Edit Your Comment

gold advise

Biedrs kopš

1117 ieraksti

Nov 15, 2018 at 16:35

Biedrs kopš

1117 ieraksti

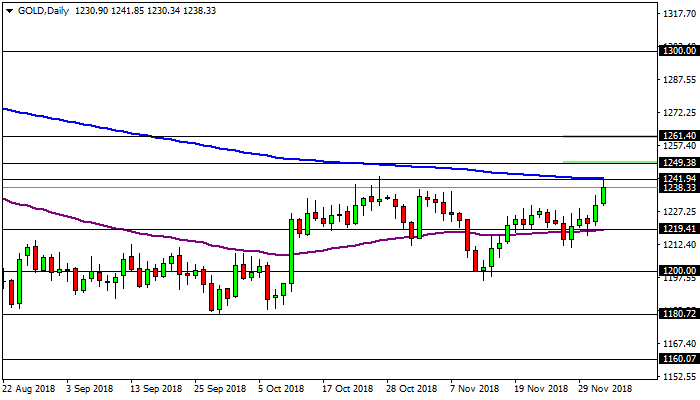

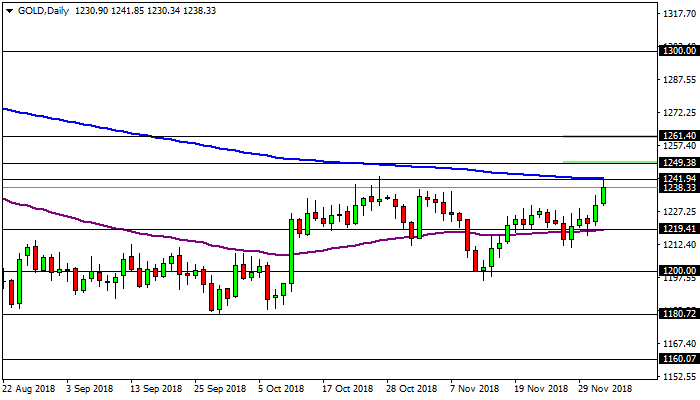

There is a pullback indeed, but the precious metal is still consolidating sideways between $1,200 and $1,215 and so far there is no signal that consolidation will end.

Biedrs kopš

775 ieraksti

Nov 16, 2018 at 02:15

Biedrs kopš

775 ieraksti

Gold has found a good resistance at the 55 day EMA around the 1216 level and if the price bounces to the downside, it may consolidate between the 1200 level and the 55 day EMA. The most relevant support levels are the 1180 level and the low at the 1160 level. Above the 55 day EMA, the 200 day EMA is still its most relevant resistance at the 1245 level.

Biedrs kopš

1117 ieraksti

Nov 16, 2018 at 18:22

Biedrs kopš

1117 ieraksti

Gold broke out above $1,215 and continued rising towards $1,222, next week the move to the upside will probably continue.

Biedrs kopš

1117 ieraksti

Nov 19, 2018 at 17:29

Biedrs kopš

1117 ieraksti

Gold is still consolidating around $1,222 but the move to the upside towards $1,230 will probably continue.

Biedrs kopš

775 ieraksti

Nov 20, 2018 at 00:18

Biedrs kopš

775 ieraksti

Gold breaks above the 55 day EMA at the 1216 level and reaches the 1223 zone. To the upside, we must be aware of the 200 day EMA around the 1244 level, because it could act as resistance. Below the 55 day EMA, its next support is still the 1200 level.

Biedrs kopš

1117 ieraksti

Nov 20, 2018 at 17:56

(labots Nov 20, 2018 at 17:58)

Biedrs kopš

1117 ieraksti

The sideways consolidation continues and Gold has formed a shooting star candlestick at $1,230 on the four-hour time-frame, there may be a new move to the downside.

Biedrs kopš

1117 ieraksti

Nov 21, 2018 at 18:32

Biedrs kopš

1117 ieraksti

Gold continues testing $1,230 but so far there is no breakout above that level. A breakout above it could lead to another move to the upside towards $1,245.

Biedrs kopš

1117 ieraksti

Nov 22, 2018 at 17:57

Biedrs kopš

1117 ieraksti

Gold is consolidating sideways, next target will likely be around $1,220.

Biedrs kopš

1117 ieraksti

Nov 23, 2018 at 18:23

Biedrs kopš

1117 ieraksti

There is still no breakout below $1,220, there likely won't be one until the end of the day.

