- ホーム

- コミュニティ

- 経験豊富なトレーダー

- Technical & Fundamental Analysis by Sold ECN Securities

Advertisement

Edit Your Comment

Technical & Fundamental Analysis by Sold ECN Securities

Jan 20, 2022 at 07:13

Dec 08, 2021からメンバー

330 投稿

Key Releases

United States of America

The US currency is weakening today against its main competitors – the yen, the pound and the euro.

The published December data of the American labor market turned out to be positive: the number of construction permits issued increased from 1.717M to 1.873M, and the number of new homes whose construction has just begun increased from 1.678M to 1.702M. Today, the head of the White House, Joe Biden, is due to speak at a press conference on the occasion of the anniversary of his inauguration. He will inform citizens about his new legislative initiatives, as well as about further plans to combat the coronavirus pandemic.

Eurozone

The European currency is strengthening against the USD, weakening against the pound and has ambiguous dynamics paired with the Japanese yen.

December data on the consumer price index in Germany were published today, which recorded an acceleration of inflation in the country. On a monthly basis, the index increased from -0.2% to 0.5%, and on an annual basis – from 5.2% to 5.3%. The pressure in the German and European economies as a whole continues to increase. In these circumstances, investors are turning their attention to the decisions of the European Central Bank (ECB), hoping that the regulator's officials will begin a more active fight against price increases following their colleagues from the Bank of England and the US Fed. However, the matter does not go beyond comments and hints yet. Last week, ECB Head Christine Lagarde said that inflation in the eurozone this year should decrease from the record high levels currently observed, and the agency is ready to take any measures necessary to reduce it to the target of 2.0%. The official's rhetoric was interpreted by some investors as a hint at the possibility of raising rates, but more specifically, the regulator's intention will be known only in early February, when the first meeting of the current year will take place. The head of the French central bank and ECB member Francois Villeroy de Galhau noted that France's economic growth has not slowed down from the rapid spread of the COVID-19 Omicron strain, but inflation in the eurozone's second-largest economy is still too high.

United Kingdom

The British currency today is strengthening against its main competitors – the euro, the yen and the USD.

The December data on inflation in the United Kingdom published today confirmed its further growth: the consumer price index rose from 5.1% to 5.4%, reaching its highest since 1992. The negative dynamics due to the increase in the cost of energy carriers should prompt the Bank of England to raise the interest rate again in early February, which, in turn, will serve as a catalyst for strengthening the pound. In addition, the UK has signs of a gradual exit from the coronavirus pandemic caused by the Omicron strain. The incidence in the country is gradually decreasing, which allows officials to announce the mitigation of existing quarantine measures as early as next week. On the other hand, the growth of quotations is hindered by the problems of the national labor market and the intensifying political crisis, which now occupy significant attention of investors. According to November data, wage growth in the UK is slowing down and is seriously not keeping up with the increase in inflation, which may negatively affect consumption and the state of the economy as a whole. Meanwhile, investors are following the development of the situation in the country's parliament: Boris Johnson is getting closer to losing the post of prime minister due to the scandal caused by his presence at the event, while strict coronavirus restrictions were in effect on the territory of the United Kingdom. Members of the Conservative Party have already begun to collect parliamentary requests to begin the procedure for removing the politician from office, but he himself does not intend to resign.

Japan

The Japanese currency is weakening against the pound, strengthening against the USD and has ambiguous dynamics paired with the euro.

Today, the Japanese government has extended emergency measures to the capital Tokyo and more than a dozen other regions of the country to stop the rapid spread of the COVID-19 Omicron strain. These measures will allow local authorities to limit the mobility of the population and business activity, reducing the opening hours of bars and restaurants and other establishments of mass attendance. So far, the incidence in Japan remains at high levels, and officials fear that the national health system may not be able to withstand the increased number of hospitalizations. Tomorrow, bidders expect the publication of data on foreign trade for December. It is predicted that the volume of imports of Japanese goods may slow down growth from 43.8% to 42.5%, and exports – from 20.5% to 16.0%. The implementation of forecasts may put pressure on the Japanese currency.

