EURUSD gaps higher over potential French hung parliament

EURUSD opened with a positive gap on Monday after Le Pen’s far right party dominated the first round of the election on Sunday with a smaller margin than analysts expected, increasing speculation that an absolute majority on July 7 might be a struggle for the Euro-sceptic party.

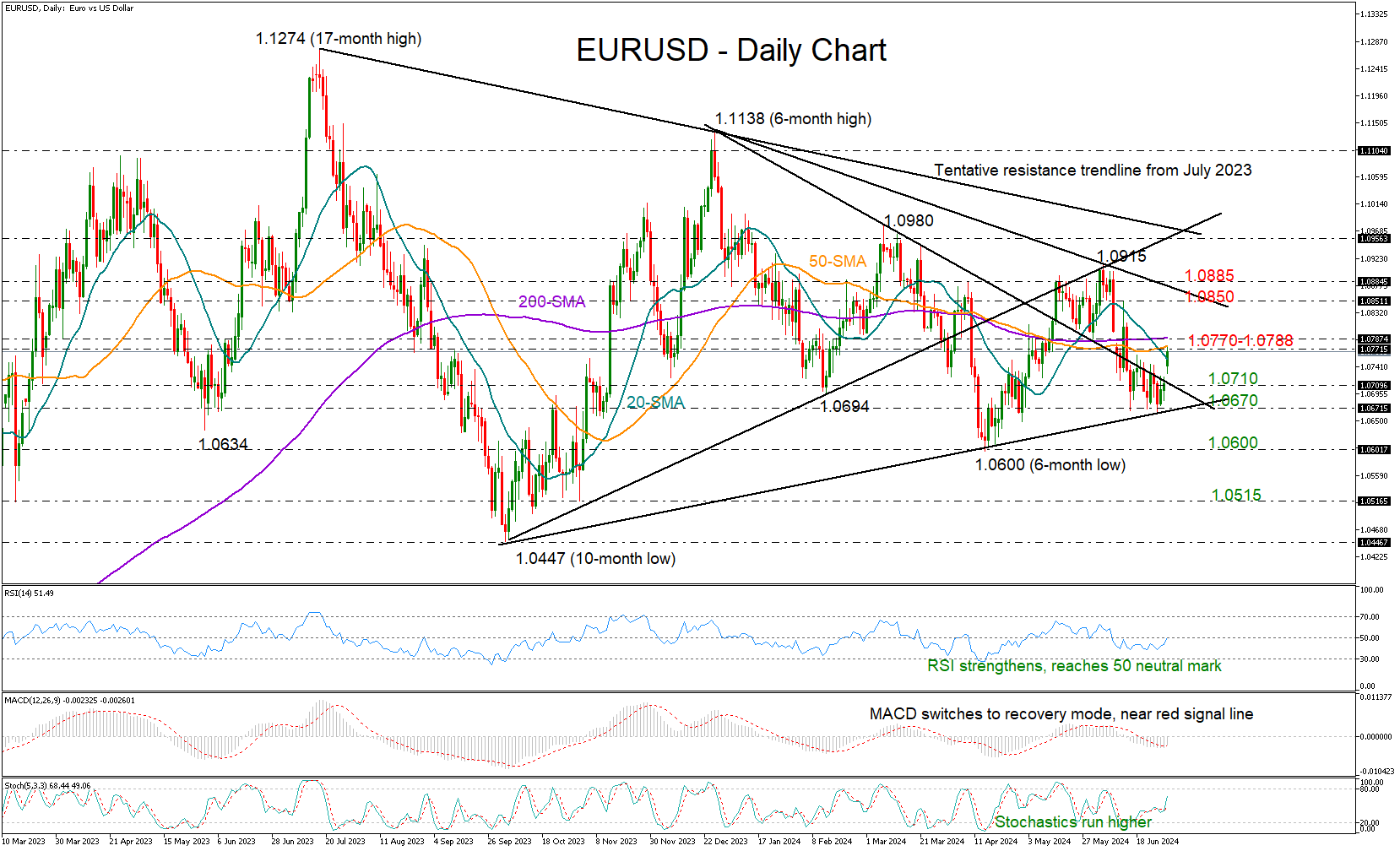

The pair ran to an almost three-week high of 1.0742, but the 20- and 50-day simple moving averages (SMAs) kept the price action limited. Also, a close above 1.0788 and the nearby 200-day SMA is still required for an advance towards the 1.0850-1.0885 constraining territory. Beyond the latter, the price could experience a significant appreciation towards the ascending line from October 2023 seen around 1.0955.

A new bullish phase is looking more likely after the latest rebound near the critical support trendline at 1.0660. The upward move in the technical indicators is another encouraging sign that the bulls could stay in play, although some caution is still necessary as the RSI has yet to climb above its 50 neutral mark and the MACD is around its red signal line in the negative region.

Nevertheless, sellers might not show up until the price tumbles below the crucial support trendline seen at 1.0670. In the event that the bearish scenario plays out, the pair could decline to 1.0600, and if it breaks below that level, it could result in more dramatic movements, ultimately shifting focus to the 1.0515 restrictive region.

Overall, EURUSD appears to have located a favorable starting point for its next bullish stage, and a move above 1.0788 may be required to trigger new buying.

.jpg)