KeltnerPRO - Jared (による keltnerpro )

| 増加 : | +5645.75% |

| ドローダウン | 58.74% |

| ピップス: | 4744.8 |

| 取引 | 1003 |

| 勝利: |

|

| 負け: |

|

| タイプ: | リアル |

| レバレッジ: | 1:100 |

| 取引: | 不明 |

Edit Your Comment

KeltnerPRO - Jared 討論

forex_trader_67253

Feb 26, 2012からメンバー

92 投稿

May 22, 2015 at 17:14

Feb 26, 2012からメンバー

92 投稿

corre71 posted:

Today showed why simply systems with good risk reward ratio are succesfull: they can go in DD, can have long stagnation periods, but till when the strategy is still valid they always recover. Today a very good day for Keltner and other BOs (fortunately am running a total of 4 BOs and all of them today have scored very high gain today and the whole month of May, with huge returns). Good week end to all and keep confident 😄

What are the other BO EAs you are running?

May 22, 2015 at 19:22

(編集済みのMay 22, 2015 at 19:23)

Jan 06, 2014からメンバー

249 投稿

Monetizer (with some manual intervention), Fe Combination (which uses 5 strategies and there is a Vola str similar to Monetizer but much more active and a Fibo str which aim to longer targets) and Forex Real Profit EA which has also a very good BO str on 4 pairs. From few days also running a strategy which operates on the break of support and resistance, Zamolxis, from a old Donnaforex memeber. To diversify running also some night scalpers

Bos can be frustrating sometimes and can lead to long stagnation periods, but in the long time they are very reliable

Bad periods wil come but we are ready to del with them

Bos can be frustrating sometimes and can lead to long stagnation periods, but in the long time they are very reliable

Bad periods wil come but we are ready to del with them

Running only Expert advisors with good long term backtests and nice forward tests

Aug 14, 2012からメンバー

30 投稿

May 23, 2015 at 00:08

Aug 14, 2012からメンバー

30 投稿

btanalysis posted:corre71 posted:

Today showed why simply systems with good risk reward ratio are succesfull: they can go in DD, can have long stagnation periods, but till when the strategy is still valid they always recover. Today a very good day for Keltner and other BOs (fortunately am running a total of 4 BOs and all of them today have scored very high gain today and the whole month of May, with huge returns). Good week end to all and keep confident 😄

What are the other BO EAs you are running?

Yes it is a very nice week for BO EA, I'm running a Price Action EA for XAUUSD and so far coudn't make any profit until I use KeltnerPRO. I think KeltnerPRO is a very consistent and good RR control EA. PPFL - Positive Profit Flow Lock I like this design, amazing Forex strategy that worth to invest our hard earn money. 😄

When it comes to trading, only the persistent survive.

forex_trader_67253

Feb 26, 2012からメンバー

92 投稿

May 08, 2014からメンバー

49 投稿

forex_trader_67253

Feb 26, 2012からメンバー

92 投稿

May 23, 2015 at 23:02

Feb 26, 2012からメンバー

92 投稿

keltnerpro posted:

I ended up closing them out because of the lower volatility of Fridays.

Chances are all of those trades will close around the same pip value as mine due the internal timer and lower volatility.

How exactly could Friday's lower volatility negatively impact the closure of those trades?

May 08, 2014からメンバー

49 投稿

May 23, 2015 at 23:28

May 08, 2014からメンバー

49 投稿

btanalysis posted:keltnerpro posted:

I ended up closing them out because of the lower volatility of Fridays.

Chances are all of those trades will close around the same pip value as mine due the internal timer and lower volatility.

How exactly could Friday's lower volatility negatively impact the closure of those trades?

It wouldn't have. The trades would have closed around market opening anyways for around the same value. Why wait?

forex_trader_67253

Feb 26, 2012からメンバー

92 投稿

May 24, 2015 at 08:26

Feb 26, 2012からメンバー

92 投稿

keltnerpro posted:btanalysis posted:keltnerpro posted:

I ended up closing them out because of the lower volatility of Fridays.

Chances are all of those trades will close around the same pip value as mine due the internal timer and lower volatility.

How exactly could Friday's lower volatility negatively impact the closure of those trades?

It wouldn't have. The trades would have closed around market opening anyways for around the same value. Why wait?