Australia

The Australian currency is strengthening against its main competitors – the euro, the pound, the yen and the USD.

The Australian dollar shows an upward trend in trading, despite the negative January data on the consumer sentiment index from Westpac: the indicator decreased from -1.0% to -0.2%. Australian citizens fear the deterioration of the epidemic situation and the tightening of quarantine restrictions, but Australian Prime Minister Scott Morrison said that the government does not plan to introduce additional sanitary measures, even despite the surge in the incidence. Moreover, the official announced the cancellation of visa fees for students and people who want to get a job at local enterprises for the next 12 weeks. These measures should reduce the labor shortage created during the pandemic.

Oil

Oil quotes are making moderate attempts to decline today.

The pressure on prices was exerted by statements from representatives of the International Energy Agency (IEA). Officials of the ministry noted that the supply of oil will soon exceed demand, as some producers may reach historical production peaks in Q1 2022. In particular, the department believes that the USA, Canada, Brazil, Saudi Arabia and Russia can seriously increase production. During the day, investors also expect the publication of a weekly report on the amount of oil reserves in the USA from the American Petroleum Institute (API). The last time the indicator decreased by 1.077M barrels, and the continuation of this trend may support oil quotes.

Solid ECN, a True ECN Broker

Jan 20, 2022 at 13:20

Dec 08, 2021からメンバー

330 投稿

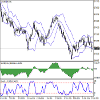

AUD/USD: wave analysis

The probability of the pair reduction remains.

On the daily chart, the development of the first wave of the higher level (1) of C has completed and a downward correction as wave (2) of C continues to be formed. At the moment, wave A of (2) has formed and wave B of (2) is developing, in which wave b of B is being formed. If the assumption is correct, after the completion of wave B of (2) the pair will continue to decline to the levels of 0.6742–0.6446. The level of 0.7616 is critical and stop-loss for this scenario.

Solid ECN, a True ECN Broker

Jan 20, 2022 at 16:03

Dec 08, 2021からメンバー

330 投稿

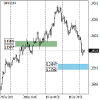

ADA/USD

The growth before the launch of the SundaeSwap exchange turned out to be temporary

Current trend

Unlike most of the leading cryptocurrencies, ADA quotes showed upward trading dynamics and only after reaching eight-week highs around 1.6345 began to adjust downwards. Experts associate the strengthening of the token's position with the creation of the Pavia application on the Cardano blockchain, as well as with the launch of the SundaeSwap (DEX) platform.

Thus, Pavia's "metaverse" has already attracted 8.3K participants, but even more investor interest is directed to the decentralized exchange SundaeSwap, the beta version of which should be launched today. The currently available version of the platform will be incomplete, the developers have limited a number of functions in it and increased the transaction processing time, but investors will already begin to receive part of the charged commission for trading as a reward for supporting the project, which will be carried out in the form of distribution of their own SUNDAE exchange token.

The interest of market participants in ADA allowed to increase the daily volume of transactions in the Cardano network to 7B, which exceeded the same figure in the Ethereum network (5.4B), but nevertheless, the positive dynamics turned out to be temporary.

Support and resistance

Currently, the price of the ADA/USD pair has corrected to the middle line of the Bollinger Bands (1.3000). Its breakdown will give the prospect of further decline to the levels of 1.1718 (Murray [6/8]) and 1.0700 (January lows), otherwise the upward dynamics may resume to 1.5625 (Murray [8/8], Fibo retracement 23.6%), 1.7578 (Murray [+1/8]), 1.8350 (Fibo retracement 38.2%). Indicators do not give a single signal: the Bollinger Bands and Stochastic are directed downwards, the MACD histogram is at the zero line, its volumes are insignificant.

Resistance levels: 1.5625, 1.7578, 1.8350.

Support levels: 1.3000, 1.1718, 1.0700.

Solid ECN, a True ECN Broker

Jan 21, 2022 at 05:48

Dec 08, 2021からメンバー

330 投稿

Gold, Elliot Wave Analysis

The pair may grow.

