 2017 at 09:09

Member Since Apr 09, 2016

419 posts

The US dollar was down against the Japanese yen on Friday. By the close of US trading, USD / JPY is trading at 112.69, losing 0.55%. I believe that support is now at 112.56, the low of Friday's trading, and the resistance is likely at 115.20 - Tuesday's high.

*Commercial use and spam will not be tolerated, and may result in account termination.

Tip: Posting an image/youtube url will automatically embed it in your post!

Tip: Type the @ sign to auto complete a username participating in this discussion.