- ホーム

- コミュニティ

- 経験豊富なトレーダー

- GBP/USD daily outlook

Advertisement

Edit Your Comment

GBP/USD daily outlook

Apr 08, 2017 at 12:46

Apr 09, 2016からメンバー

419 投稿

The British pound was down against the US dollar on Friday. By the close of US trading, GBP/USD was trading at 1.2367, losing 0.82%. I believe that support is now at 1.2367, the low of Friday's trading, and the resistance is likely at 1.2556, Monday's high.

Dec 07, 2016からメンバー

15 投稿

Jul 10, 2014からメンバー

1114 投稿

Jan 17, 2017からメンバー

8 投稿

Oct 02, 2014からメンバー

905 投稿

forex_trader_338100

Jun 21, 2016からメンバー

287 投稿

Apr 19, 2017 at 10:17

Jun 21, 2016からメンバー

287 投稿

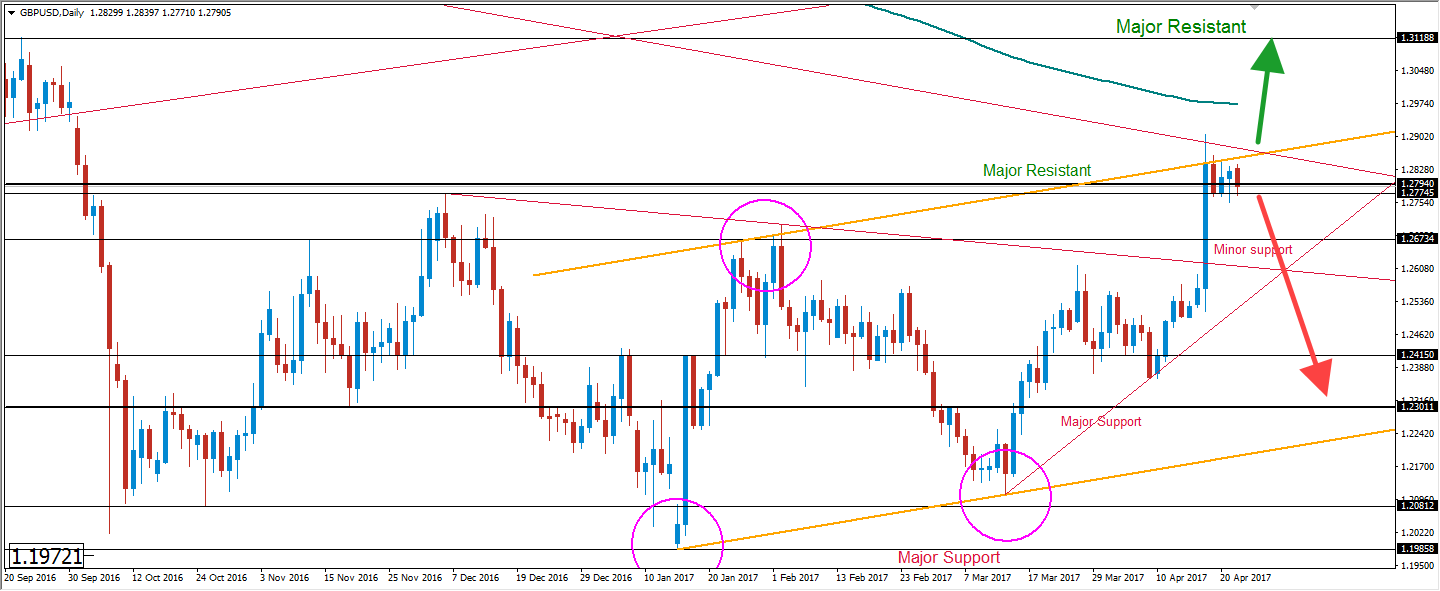

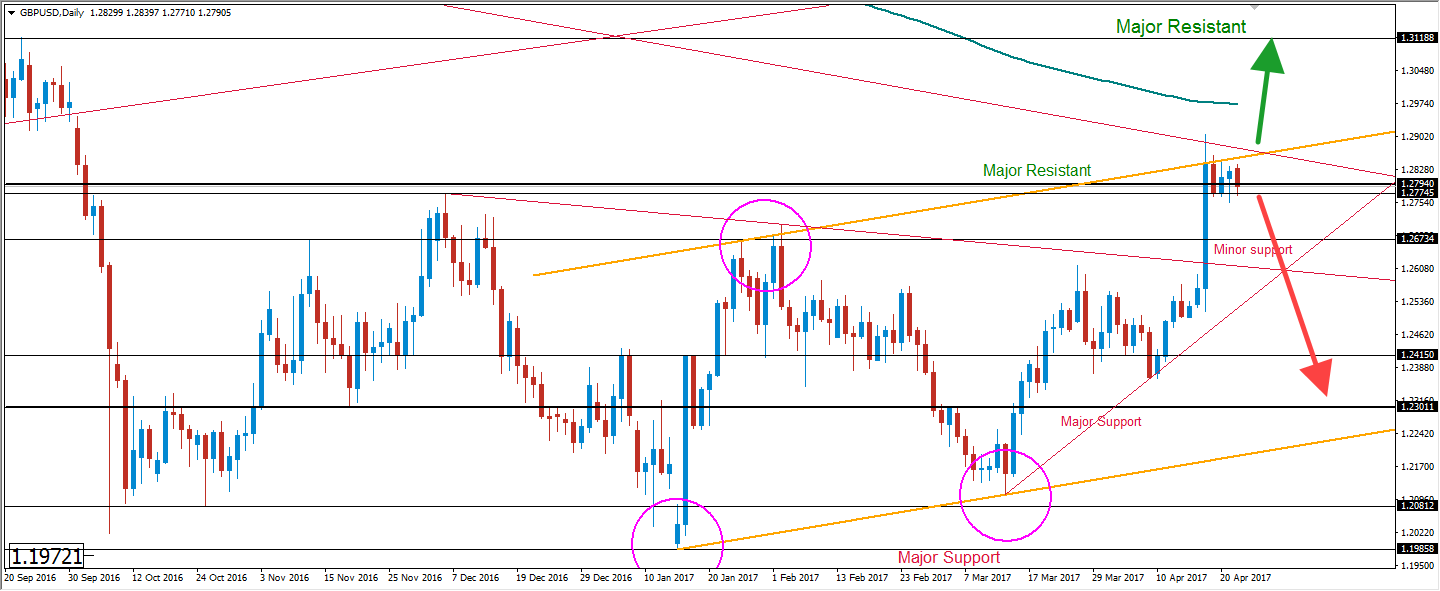

GBPUSD is losing 0.09% at 1.2830 and a break below 1.2623 (200-day sma) would expose 1.2521 (20-day sma) and finally 1.2513 (low Apr.18). On the upside, the next hurdle lines up at 1.2904 (high Apr.18) followed by 1.3125 (high Sep.22 2016) and then 1.3279 (high Sep.15).

Jul 10, 2014からメンバー

1114 投稿

Apr 20, 2017 at 10:57

Nov 16, 2015からメンバー

708 投稿

The British pound recorded a decline against the US dollar on Wednesday. The currency pair opened at 1.2841 and after a volatile session the pound ended at 1.2775. Daytime extreme values were reached at 1.2859 and 1.2769 respectively. The MA took up the beating formation as the indicators developed above the average levels, contributing to positive attitudes. The main challenge remains 1.3090.

forex_trader_338100

Jun 21, 2016からメンバー

287 投稿

Apr 21, 2017 at 09:43

Jun 21, 2016からメンバー

287 投稿

GBPUSD is down 0.11% at 1.2798 and a breakdown of 1.2766 (low Apr.19) would expose 1.2619 (200-day sma) and finally 1.2549 (20-day sma). On the upside, the next next resistance lines up at 1.2904 (high Apr.18) followed by 1.3125 (high Sep.22 2016) and then 1.3279 (high Sep.15)

Apr 22, 2017 at 19:14

Apr 09, 2016からメンバー

419 投稿

As expected, the lightweight bearish correction from Wednesday was only temporary. On Thursday, we saw renewed demand below the 1.2800 level, and although the bullish outcome was not particularly long, rejecting the lower values was almost restored. This holds the "cable" over the 200 MA.

Countering these positive facts, the price movement in the currency pair met support from investors during the Asian session of Friday. Conflicting signals indicate that timely analysis should be done with caution, although at this point I expect the corrective movement to deepen, forming lower bottoms.

Countering these positive facts, the price movement in the currency pair met support from investors during the Asian session of Friday. Conflicting signals indicate that timely analysis should be done with caution, although at this point I expect the corrective movement to deepen, forming lower bottoms.