On the daily chart, the fifth wave of the higher level (5) develops, within which the first entry wave 1 of (5) formed, the correctional wave 2 of (5) developed, and the wave 3 of (5) forms. Now, the first wave of the lower level i of 3 is developing, within which a local correction has ended as the wave (iv) of i, and the fifth wave (v) of i is developing. If the assumption is correct, the pair will grow within the wave to the levels of 1919.90–2067.60. In this scenario, critical stop loss level is 1752.82.

Solid ECN, a True ECN Broker

Jan 21, 2022 at 08:27

Dec 08, 2021からメンバー

330 投稿

McDonald’s Corp. Elliot Wave Analysis

The price may rise.

On the daily chart, the fifth wave of the higher level (5) is developing, as part of which the wave 3 of (5) continues forming. At the moment, the third wave of the lower level iii of 3 is developing, as part of which wave (iii) of iii is developing. If the assumption is correct, the price will rise in wave (iii) of iii to 280.00–295.00. The level of 244.07 is critical and stop-loss for this scenario.

Solid ECN, a True ECN Broker

Jan 21, 2022 at 09:33

Dec 08, 2021からメンバー

330 投稿

GBP/USD

The pound is developing flat dynamics

Current trend

The pound is traded in different directions against the US currency during the morning session, consolidating near 1.3600 and local lows from January 18.

The US dollar is actively recovering its positions at the end of the week; however, its growth is limited by not the most confident macroeconomic statistics from the US. Disappointing data came out the day before, reflecting an increase in the number of Initial Jobless Claims from 231K to 286K, while analysts expected a further decrease in the figure to 220K. The number of Continuing Jobless Claims for the week ended January 7 increased from 1.551M to 1.635M, which also turned out to be worse than preliminary market estimates at 1.58M.

Today, investors are waiting for the publication of December data on the dynamics of Retail Sales in the UK. Analysts' forecasts, however, do not promise any support for the pound, and therefore the corrective sentiment in the asset may develop further.

Support and resistance

On the D1 chart, Bollinger Bands are reversing into a horizontal plane. The price range is narrowing, reflecting the appearance of mixed dynamics of trading in the short and ultra-short term. MACD is going down preserving a stable sell signal (located below the signal line). Stochastic, having approached its lows, is trying to reverse into a horizontal plane, indicating risks of an oversold pound in the ultra-short term. Under these conditions, trading participants should look at the possibility of the appearance of corrective dynamics for the instrument in the nearest time intervals.

Resistance levels: 1.3650, 1.3700, 1.3750, 1.3800.

Support levels: 1.3600, 1.3550, 1.3500, 1.3460.

Solid ECN, a True ECN Broker

Jan 21, 2022 at 13:32

Dec 08, 2021からメンバー

330 投稿

AUD/USD

The Australian dollar ends the week with flat dynamics

Current trend

The Australian dollar, thanks to the active actions of the “bears”, is losing ground at the end of the current trading week, testing the level of 0.7200 for a breakdown. AUD/USD pair is losing ground and moving into the “red” zone, despite the fact that there are not many fundamental reasons for the growth of the American currency. The data released the day before from the US failed to support the “bullish” sentiment of investors in the US currency, neither within the data on Initial Jobless Claims, nor on the statistics of Existing Home Sales.

In turn, on Thursday, the Australian dollar managed to enlist fairly strong support from market participants after the publication of a strong report on the Australian labor market for December. The Employment Change increased by 64.8K jobs, which turned out to be significantly better than market expectations of 30K jobs. At the same time, the Unemployment Rate in the country in December fell to new record lows at around 4.2%, although analysts' forecasts suggested a decline from only 4.6% to 4.5%.

Support and resistance

On the daily chart, Bollinger Bands show flat dynamics. The price range remains virtually unchanged, remaining spacious enough for the current level of activity in the market. MACD is stretching into a line along the zero level, signaling an approximate balance of power between sellers and buyers in the short term. Stochastic is trying to reverse upwards, near the level of “20” and indicating the continuation of the “bullish” momentum since the middle of the week.

Resistance levels: 0.7250, 0.7300, 0.7328, 0.7369.

Support levels: 0.7200, 0.7160, 0.7128, 0.7100.

