GBPUSD relies on support levels as bears stay in play

GBPUSD came under renewed downside pressure on the first trading day of February, feeling the blues from Powell’s hawkish rate message.

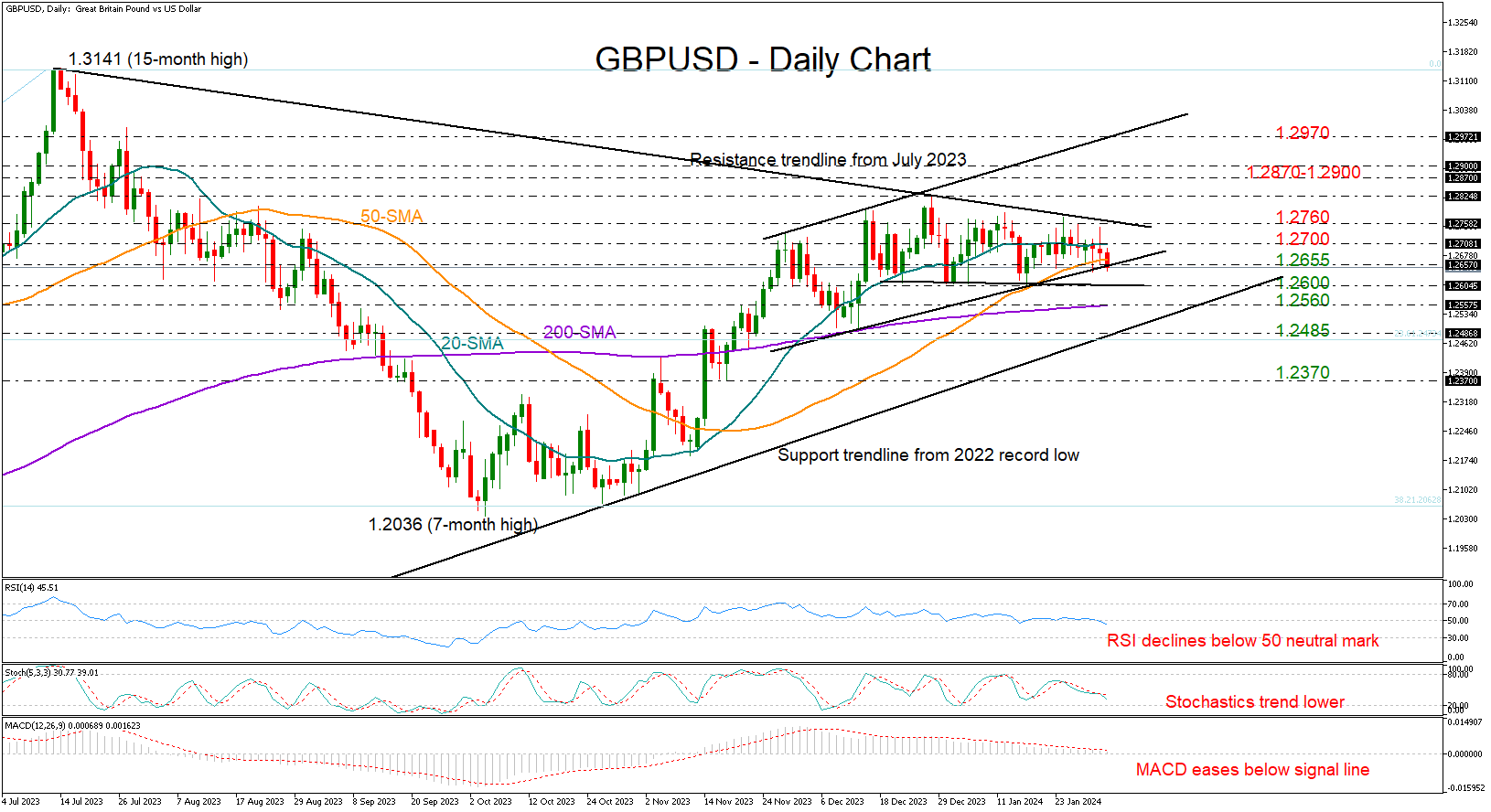

The pair is currently testing the short-term support trendline from December’s lows at 1.2647, but the technical indicators cannot guarantee a rebound in the coming sessions. The RSI has slid below its 50 neutral mark, the stochastic oscillator is drifting southwards, and the MACD remains negatively charged below its red signal line.

Moreover, the pair could not successfully close above the 20-day simple moving average (SMA), nor it could reach the resistance trendline from July 2023 at 1.2760, increasing the risk for a bearish breakout.

Despite the bearish vibes in the market, there are a couple of key support levels, which could still cool selling forces. The area of 1.2560-1.2600 could come first into view ahead of the crucial ascending trendline at 1.2485, which connects the September 2022 record low and the October 2023 trough. A decisive close below the latter would shift the outlook from neutral to bearish, likely intensifying the decline towards the 1.2370 bar.

In the event of an upside reversal, the bulls might attempt to push above the 20-day SMA at 1.2700 and beyond the resistance trendline from July 2023 at 1.2760. If they succeed, the price could increase straight up to December’s high of 1.2826, while higher, it could retest the 1.2870-1.2900 region before gearing up to meet the ascending line from November currently around 1.2970.

Summing up, downside pressures could persist in GBPUSD, but any potential declines may not upset traders unless the pair crosses below 1.2485.

.jpg)