Biedrs kopš

1117 ieraksti

Nov 26, 2018 at 18:15

Biedrs kopš

1117 ieraksti

Gold is still consolidating and it has formed a spinning top candlestick at $1,228 on the daily time-frame, so the move to the downside will probably continue.

Biedrs kopš

775 ieraksti

Nov 27, 2018 at 01:03

Biedrs kopš

775 ieraksti

Yes, indeed. The consolidation on gold continues around the 1223 level, with the 55 day EMA around the 1218 level acting as support. To the upside, the 200 day EMA at the 1243 level could act as resistance.

Biedrs kopš

10 ieraksti

Nov 27, 2018 at 11:04

Biedrs kopš

10 ieraksti

I am looking for gold to range between 1240 and 1180 for the next 3-6 months. Global economics should be stable but not strong which will lead to flat gold demand

Biedrs kopš

1117 ieraksti

Nov 27, 2018 at 18:13

Biedrs kopš

1117 ieraksti

Gold is consolidating sideways indeed, next target is likely at $1,200. A breakout below that support could lead to a further move to the downside towards $1,180.

Biedrs kopš

775 ieraksti

Dec 04, 2018 at 20:43

Biedrs kopš

775 ieraksti

Possible obstacles on gold’s rally. Gold accelerates its bullish momentum during today’s session and reaches the 1241 level, zone that is has not visited since October 26th. Gold has been supported by the pullback on the Dollar, but if the greenback goes back to its bullish trend, then gold may try to fall back down. Even if the price of gold manages to break above the 200 day EMA at the 1241 level, its next resistances are at the 1249 level where we can find the 55 week EMA and the 1261 level where we can find the 200 week EMA. In case of a breakout above the 200 week EMA at the 1261 level, gold could have the road clear for a rally to the 1300 level. On the other hand, if gold pulls back down, then the 55 day EMA at the 1219 level could act as support, followed by the 1200 psychological level.

Biedrs kopš

775 ieraksti

Dec 07, 2018 at 21:09

Biedrs kopš

775 ieraksti

Good rally on gold above the 200 day EMA at the 1241 level to reach the 55 week EMA at the 1249 level. Above the 55 week EMA, its next resistance could be the 200 week EMA at the 1261 level. To the downside, the 1220 level could act as support.

Biedrs kopš

775 ieraksti

Dec 15, 2018 at 21:32

Biedrs kopš

775 ieraksti

Gold drops again below the 200 day EMA at the 1242 level, but its is leaving a long lower shadow on the daily candle, which could be a sign that buyers are taking control of the market.

Biedrs kopš

775 ieraksti

Dec 19, 2018 at 18:01

Biedrs kopš

775 ieraksti

Bullish breakout on gold. The price of gold breaks above the 55 week EMA at the 1250 level and settles around the 1254 level. Gold is supported by the drop on the US Dollar and if it continues higher, the 200 week EMA at the 1261 level could act as resistance. In case of a pullback, the 200 day EMA at the 1242 level could act as support. Below the 200 day EMA, its next support could be the 55 day EMA at the 1227 level.

Biedrs kopš

775 ieraksti

Dec 20, 2018 at 20:05

Biedrs kopš

775 ieraksti

Gold breaks above the 1261 level where we can find the 200 week EMA, but it could find some resistance around that zone. In case of a pullback, the 55 week EMA at the 1250 level could act as support, followed by the 200 day EMA at the 1242 level.

Biedrs kopš

10 ieraksti

Dec 21, 2018 at 11:33

Biedrs kopš

10 ieraksti

Is gold anti correlated to stocks? Gold has increased as S&P has fallen. Is this what they call a flight to safety?

Biedrs kopš

775 ieraksti

Jan 04, 2019 at 00:47

Biedrs kopš

775 ieraksti

Dostiev posted:

Is gold anti correlated to stocks? Gold has increased as S&P has fallen. Is this what they call a flight to safety?

Yes. Gold and stocks usually have a negative correlation, because gold acts as a safe haven asset during uncertainty in stocks.

*Spams netiks pieļauts, un tā rezultātā var slēgt kontu.

Tip: Posting an image/youtube url will automatically embed it in your post!

Tip: Type the @ sign to auto complete a username participating in this discussion.