Oct 02, 2014からメンバー

905 投稿

Apr 24, 2017 at 19:56

Feb 04, 2017からメンバー

40 投稿

French Election could effect more as Macron seems to be ahead in the 2nd round. Macron is anti UK due to the Brexit.

Technical chart is at the resistant zone but momentum is Bullish . However GBPUSD must break the previous Lower Low trendline ( Low of April 13, 2015 and Feb 29, 2016)

Check my Tickmil chart, and you need to update the price action according to your broker)

Technical chart is at the resistant zone but momentum is Bullish . However GBPUSD must break the previous Lower Low trendline ( Low of April 13, 2015 and Feb 29, 2016)

Check my Tickmil chart, and you need to update the price action according to your broker)

Helping new traders

Apr 25, 2017 at 10:26

Mar 23, 2017からメンバー

38 投稿

GBP/USD:

The GBP/USD pair prolonged its consolidative price action and is currently placed closer to the lower band of its five-day old trading range, near 1.2775 levels.

The pair traded with mild bearish bias for the third consecutive session and continued with its struggle to build on previous week's strong up-surge led by the UK PM Theresa May's announcement to call for a snap election on June 8th.

GBP/USD Technical Levels:

On a sustained break below 1.2775-70 support, leading to a subsequent break below mid-1.2700s, would turn the pair vulnerable to aim back towards 1.2710-1.2700 support area. On the flip side, momentum back above the 1.2800 handle might continue to confront resistance near 1.2835-40 resistance area, above which a fresh bout of buying interest is likely to lift the pair back towards reclaiming the 1.2900 handle with some intermediate resistance near 1.2870-75 zone.

Trend Index:

Bullish

The GBP/USD pair prolonged its consolidative price action and is currently placed closer to the lower band of its five-day old trading range, near 1.2775 levels.

The pair traded with mild bearish bias for the third consecutive session and continued with its struggle to build on previous week's strong up-surge led by the UK PM Theresa May's announcement to call for a snap election on June 8th.

GBP/USD Technical Levels:

On a sustained break below 1.2775-70 support, leading to a subsequent break below mid-1.2700s, would turn the pair vulnerable to aim back towards 1.2710-1.2700 support area. On the flip side, momentum back above the 1.2800 handle might continue to confront resistance near 1.2835-40 resistance area, above which a fresh bout of buying interest is likely to lift the pair back towards reclaiming the 1.2900 handle with some intermediate resistance near 1.2870-75 zone.

Trend Index:

Bullish

*商用利用やスパムは容認されていないので、アカウントが停止される可能性があります。

ヒント:画像/YouTubeのURLを投稿すると自動的に埋め込まれます!

ヒント:この討論に参加しているユーザー名をオートコンプリートするには、@記号を入力します。