Solid ECN, a True ECN Broker

Jan 21, 2022 at 15:52

Dec 08, 2021からメンバー

330 投稿

EUR/USD

The dollar continues to dominate the pair

Current trend

Quotes of EUR/USD are being corrected, trading around 1.1322 after updating of the local lows of January 10 yesterday. The European currency continues unsuccessful attempts to consolidate in the uptrend, but the growth of quotations is hindered by weak macroeconomic statistics from the eurozone, which once again pointed to record inflation rates in the region.

According to published data, in December, the growth of consumer prices in annual terms reached 5.0%, while the monthly rate was fixed at 0.4%. Representatives of the European Central Bank (ECB) continue to assure that the current situation is the result of high energy prices, and the indicator of the Core Consumer Price Index, which does not include this category of goods, indirectly confirms this, remaining at the level of 2.6%. For this reason, the regulator is in no hurry to adjust the parameters of monetary policy and, in particular, to raise interest rates, limiting itself only to curtailing the asset purchase program (PEPP) until the end of March, which undoubtedly hinders the growth of the euro.

In the meantime, the US currency cannot decide on the priority direction of movement. On the one hand, investors hope for the beginning of a cycle of raising interest rates, and on the other hand, the labor market is again actively declining. According to statistics, the number of Initial Jobless Claims increased by 55K, amounting to 286K against 220K expected by analysts. It is also alarming that the negative dynamics have been observed for the fourth week in a row.

Support and resistance

Despite all attempts to grow, EUR/USD remains within the framework of the global Flag pattern, the implementation of which has not yet begun. The EMA fluctuation range on the Alligator indicator narrowed almost completely, and the AO oscillator histogram began to form descending bars again.

Support levels: 1.1271, 1.1050.

Resistance levels: 1.1378, 1.1525.

Solid ECN, a True ECN Broker

Jan 24, 2022 at 06:26

Dec 08, 2021からメンバー

330 投稿

EUR/USD, Elliot Wave Analysis

The pair may grow.

On the daily chart, the first wave of the higher level 1 of (3) formed, and a downward correction developed as the second wave 2 of (3), within which the wave c of 2 formed. Now, the development of the third wave 3 of (3) started, within which the first wave of the lower level (i) of i of 3 forms. If the assumption is correct, the pair will grow to the levels of 1.1687–1.1907. In this scenario, critical stop loss level is 1.1215.

Solid ECN, a True ECN Broker

Jan 24, 2022 at 07:44

Dec 08, 2021からメンバー

330 投稿

Apple Inc Elliot Wave Analysis

The price is in a correction, a fall is possible.

On the daily chart, the third wave of the higher level 3 developed, within which the wave (5) of 3 formed. Now, a correction has developed as the wave 4 of (5), and a downward correction is developing as the fourth wave 4, within which the wave (A) of 4 is forming. If the assumption is correct, the price will fall to the levels of 148.43–127.03. In this scenario, critical stop loss level is 183.16.

Solid ECN, a True ECN Broker

Jan 24, 2022 at 09:16

Dec 08, 2021からメンバー

330 投稿

XAU/USD: stabilization after last week's decline

Current trend

Gold prices are consolidating near the level of 1835.00 after a corrective decline at the end of last week, when the XAU/USD pair retreated from its local highs of November 22.

Significant support for metal quotes is still provided by the risks of the total spread of inflation as the world economy recovers. At the same time, investors are in no hurry to open new long positions in anticipation of the start of the US Federal Reserve's interest rate hike cycle. The first of them may take place as early as March, and four adjustments of the indicator are expected during 2022. Also, in the summer, the regulator may announce the start of a noticeable reduction in its balance sheet.

Gold is also strengthening against the backdrop of ongoing epidemiological risks. The incidence of coronavirus remains quite high, and production continues to face supply chain disruption problems.

Support and resistance

On the daily chart, Bollinger Bands reverse into a horizontal plane. The price range expands above, letting the "bulls" renew local highs.

MACD is growing, keeping a poor buy signal (the histogram is above the signal line). Stochastic reversed at the level of 80 downwards and signals in favor of developing a corrective decline in the next time intervals.

