Forex stratēģijas

Strategies are backtests performed in the MetaTrader 4 platform, based on expert advisor or indicator. When you are developing Strategies, you may have different versions and test results with multiple parameters. Use our Strategies section to keep all of your backtests organized and well documented so you can easily keep track of your work.You can even attach your files to each strategy you upload, share it and create strategy groups.

Each Strategy is analyzed to create a Strategy report with our advanced statistics and metrics.

Manas stratēģijas

| Vārds | Ienākumi | Kritums (Drawdown) | Pipi | Diskusija | Tests beidzies | |

|---|---|---|---|---|---|---|

| VIP EA | +702988.94% | 3.62 | 17581.4 | 6 | Aug 06, 2024 |  |

| EAAIFX LOW D... | +246201.84% | 10.08 | 6170.0 | 0 | Feb 28, 2025 |  |

| FXPIP.ONE | +167492.9% | 100.00 | 1298020.0 | 7 | Dec 06, 2024 |  |

| EA Happy Gol... | +64556.7% | 22.61 | 50348.0 | 35 | Apr 04, 2017 |  |

| Master Scalp... | +60797.87% | 95.54 | 147496.0 | 0 | May 16, 2024 |  |

| BTC-ICMarket... | +16470.75% | 4.72 | 30206.1 | 4 | Jul 10, 2022 |  |

| Mtrader | +14177.85% | 37.50 | 400190.5 | 4 | Jun 21, 2022 |  |

| EuroStable E... | +6723.24% | 22.94 | 11303.0 | 1 | May 24, 2024 |  |

| ABRA_AI_TRAD... | +3766.36% | 12.45 | 69957.0 | 0 | Yesterday at 00:00 |  |

| Master Arnon... | +1432.18% | 73.44 | 303554.0 | 1 | Aug 20, 2024 |  |

Pēdējās pievienotās stratēģijas

|

ABRA_AI_TRADER

4 stundas atpakaļ |

+3766.36% |

|

MetaPeak

Aug 20 at 05:37 |

+884.33% |

|

Lumi Capital - tester

Aug 19 at 11:38 |

+18.74% |

|

PrimeBoost V2.3

Aug 12 at 00:50 |

+10.55% |

|

Nasdaq 2025

Aug 10 at 10:41 |

+6.78% |

|

OPLN Grid System 1y BT

Aug 07 at 10:07 |

+4.56% |

|

BW 9 Pair

Aug 01 at 16:56 |

+2.42% |

|

BBRSI scalping

Jul 29 at 12:55 |

-99.9% |

|

SSIBS EA

Jul 28 at 06:44 |

+500.45% |

|

Real Gold EA

Jul 23 at 12:49 |

+35.13% |

What is a Strategy Tester?

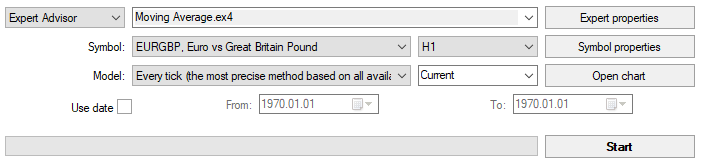

When trading forex, you can trade a demo account or a real account (both are considered forward tests as they test against the present data). The demo account is a nice option to start with as you can simulate real trading with demo funds (minus the psychology factor), however what if you have a trading strategy which you want to test against the past? You can of course do it by hand which would be an impossible task (testing multiple timeframes and instruments) or you can run a strategy test. A strategy test allows you to test your expert advisor on a predetermined set of data which can be a specific symbol (can be a synthetic symbol as well), specific timeframe or both. You could even set a model test method such testing on every tick, control points or open prices (of course the more data you test or the higher “resolution”, the longer it will take to complete, all configurable in the tester window:

What are trading robots?

MetaTrader trading robots, or expert advisors are programs written to do as the name suggests - trade. A trading robot allows the trader to write an automated trading program which can trade 24/7 with different scenration and remove the human factor from trading. This is not to say that a trading robot can replace a human trader however it is a great addition to your trading tools as long as your trading technique can be programmed.

Many tirdzniecības sistēmas use trading robots to increase profits and optimize their trading since once you built your expert advisor, you can easily optimize it with the mt4 strategy tester.

Are backtesting results will be the same with live trading?

Not necessarily, for several reasons:

- The market always evolves and adapts so a backtest that is profitable for the past 3 years could be losing on the next. This is why it is commonly said: “Past performance is not indicative of future results.”

- Backtest does not always take into account all costs associated with trading - a trading robot optimized for a low spreads account will not necessarily be successful on a high spareads or low commission account. Other costs such as swaps can also have a huge impact on a trading system, for example if positions are held long-term.

- Backtest execution is not the same as live execution - a backtest does not take into account the different market conditions such as increase in spreads nor high impact events which can move the market quickly in a short period of time (unless you’re using tick data for your backtest).

- Human factor - it is easy to do a backtest with a few clicks and see the results however when you start trading with real money, you will not be as indifferent to increasing losses in your account and can manually disable the expert advisor to prevent further losses (unlike with a backtest where you allow it to complete with zero risk).

What software should I use for backtesting?

The most popular backtesting software, as you might have guessed, is the MetaTrader Strategy Tester. It is included for free in every broker’s MetaTrader trading platform and gives you endless opportunities to program and backtest your strategy and expert advisor until you’re satisfied and ready to move to a live (or a demo) account.

When performing the different optimizations and configurations of your trading robot, you can upload it to your Myfxbook account and save every setup - this will help you to organize your different versions and even share it with others (for example your trading partner).

What is the best model to test my expert advisor against?

MT4 allows 3 different models:

- Every tick - the most precise method (slowest, most accurate).

- Control points - a crude method (faster, less accurate).

- Open prices - (fastest, least accurate).

In optimal conditions the first option would be the way to go since it covers the complete historical data as you would have traded it real time, however the speed of backtest could have an impact on your development speed where you wait several hours (or even days to complete the test), so you would better start with the control points to pinpoint specific expert advisors variations and once you narrow down the available options, use the tick method to complete the optimization.

Keep in mind that you may over optimize your mt4 strategy as you’re assuming that what worked in the past will still work in the future - this is why an optimization of a trading robot is an on-going process and not one time process.

All performance claims found on Myfxbook about strategies must be regarded as hypothetical. Use of Myfxbook to offer or subscribe to a strategy indicates you agree to our Terms & Conditions. Before using any strategy listed on Myfxbook you should be aware that there is often a vast difference between hypothetical results and real-life trading results achievable in a real brokerage account, and real-live results are almost always vastly worse than hypothetical results. Performance results for strategies listed on Myfxbook do not take into account fees, spreads and/or trading commissions that may be charged by your broker. Please consult with your broker for information on these costs. Additional information on how Myfxbook calculates performance data can be found on the Myfxbook help page.

HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM. ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS.