EBC Markets Briefing | Dow hits record; Visa and Mastercard upgraded

The Dow and S&P 500 posted record closing highs overnight, while the dollar and Treasury yields extended declines from the day before, when the Fed gave a less hawkish outlook than expected.

Fed Chair Powell sounded balanced at a press conference, saying he did not "think a rate hike is anyone's base case." That left interest rate futures with at least two rate cuts priced in for next year.

The latest projections issued after the central bank's rate reduction showed the median policymaker sees just one 25-bp cut in 2026, the same outlook as in September.

Trade deficit unexpectedly narrowed in September, touching the lowest level in more than five years, as exports accelerated and imports rose marginally, which could provide a boost to Q3 growth.

Hedge funds' exposure to AI-related tech hardware reached its highest in October since at least 2016, suggesting they believed markets had further to go, Goldman Sachs said in a client note.

Meanwhile, speculators have downsized their trades in power companies, which are also considered part of the sector behind the servers that power AI as well as its research and development.

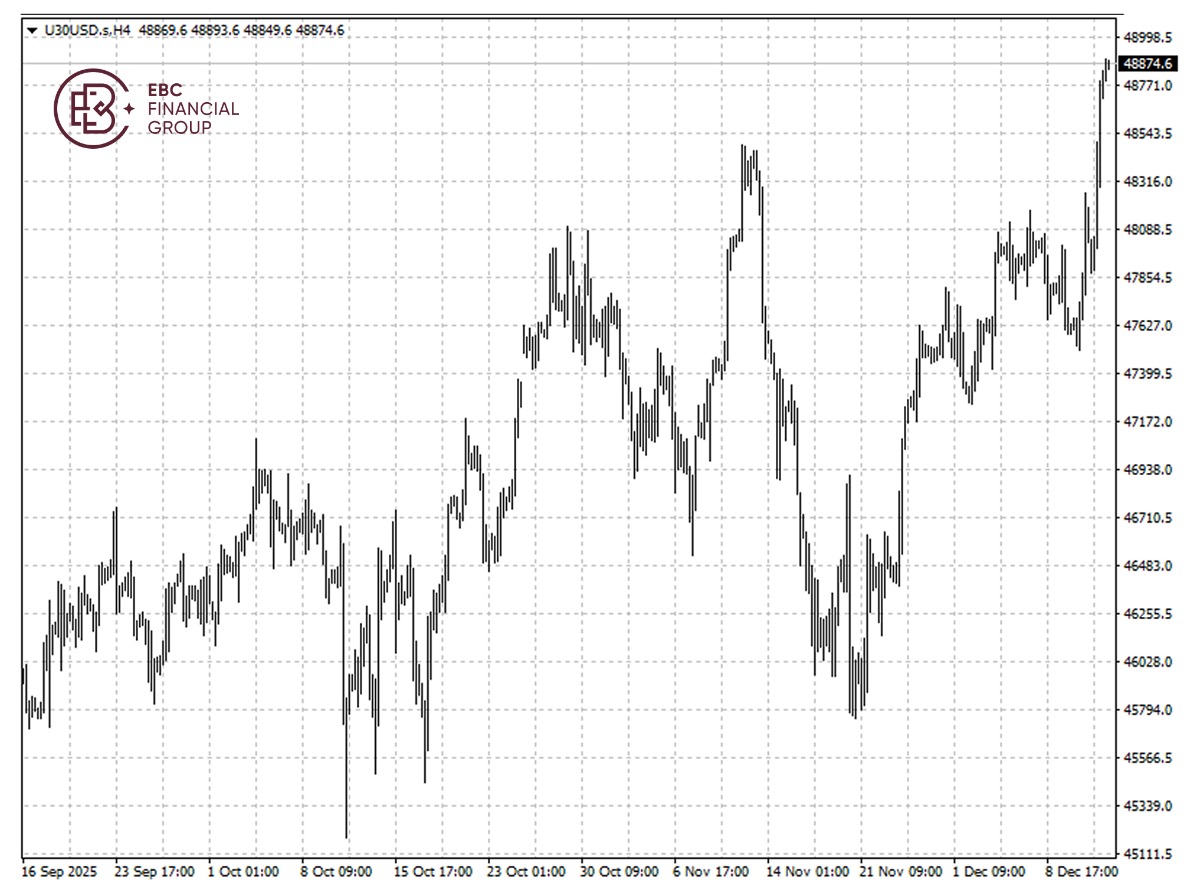

The Dow is set to test the 49,000 psychological mark and there seems little to hinder the process. However, we may see some consolidation after the index pushes above 48,900.

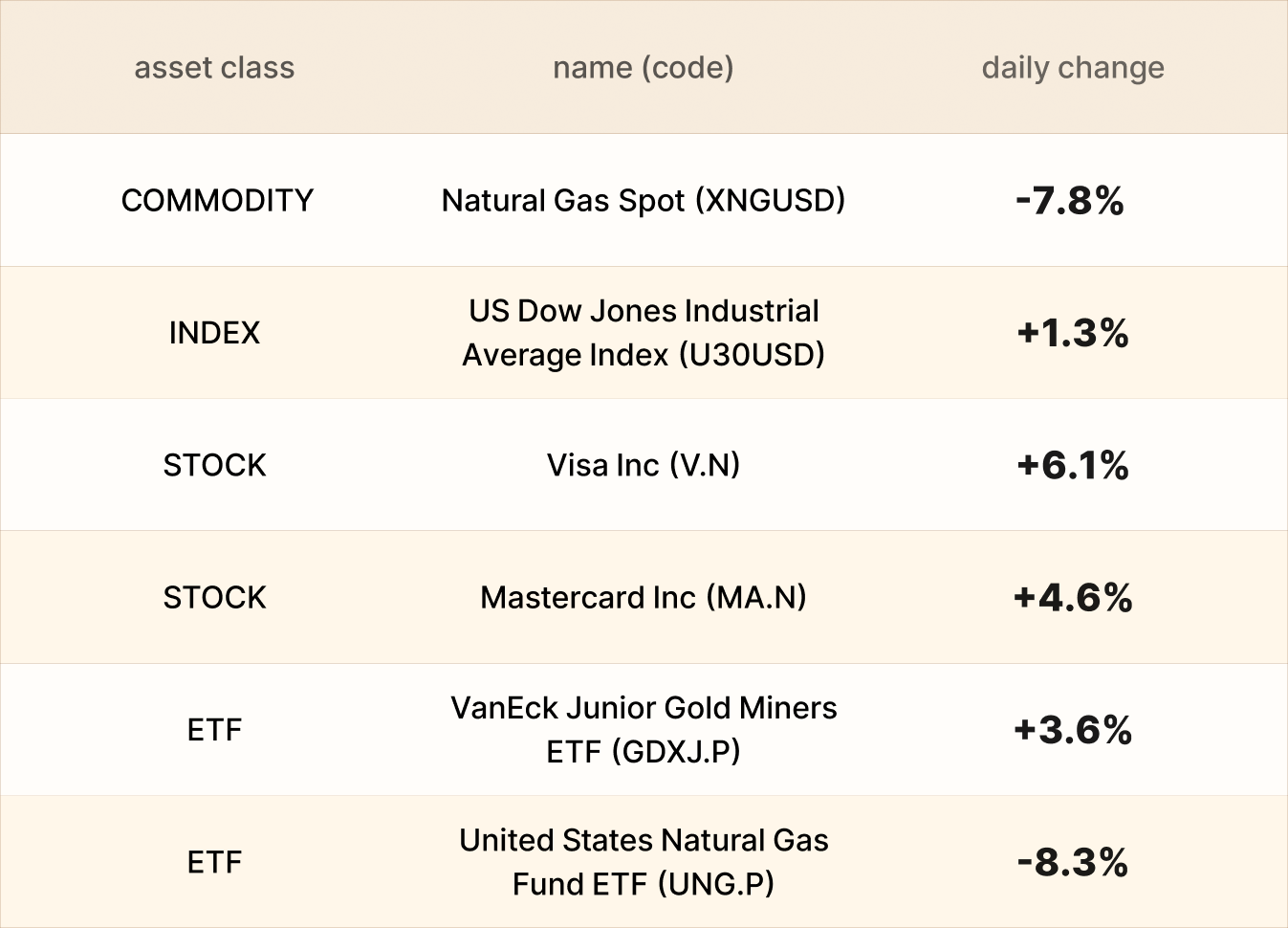

Asset recap

As of market close on 11 December, among EBC products, Visa and Mastercard shares led gains. HSBC upgraded both to Buy, citing strong services growth that supports a durable earning outlook.

Gold rose to hit its highest level in more than a month and silver surged to a record high after the Fed rate cut pushed the dollar lower. Deutsche Bank said "reflation is back”"as global central banks diverge from the Fed.

US natural gas kept falling on more moderate two-week forecasts for weather and demand, near-record output, ample amounts of gas in storage and lower prices around the world.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.