EBC Markets Briefing | Australian dollar cheers Chinese massive stimulus

The antipodean currencies scaled multi-month peaks on Wednesday while the yuan hit its strongest level in more than a year, as China's aggressive stimulus package boosted risk appetite.

The Australian dollar later pared some of its gains after data showed domestic consumer prices slowed to a three-year low in August, while core inflation hit its lowest since early 2022.

The PBOC announced plans to lower borrowing costs and inject more funds into the economy, as well as to ease households' mortgage repayment burden, the latest effort to battle deflation.

Iron ore rallied strongly for a second day on speculation that China’s mammoth stimulus would help to bolster demand, raising the possibility that prices may have the momentum to push back into 3-digits.

The RBA on Tuesday reiterated that interest rate cuts were unlikely in the near term as it held policy steady, but softened its hawkish stance by saying monetary tightening was not discussed.

The political pressure is ramping up for an easing. The left-wing Greens demanded the government to engineer a cut in interest rates in exchange for their support in parliament to pass the long-delayed reforms to the RBA.

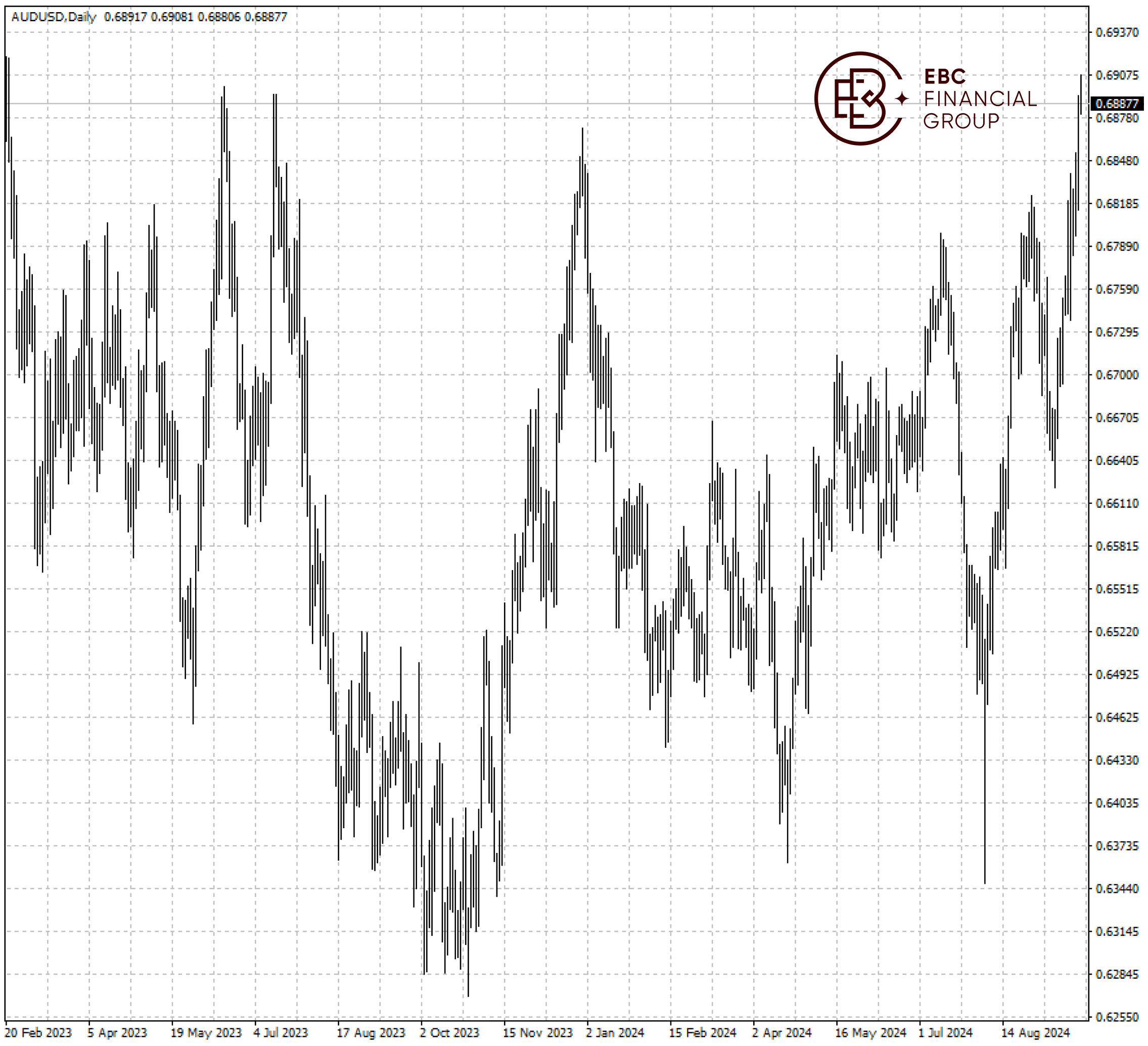

The Australian dollar is facing the major resistance at 0.6900. Another rejection the level could lead to a deep correction towards 0.6600 as seen in 2023.

EBC Institute Perspectives Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC International Business Expansion or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.