Why doesn't the EA then automatically close profitable trades by Friday market closure every time?

May 08, 2014からメンバー

49 投稿

May 24, 2015 at 14:24

May 08, 2014からメンバー

49 投稿

btanalysis posted:keltnerpro posted:btanalysis posted:keltnerpro posted:

I ended up closing them out because of the lower volatility of Fridays.

Chances are all of those trades will close around the same pip value as mine due the internal timer and lower volatility.

How exactly could Friday's lower volatility negatively impact the closure of those trades?

It wouldn't have. The trades would have closed around market opening anyways for around the same value. Why wait?

Why doesn't the EA then automatically close profitable trades by Friday market closure every time?

Sometimes it's best not to. It's really situational.

forex_trader_67253

Feb 26, 2012からメンバー

92 投稿

May 24, 2015 at 16:07

Feb 26, 2012からメンバー

92 投稿

keltnerpro posted:btanalysis posted:keltnerpro posted:btanalysis posted:keltnerpro posted:

I ended up closing them out because of the lower volatility of Fridays.

Chances are all of those trades will close around the same pip value as mine due the internal timer and lower volatility.

How exactly could Friday's lower volatility negatively impact the closure of those trades?

It wouldn't have. The trades would have closed around market opening anyways for around the same value. Why wait?

Why doesn't the EA then automatically close profitable trades by Friday market closure every time?

Sometimes it's best not to. It's really situational.

Is it best to leave the trades open over the weekend most of the time?

Aug 07, 2014からメンバー

9 投稿

May 08, 2014からメンバー

49 投稿

forex_trader_190177

May 12, 2014からメンバー

21 投稿

Jun 08, 2015 at 06:36

May 12, 2014からメンバー

21 投稿

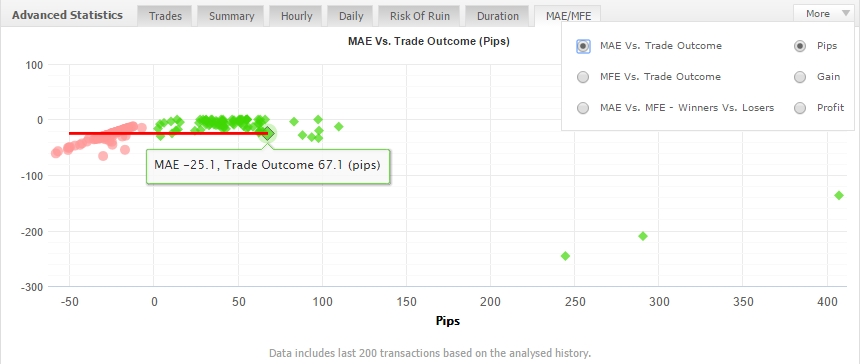

This algorithm should have a MAE (Maximum Adverse Excursion) limit set to -25 pips, as seen from its MyFXBook statement under the MAE/MFA tab. That is, if a trade moves 25 pips is the adverse direction, it should be closed out there. That way, a very significant portion of the losses can be cut, with no cuts made to the profits. What do you think, Jared?

forex_trader_190177

May 12, 2014からメンバー

21 投稿

forex_trader_190177

May 12, 2014からメンバー

21 投稿

May 08, 2014からメンバー

49 投稿

Jun 08, 2015 at 13:20

May 08, 2014からメンバー

49 投稿

giangian posted:

This graph illustrates how a hard SL at 25 pips would cut the greater portion of all losses while retaining nearly all profits:

Jared, can you add it to the bot's settings - at least, as a switchable parameter (true/false)?

What about the trades that have a drawdown that exceeded 25 pips, and ended up closing in Profit?

The trades that KeltnerPro wins big on, are the ones that have a SL that is far greater than 25 pips and sometimes have a drawdown that is also greater than 25 pips.

It is something I will look into for sure, but I imagine it will probably end up cutting down on the profits.

May 08, 2014からメンバー

49 投稿

*商用利用やスパムは容認されていないので、アカウントが停止される可能性があります。

ヒント:画像/YouTubeのURLを投稿すると自動的に埋め込まれます!

ヒント:この討論に参加しているユーザー名をオートコンプリートするには、@記号を入力します。