It is better to pay attention to the possibility of downward signals developing in the short and/or ultra-short term.

Resistance levels: 1840.00, 1847.63, 1860.00.

Support levels: 1831.66, 1823.09, 1814.06, 1805.50.

Solid ECN, a True ECN Broker

Jan 24, 2022 at 10:26

Dec 08, 2021からメンバー

330 投稿

USD/JPY, the US dollar is recovering its positions

Current trend

During Asian trading, the USD/JPY pair actively grows, rapidly retreating from the local lows of January 14, renewed last week, and testing the level of 114.00 for a breakout.

The instrument receives support amid market expectations of the US Federal Reserve's relatively early tightening of monetary policy. Last week, investors reacted optimistically to a publication from the Bank of America Corp. holding, according to which, during 2022, the US currency may significantly strengthen against the euro and the yen on the difference in interest rates. In particular, experts expect a seven-fold increase, while a more restrained forecast suggests an adjustment only once a quarter.

The dollar is also growing against the backdrop of the rhetoric of US Treasury Secretary Janet Yellen, who noted a significant improvement in the state of the national labor market and the economy as a whole. At the same time, the head of the department emphasized the risks of record inflation, but US officials again tend to call it only a "temporary phenomenon."

Support and resistance

On the daily chart, Bollinger Bands show a steady decline. The price range is narrowing, reflecting the emergence of ambiguous trading dynamics in the short term. MACD is correcting, keeping the previous strong sell signal and being below the signal line. Stochastic shows a downward direction but is quickly approaching its lows, indicating that the dollar may become oversold in the ultra-short term.

Resistance levels: 114.00, 114.50, 115.00, 115.50.

Support levels: 113.50, 113.00, 112.50, 112.00.

Current trend

During Asian trading, the USD/JPY pair actively grows, rapidly retreating from the local lows of January 14, renewed last week, and testing the level of 114.00 for a breakout.

The instrument receives support amid market expectations of the US Federal Reserve's relatively early tightening of monetary policy. Last week, investors reacted optimistically to a publication from the Bank of America Corp. holding, according to which, during 2022, the US currency may significantly strengthen against the euro and the yen on the difference in interest rates. In particular, experts expect a seven-fold increase, while a more restrained forecast suggests an adjustment only once a quarter.

The dollar is also growing against the backdrop of the rhetoric of US Treasury Secretary Janet Yellen, who noted a significant improvement in the state of the national labor market and the economy as a whole. At the same time, the head of the department emphasized the risks of record inflation, but US officials again tend to call it only a "temporary phenomenon."

Support and resistance

On the daily chart, Bollinger Bands show a steady decline. The price range is narrowing, reflecting the emergence of ambiguous trading dynamics in the short term. MACD is correcting, keeping the previous strong sell signal and being below the signal line. Stochastic shows a downward direction but is quickly approaching its lows, indicating that the dollar may become oversold in the ultra-short term.

Resistance levels: 114.00, 114.50, 115.00, 115.50.

Support levels: 113.50, 113.00, 112.50, 112.00.

Solid ECN, a True ECN Broker

Jan 24, 2022 at 14:26

Dec 08, 2021からメンバー

330 投稿

Brent Crude Oil: prices are holding near record highs

Current trend

Brent Crude Oil prices continue to rise during today's trading, testing the $88.00 per barrel mark and returning to the previous record highs renewed last week. Earlier, the quotes reached their seven-year peaks, reacting to the active recovery of the global economy, as well as interruptions in the supply of oil and oil products in the Middle East. The current growth rate is only slightly lower than in 2009, and optimistic investors suggest that oil prices will be able to consolidate above $100 per barrel by the third quarter of 2022.

Today, traders are focused on an extensive block of macroeconomic statistics from the US. In particular, the markets will be interested in data on the dynamics of business activity indices from Markit for January. Also, during the day, the index of business activity in the industrial sector of the Dallas Fed, as well as the placement of 2-year bonds will be released.

