The FOMC gave dollar a boost, but hardly for long

The FOMC gave dollar a boost, but hardly for long

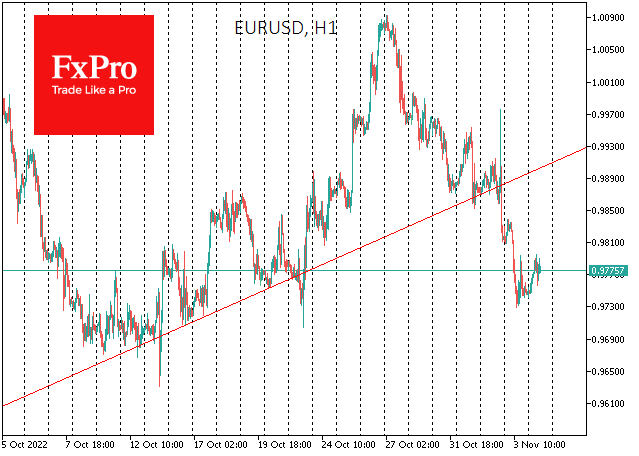

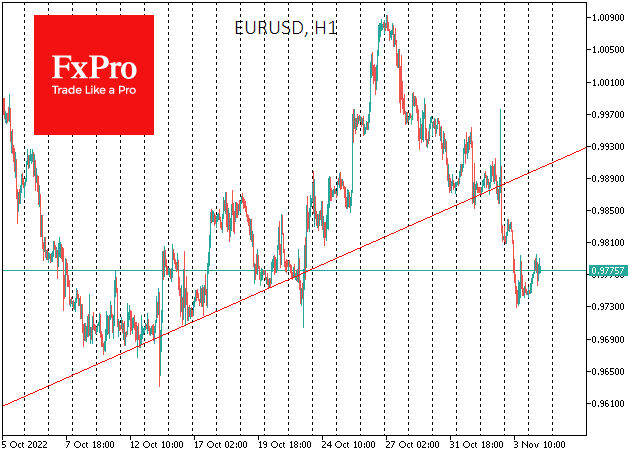

The market reaction to Powell's comments on Wednesday has shattered the nice technical picture that has been forming in EURUSD for a month since late September. In this environment, the question of whether the dollar could renew the highs made at the end of September is becoming more relevant.

Having lost over 22% since May 2021, EURUSD climbed from 0.9530 in late September to 1.0080 a month later. The current rate was above the previous local highs and the 50-day moving average, giving a double signal to end the downtrend.

During this one-month bounce, local support was formed, and the 50 SMA has been in place for three consecutive days.

However, the market reaction to Powell's comments after the FOMC meeting broke this nice technical picture. With a strong move, EURUSD went under its 50-day average and broke the support. The frustration of the speculators was so intense that the downside movement in the pair continued yesterday, dropping it to the area of 0.9730.

Strictly speaking, the recovery of the dollar momentum of the last ten days created the technical prerequisites for the EURUSD pair to renew multi-year lows, suggesting that by mid-November, it could fall under 0.9500.

At the same time, it would be wrong not to point out the fundamental resistance to dollar growth. ECB officials are becoming increasingly outspoken about their willingness and need to sacrifice economic growth to fight inflation, which means they intend to raise rates despite falling GDP.

Other important actions are the continuing and increasing interventions by Asian countries, which are fighting the fall of their currencies through the sale of USD reserves, thus increasing the supply of USD on the markets.

History also teaches us that while the Fed often leads the monetary cycle, others quickly catch up. The USD, meanwhile, on average, begins its rally six months before the reversal to tightening and six months after it begins. In this context, the current rally looks very ageist.

On the balance sheet, we anticipate great difficulty with the dollar's rise and assume more chances for a sideways formation than a sustained retreat to new EURUSD lows. Moreover, we would not be surprised if EUR buying already strengthens at 0.9700 with a more measured reversal than in October, but still an upside in the pair will follow.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)