EBC Markets Briefing | European stocks increase with massive inflow

European shares ended at a three-week high on Friday, notching up their second straight weekly gain as signs of a potential de-escalation in the US-China trade war encouraged risk-taking.

European equity funds drew massive inflows in the week ended April 16, while US funds faced hefty outflows, as investors continued to shift capital on concerns over US trade tariffs.

European stocks tumbled earlier this month after Washington shocked investors, but have since recovered slightly following his announcement of a 90-day pause on the reciprocal measures.

But European companies are expected to report a drop of 3.5% in first-quarter earnings, while consensus for revenue also continued to worsen with only a 1.4% according to LSEG I/B/E/S data.

The IMF forecast growth in the Euro Area would slow to 0.8% in 2025 and 1.2% in 2026, with both forecasts about 0.2 ppt down from January. Despite that, the situation could be worse across the pond.

It downgraded its forecast for US growth by 0.9 ppt to 1.8% in 2025 and by 0.4 ppt to 1.7 % in 2026. Though it does not forecast a recession in the country, but the odds of a downturn had increased to 37%.

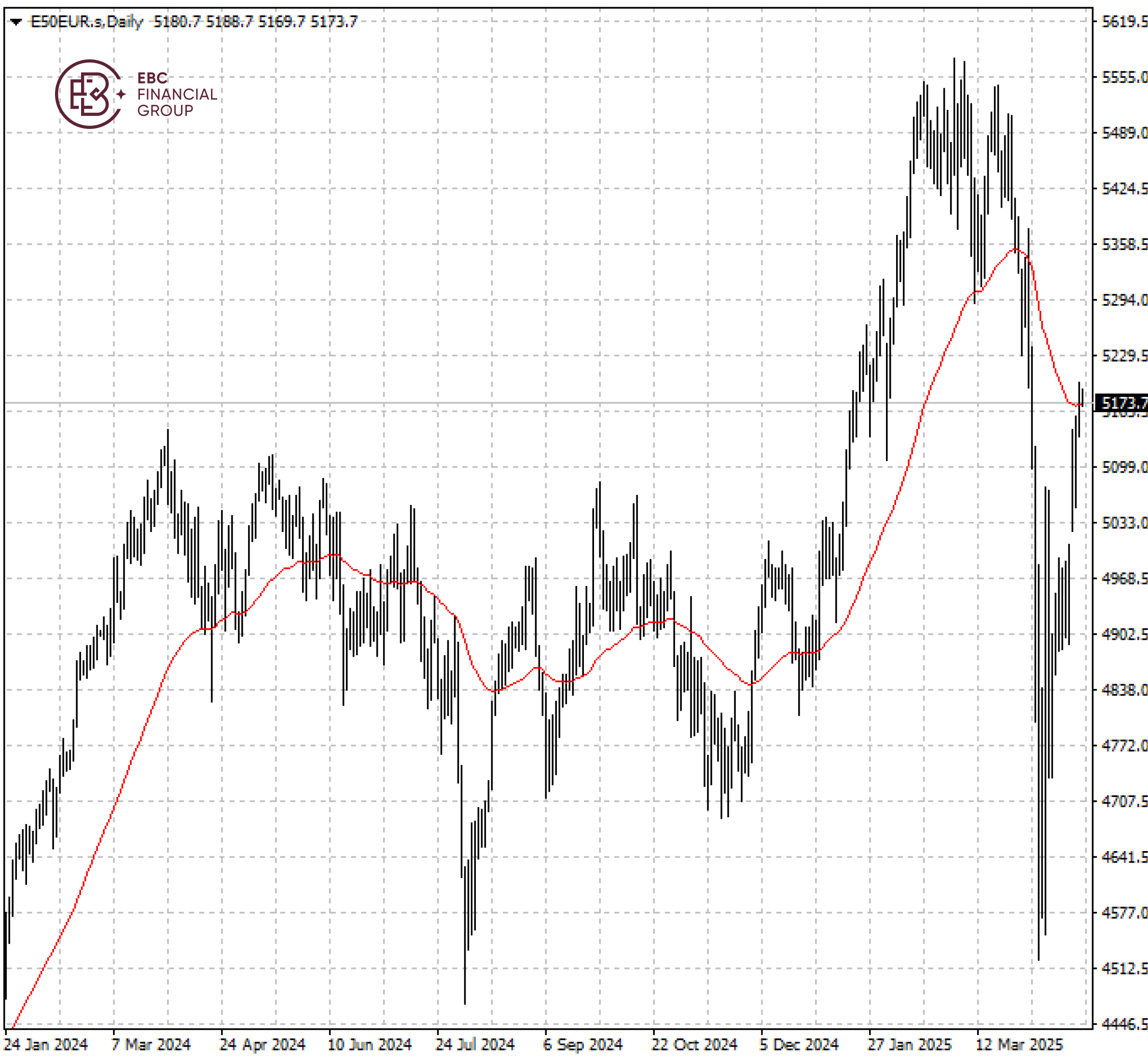

The Stoxx 50 has maintained the upside momentum after a push above the 50 EMA. The initial resistance is seen around 5,230.

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.