Support and resistance

On the daily chart, Bollinger Bands show a steady growth: the price range is actively narrowing, reflecting the emergence of an ambiguous trading dynamics in the short term. MACD maintains a poor sell signal, being below the signal line but tends to change the trend. Stochastic, retreating from its highs, reversed into a horizontal plane, reacting to the return of the "bullish" dynamics at the end of the last trading week.

Resistance levels: 88.79, 90, 91.

Support levels: 87, 86, 84.5, 83.5.

Solid ECN, a True ECN Broker

Jan 24, 2022 at 15:29

Dec 08, 2021からメンバー

330 投稿

BTC/USD, digital gold remains under pressure

Current trend

Last week, the BTC/USD pair was actively losing value and reached its lowest level since July last year, dropping below 34000.00. The pressure on the first cryptocurrency was caused by a complex of negative factors, although the opinions of investors differ regarding the central one.

Thus, the downward correction of the entire cryptocurrency sector is facilitated by the fall of the American stock market and the growth in the yield of American bonds in anticipation of the imminent increase in interest rates and the meeting of the US Federal Reserve scheduled for Wednesday. Investors fear that the rhetoric of regulator officials may become even more "hawkish" against the background of a record increase in inflation in the country, which could lead to further strengthening of the US currency against alternative assets.

Among other factors putting pressure on the digital market, experts cite the report of the Bank of Russia on cryptocurrencies, which recommends banning both their use and activities for the extraction of digital assets due to threats to financial stability, the well-being of citizens, and the sovereignty of monetary policy. If such a decision is made, BTC mining may suffer since the country accounts for more than 10% of the world's hashrate, and Russia is one of the top three in terms of cryptocurrency mining.

Support and resistance

Now the price of the BTC/USD pair is around 35000.00 (Fibonacci correction 50.0%), consolidation below which allows a decline to 31250.00 (Murrey [5/8]), 28300.00 (Fibonacci correction 61.8%). The breakout of 37500.00 allows an upward correction to the area of 41700.00 (Fibonacci correction of 38.2%, which will unlikely break the currently observed downtrend. Indicators signal the possibility of a decrease: Bollinger bands are directed downwards, the MACD histogram is increasing in the negative zone.

Resistance levels: 37500.00, 41700.00

Support levels: 35000.00, 31250.00, 28300.00.

Solid ECN, a True ECN Broker

Jan 24, 2022 at 16:26

Dec 08, 2021からメンバー

330 投稿

NZD/USD

The "bears" prepare to renew the December low

Current trend

The NZD/USD pair maintains its downward trend amid the recovery of the US dollar, currently trading around 0.6705.

Investors expect decisive action from the US Federal Reserve to tighten monetary policy to curb inflation, which has reached record levels for almost 40 years. In December, representatives of the department announced the beginning of the curtailment of the program of emergency stimulus to the economy, after which a smooth cycle of interest rate adjustment will follow. It is expected that this year, it will be raised three times. Traders put the "hawkish" policy of the US Federal Reserve into dollar quotes, thereby helping to strengthen its rate against all major competitors.

Meanwhile, the Reserve Bank of New Zealand is in no hurry to take active steps to change monetary policy, despite the existing growth in consumer prices. Annual food inflation in the country reached 4.5% for December, the highest rate in a decade. Experts believe that the negative dynamics will become a catalyst for another sharp increase in the consumer price index, which will be released on Thursday, January 27. The figure is forecast to increase to 5.7% in 2021, while inflation for the fourth quarter of last year is expected to be 1.3%. At the moment, the difficult situation with the spread of coronavirus is a deterrent for the regulator in adjusting the current parameters. New Zealand Prime Minister Jacinda Ardern announced that the country is moving to a red, maximum alert level due to the discovery of 12 cases with the Omicron strain, with the introduction of appropriate sanitary restrictions. The new measures do not provide for the announcement of a lockdown but include a requirement to reduce the number of visitors to mass events to 100 people, provided they are vaccinated, and in the absence of such, to 25 and mandatory social distancing and wearing medical masks.

Support and resistance

The long-term trend in the NZD/USD pair is downwards. After testing 0.6864 in the first half of January, the instrument fell to the support level of 0.6700 and is preparing to break through it. In this case, further decline is possible, with the target at 0.6540.

