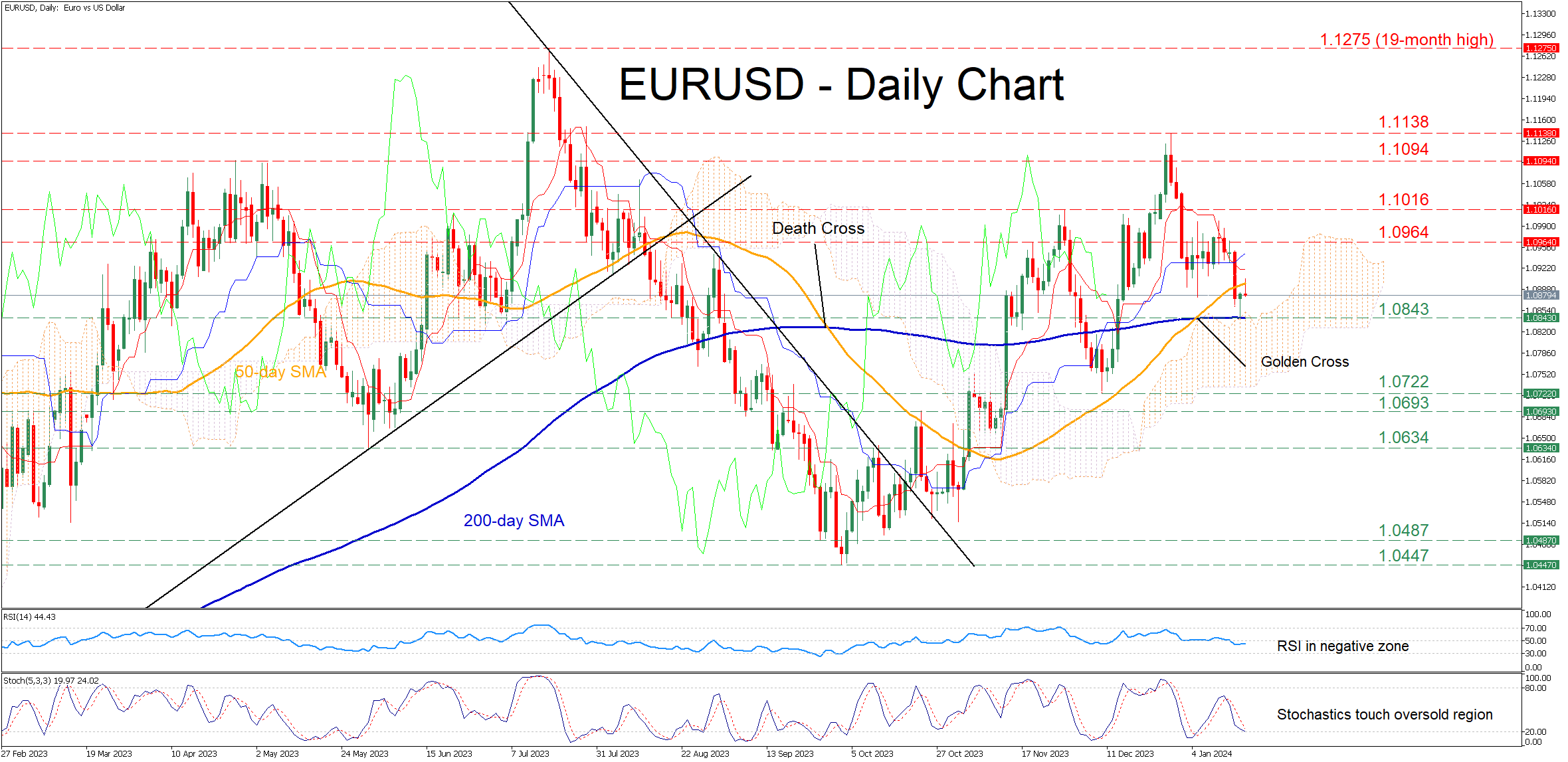

EUR/USD finds support at the 200-day SMA

EURUSD had been trading sideways since the beginning of the year following its pullback from the December high of 1.1138. The pair spiked lower on Tuesday, but the congested region that includes the 200-day simple moving average (SMA) and the top of the Ichimoku cloud rejected further retreats.

Considering that both the RSI and stochastics are deep in their negative zones, the price could revisit its recent support of 1.0843, which overlaps with the 200-day SMA. Piercing through that wall, the pair may challenge the December bottom of 1.0722. Even lower, the 1.0634 barricade could provide downside protection.

On the flipside, should the pair rotate higher, the November resistance of 1.0964 could prove to be the first barrier for the bulls to overcome. A violation of that territory could pave the way for the November high of 1.1016. Further advances may then encounter resistance at the April peak of 1.1094.

In brief, EURUSD has lost some ground in the short term, but the 200-day SMA prevented a steep decline for now. Therefore, the bulls could continue to hope for a recovery as long as the latter holds its ground.

.jpg)