The numbered days of S

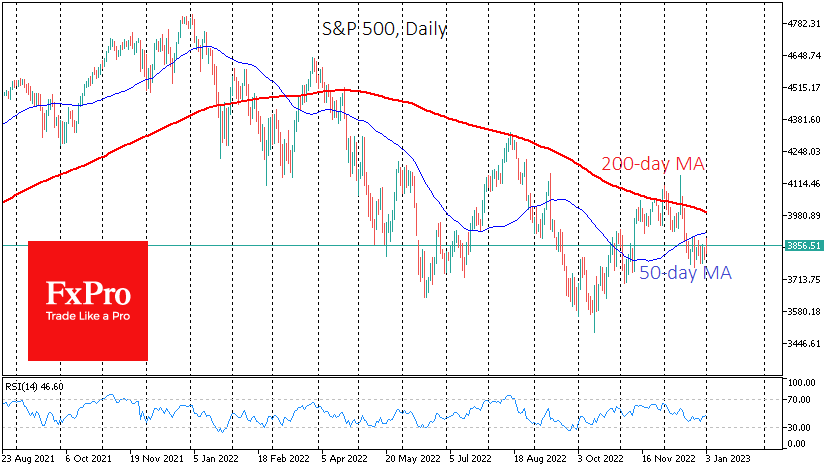

The S&P 500 index peaked in the first trading session of 2022, and it would be naive to expect the index to start rising from the first days of the new year. The stock markets may experience some pressure in the coming weeks, but there is growing confidence that the index will end 2023 with a gain in the region of 4000 from the current levels near 3800.

The short-term risks for the stock indices are now centred around the effects on the economy of the key rate hikes and the assessment of how many more hikes are in store over the coming months.

In previous months, employment and consumer activity data have surprised both markets and the Fed with their strength. However, it is worth preparing for cuts to increasingly extend beyond the tech giants, spreading across the economy.

Although markets and many observers are predicting a recession, the worsening economic data will likely trigger a new sell-off in equities that might take the S&P500 to the 3600 area. Approaching last October’s lows seems enough reason for the Fed to soften its policy stance further.

At the same time, the current slowdown, created by the Fed's hands, is less frightening than the natural recessions of 2000/01, 2007/08 and 2020.

At the same time, there is a significant risk that the US economy still degenerates to the level of a natural recession, requiring stimulus from the central bank and the government to revive growth. In the latter case, the market pressure could go much further than the base case scenario suggests. The disappointment of early buyers and retailers creates the potential for the S&P500 to fall to 3,000 by the end of the year.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)