The medium-term trend is downwards. After the test of the key resistance of 0.6910–0.6890, the correction was completed, and a new impulse began, as a result of which the price reached the first sell target — the level of 0.6707, which breakdown allows the "bears" to test the target zone 3 (0.6648–0.6629).

Resistance levels: 0.6864, 0.7055.

Support levels: 0.67, 0.654.

The "bears" prepare to renew the December low

Current trend

The NZD/USD pair maintains its downward trend amid the recovery of the US dollar, currently trading around 0.6705.

Investors expect decisive action from the US Federal Reserve to tighten monetary policy to curb inflation, which has reached record levels for almost 40 years. In December, representatives of the department announced the beginning of the curtailment of the program of emergency stimulus to the economy, after which a smooth cycle of interest rate adjustment will follow. It is expected that this year, it will be raised three times. Traders put the "hawkish" policy of the US Federal Reserve into dollar quotes, thereby helping to strengthen its rate against all major competitors.

Meanwhile, the Reserve Bank of New Zealand is in no hurry to take active steps to change monetary policy, despite the existing growth in consumer prices. Annual food inflation in the country reached 4.5% for December, the highest rate in a decade. Experts believe that the negative dynamics will become a catalyst for another sharp increase in the consumer price index, which will be released on Thursday, January 27. The figure is forecast to increase to 5.7% in 2021, while inflation for the fourth quarter of last year is expected to be 1.3%. At the moment, the difficult situation with the spread of coronavirus is a deterrent for the regulator in adjusting the current parameters. New Zealand Prime Minister Jacinda Ardern announced that the country is moving to a red, maximum alert level due to the discovery of 12 cases with the Omicron strain, with the introduction of appropriate sanitary restrictions. The new measures do not provide for the announcement of a lockdown but include a requirement to reduce the number of visitors to mass events to 100 people, provided they are vaccinated, and in the absence of such, to 25 and mandatory social distancing and wearing medical masks.

Support and resistance

The long-term trend in the NZD/USD pair is downwards. After testing 0.6864 in the first half of January, the instrument fell to the support level of 0.6700 and is preparing to break through it. In this case, further decline is possible, with the target at 0.6540.

The medium-term trend is downwards. After the test of the key resistance of 0.6910–0.6890, the correction was completed, and a new impulse began, as a result of which the price reached the first sell target — the level of 0.6707, which breakdown allows the "bears" to test the target zone 3 (0.6648–0.6629).

Resistance levels: 0.6864, 0.7055.

Support levels: 0.67, 0.654.

Solid ECN, a True ECN Broker

Jan 25, 2022 at 06:40

Dec 08, 2021からメンバー

330 投稿

Silver, Elliot Wave Analysis

The pair may grow.

On the daily chart, the first wave of the higher level (1) of 3 formed, a downward correction developed as the wave (2) of 3, and the development of the third wave (3) of 3 started. Now, the first wave of the lower level i of 1 of (3) has formed, a local correction has developed as the wave ii of 1, and the wave iii of 1 is forming, within which the development of the wave (iv) of iii is ending. If the assumption is correct, after the end of the correction, the price will grow to the levels of 26.76–28.68. In this scenario, critical stop loss level is 22.72.

Solid ECN, a True ECN Broker

Jan 25, 2022 at 07:30

Dec 08, 2021からメンバー

330 投稿

PayPal Holdings, Elliot Wave Analysis

The price may fall.

On the daily chart, the third wave of the higher level (3) developed, and a downward correction develops as the fourth wave (4). Now, the wave C of (4) is forming, within which the third wave of the lower level iii of C has formed, a local correction has ended as the fourth wave iv of C, and the wave v of C is developing. If the assumption is correct, the price will fall to the levels of 140.00–128.71. In this scenario, critical stop loss level is 179.02.

Solid ECN, a True ECN Broker

Jan 25, 2022 at 09:41

Dec 08, 2021からメンバー

330 投稿

EURUSD Market Analysis

The euro is trying to return to decline

The European currency shows a moderate decrease against the US dollar during the Asian session, developing an uncertain "bearish" momentum, formed the day before, and again testing 1.13 for a breakdown.

