- ホーム

- コミュニティ

- 経験豊富なトレーダー

- Gold

Advertisement

Edit Your Comment

Gold

Jan 10, 2017 at 09:52

Jan 14, 2011からメンバー

34 投稿

Look at this transactions TP is 1300.....:)

https://consiliuminvest.com/strategies/43-long-term-investment

https://consiliuminvest.com/strategies/43-long-term-investment

Jan 10, 2017 at 09:52

Jan 14, 2011からメンバー

34 投稿

Look at this taransactions

Oct 02, 2014からメンバー

905 投稿

Mar 25, 2015からメンバー

70 投稿

Jan 19, 2017 at 11:00

Sep 24, 2016からメンバー

22 投稿

These are my profits in the last two days. It's a result of my forex signals.

ahmedmohamedkotp@

forex_trader_252244

May 26, 2015からメンバー

85 投稿

Mar 06, 2017 at 20:40

May 26, 2015からメンバー

85 投稿

Gold drops below $1230

A stronger US dollar across the board pushed the price of the yellow metal to the downside. The value of the ounce is pulling back on Monday after a having a sharp rally on Friday, from 2-week lows.

XAU/USD reached $1236 at the beginning of the week but then lost strength and started to decline. Recently it broke below the short-term support area around $1230 and fell to $1228 hitting a fresh daily low.

Now the metal is looking at the next support at $1225. Below there attention would turn to Friday’s low at $1222 and then to the $1220 zone. A consolidation below $1220 could open the doors for a test of $1205 - $1200.

To the upside, now $1230 is the immediate resistance. XAU/DUSD needs to rise above the 20-day moving average that stands at $1238 in order to remove the short-term bearish pressure.

Since the beginning of March, gold lost more than $20, amid a recovery of the US dollar supported by expectations of several rate hikes from the Federal Reserve during 2017. For the current year, is still in positive territory, up 7%

Mar 28, 2017 at 06:25

Dec 02, 2016からメンバー

2 投稿

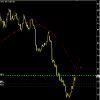

Gold Price Predictions March 2017

XAUUSD is in a bullish trend, and little more upward movement is expecting.We will look for reversal signal from 1263 or 1267-71 level which is weekly trend resistance zone mentioned in a chart below.Current gold price is around 1260.

Yellow metal immediate support level is forming at 1245-47 area, which could be our first bearish target after reversal confirmation.

Please have a look at daily chart below to get the trade idea.

XAUUSD is in a bullish trend, and little more upward movement is expecting.We will look for reversal signal from 1263 or 1267-71 level which is weekly trend resistance zone mentioned in a chart below.Current gold price is around 1260.

Yellow metal immediate support level is forming at 1245-47 area, which could be our first bearish target after reversal confirmation.

Please have a look at daily chart below to get the trade idea.

dailygoldanalysis1@

Mar 28, 2017 at 08:12

Mar 29, 2011からメンバー

9 投稿

Wow... Totally agree with prediction by Daily Gold Analysis i am monitoring same resistance trendline for years but the resistance trendline need to be seen on weekly or monthly eagle eye level of weekly chart analysis for global looks...Have A Nice Idea of All pairs associated with gold dear..Thank You ..Great Idea Actually.😲😀

forex_trader_338100

Jun 21, 2016からメンバー

287 投稿

Mar 28, 2017 at 09:32

Jun 21, 2016からメンバー

287 投稿

On the upside, $1260 region (200-day SMA) remains immediate strong hurdle, which if cleared decisively is likely to lift the commodity towards $1275 horizontal resistance with some intermediate resistance near $1270 level. Meanwhile on the downside, retracement below $1250 area is likely to find support near $1245 horizontal level, below which the corrective slide could get extended towards $1236-35 support zone.

Apr 20, 2017 at 08:56

Mar 23, 2017からメンバー

38 投稿

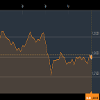

Yesterday we expected bearish movement with minimum target 1271.Market move lower and bounce from 1274 zone.Current gold price is 1279, It seems bearish bias is still not over and we are still expecting a more bearish move towards minimum 1271 and maximum 1263.

TREND INDEX

Bearish

AVG SELL PRICE

1291.00

AVG BUY PRICE

1248.00

TREND INDEX

Bearish

AVG SELL PRICE

1291.00

AVG BUY PRICE

1248.00

Apr 23, 2017 at 07:08

Mar 23, 2017からメンバー

38 投稿

Analysis For 24th April 2017:

Gold prices broke out and are forming a bull flag pattern ahead of Sunday’s Presidential Election. The moved toward safe-haven assets continue to drive gold prices higher. It appears that the elections are a binary event that will drive prices. If Le Pen performs better than expected, gold will likely benefit.

Support is seen near the 10-day moving average at 1,280. Resistance is seen near the November 8, US Election Day highs at 1,337. Momentum has turned neutral as the MACD (moving average convergence divergence) index prints near the zero-index level with a flat trajectory that reflects consolidation.

Gold prices broke out and are forming a bull flag pattern ahead of Sunday’s Presidential Election. The moved toward safe-haven assets continue to drive gold prices higher. It appears that the elections are a binary event that will drive prices. If Le Pen performs better than expected, gold will likely benefit.

Support is seen near the 10-day moving average at 1,280. Resistance is seen near the November 8, US Election Day highs at 1,337. Momentum has turned neutral as the MACD (moving average convergence divergence) index prints near the zero-index level with a flat trajectory that reflects consolidation.

Apr 24, 2017 at 07:06

Mar 23, 2017からメンバー

38 投稿

Asia’s open saw gold drop $20 on safe haven liquidation, following Macron’s win in the 1st round French presidential voting. Gold traded as low as 1265.50 from a 1284 close before rallying back to the 1272 level.

With geopolitical uncertainty now subsiding globally, at a rate of knots for now, the way lies clear for a possible deeper correction in gold after multiple failures in the 1285/1295 region. Barring a massive surprise from Ms Le Pen in the 2nd round, the intricacies of the French presidency and legislature elections will fade from meaningfully affecting the price of precious metals going forward.

Gold’s present level is 1270 with 1272 nearby a daily support and an intraday pivot. Resistance lies at 1284 with support at 1260 below and then 1255, the 200-day moving average.

With geopolitical uncertainty now subsiding globally, at a rate of knots for now, the way lies clear for a possible deeper correction in gold after multiple failures in the 1285/1295 region. Barring a massive surprise from Ms Le Pen in the 2nd round, the intricacies of the French presidency and legislature elections will fade from meaningfully affecting the price of precious metals going forward.

Gold’s present level is 1270 with 1272 nearby a daily support and an intraday pivot. Resistance lies at 1284 with support at 1260 below and then 1255, the 200-day moving average.

*商用利用やスパムは容認されていないので、アカウントが停止される可能性があります。

ヒント:画像/YouTubeのURLを投稿すると自動的に埋め込まれます!

ヒント:この討論に参加しているユーザー名をオートコンプリートするには、@記号を入力します。