US inflation sparks risk appetite

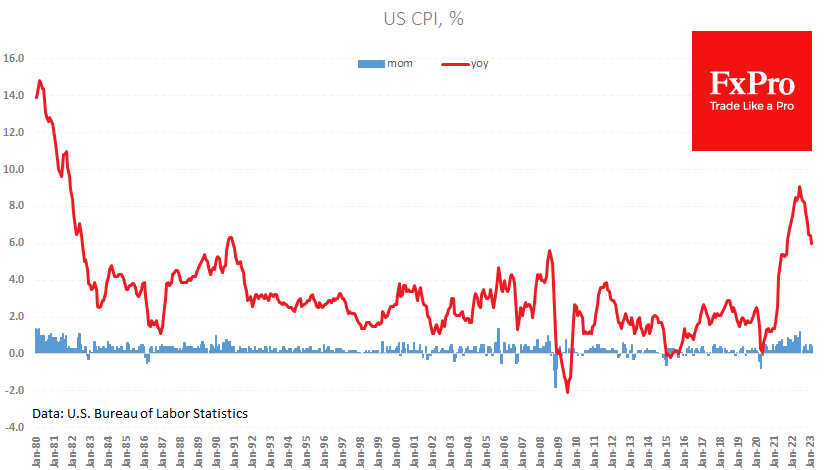

The US consumer price index rose 0.4% in February, slowing the annual rate to 6.0%, in line with economists' expectations. The core price index, which excludes food and energy, rose 0.5% for the month (0.4% expected) and slowed slightly to 5.5% for the year from 5.6%.

It is important to note that the monthly price increase remains above the 0.17% needed to reach an annual inflation rate of 2%. This is despite falling commodity prices. Technically, the latest figures do not support the hypothesis of a sustained slowdown in inflation.

Nevertheless, price increases are not out of control, and the effects of the previous policy tightening are not yet fully reflected in the economic data. The robust labour market data of the last two months has not led to a significant acceleration in the rate of price and wage increases, and this seems to be a good reason for the Fed to raise rates by 25 points and not 50 as feared a week ago, but also not to abandon the rate hike altogether, as was almost done at the height of the banking mini-panic on Monday.

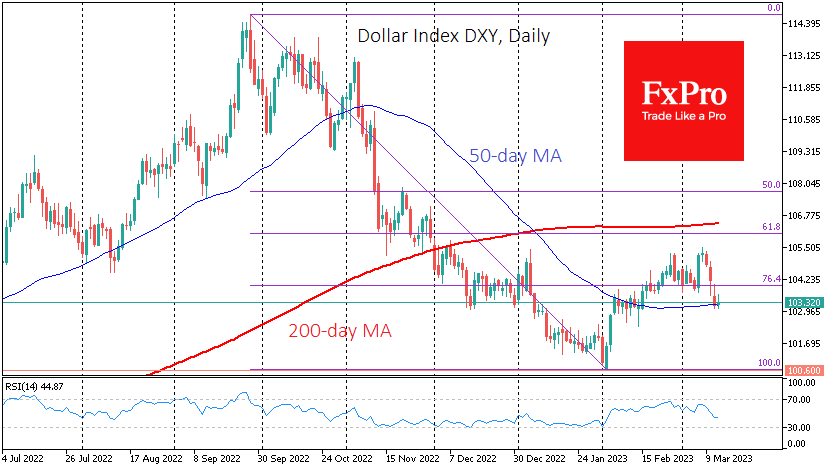

The inflation data did not initially trigger a strong reaction in the currency market. However, in the last few minutes there was some demand for the dollar and for equities, as we see a return of capital to US assets after yesterday's near-panic selling. Looking beyond the next few minutes, it is worth remembering that the recovery in risk demand (stock buying) is also feeding a weaker dollar and supporting commodity prices.

By the FxPro analyst team

-11122024742.png)

-11122024742.png)