The macroeconomic statistics from Europe published the day before did not provide significant support to the single currency, while the demand for risky assets remains reduced due to the aggravation of the situation on the Ukrainian border. The Markit Services PMI in the euro area in January fell from 53.1 to 51.2 points against the forecast of 52.2 points. At the same time, the Manufacturing PMI over the same period accelerated from 58 to 59 points, mainly due to the growth in production in Germany. Still, the Eurozone Composite Manufacturing PMI fell from 53.3 to 52.4, worse than market forecasts of 52.6.

Quotes of the single European currency are also under pressure from the report of the Deutsche Bundesbank, which warned of a possible contraction of the German economy in Q4 2021.

Bollinger Bands in D1 chart demonstrate flat dynamics. The price range is changing slightly, but remains rather spacious for the current level of activity in the market. MACD is going down preserving a stable sell signal. Stochastic, on the contrary, maintains a fairly solid growth, signaling the risks of a corrective upswing in the ultra-short term.

Resistance levels: 1.1363, 1.14, 1.1422, 1.146.

Support levels: 1.13, 1.1255, 1.122, 1.1185.

Solid ECN, a True ECN Broker

Jan 25, 2022 at 10:32

Dec 08, 2021からメンバー

330 投稿

AUD/USD, the instrument renews local lows

Current trend

During the Asian session, the AUD/USD pair shows flat dynamics, holding near the level of 0.7130. Yesterday, the instrument steadily declined, having renewed local lows of December 20. However, by the time the daily session was closed, it partially restored lost positions.

The asset was supported by poor US macroeconomic data, which reduced the likelihood that the US Federal Reserve would raise rates more than four times in 2022. Thus, Markit Manufacturing PMI for January fell from 57.7 to 55.0 points, while analysts' forecasts suggested a decline to 56.7 points. Service PMI fell from 57.6 to 50.9 points, which was worse than forecasts of 55.0 points.

On Tuesday, further development of the upward dynamics is facilitated by data from Australia. In the fourth quarter of 2021, the consumer price index increased by 1.3% QoQ and 3.5% YoY, which was better than analysts' forecasts of +1.0% QoQ and +3.2% YoY.

Support and resistance

On the daily chart, Bollinger bands try to reverse into a horizontal plane. The price range expands from below, but not as fast as the "bearish" activity develops. The MACD indicator shows a moderate decline and keeps the same sell signal (the histogram is below the signal line). Stochastic keeps its downtrend but is quickly approaching its lows, indicating that the instrument may become oversold in the ultra-short term.

Resistance levels: 0.7160, 0.7200, 0.7250, 0.7300.

Support levels: 0.7128, 0.7100, 0.7050, 0.7000.

Solid ECN, a True ECN Broker

Jan 25, 2022 at 14:34

Dec 08, 2021からメンバー

330 投稿

GBP/USD, the "bearish" momentum intensifies

Current trend

The British pound remains under pressure due to the difficult epidemiological situation in the country and poor macroeconomic data, and the GBP/USD pair may continue to decline towards the 1.3418–1.3365 area. Thus, Composite PMI in industry and services in the UK fell to 53.4 points from 53.6 points a month earlier, while analysts expected the index to rise to 55.0 points.

The long-term trend in the GBP/USD pair is downwards. After the breakdown of 1.3610, the rate decreases to 1.3418–1.3365. If this area is broken, further development of negative dynamics to the lows of December 2021 is possible.

The medium-term trend remains upwards. A correction is developing within its trend, the target of which is to test the key support at 1.3405–1.3370, after which new purchases can be considered with the target at the year's high.

Support and resistance

Resistance levels: 1.3610, 1.3710, 1.3820.

Support levels: 1.3418, 1.3365, 1.3200.

Solid ECN, a True ECN Broker

*商用利用やスパムは容認されていないので、アカウントが停止される可能性があります。

ヒント:画像/YouTubeのURLを投稿すると自動的に埋め込まれます!

ヒント:この討論に参加しているユーザー名をオートコンプリートするには、@記号を入力します。