Bitcoin is under pressure but beats expectations

Market picture

The crypto market capitalisation is down 0.8% in 24 hours to $2.55 trillion. Bitcoin is losing 0.7%, Ethereum is down 1.1%, and the top altcoins are changing between -0.9% (Toncoin) and +1.1% (Solana).

Bitcoin's hashrate updated a record after the fourth halving. The index reached 676 Eh/s now. The moving average of BTC hashrate over the last 7 days exceeded 650 Eh/s, having reached 659 Eh/s at the beginning of the week. Bitcoin miner capacity increased after the halving, although the opposite was expected.

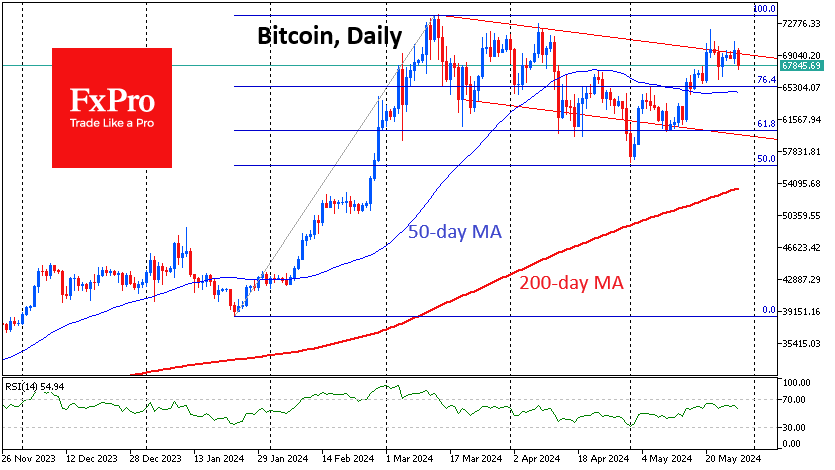

Bitcoin failed to build on Monday's gains and is losing ground on Tuesday. It is pulling back deep from the upper boundary of the trading range, trading at $68K. The lower boundary of the range (a potential target for bears) is below $60K. That said, the first cryptocurrency's ability to consolidate above $70K will break this bearish pattern.

News background

Disposer MtGox has begun actively distributing funds. A total of 142,000 BTC ($9.7 billion), 143,000 BCH ($69.6 million) and 69 billion yen ($439 million) are scheduled to be distributed. This event temporarily pressurises the markets as the recipients of the assets can sell them immediately. However, this sell-off will finally close a longstanding phobia.

Ethereum developers announced that the Pectra update will be released by the first quarter of 2025. This is the next major upgrade to the network after Dencun, which was implemented in March. The update will include proposals to improve the Ethereum Virtual Machine object format, as well as the deployment of EIP-7251.

Bloomberg recorded a sharp rise in the number of crypto funds. Between January and March, 25 cryptocurrency-focused venture capital and hedge funds entered the market, the highest number since the second quarter of 2021.

The aggregate value of blockchain assets (TVL) in The Open Network (TON) exceeded $300 million, with the figure showing parabolic growth since the beginning of March. The liquidity flow is mainly related to the Tonstakers liquidity-stacking programme and the decentralised exchange Ston.fi.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)