Nas100 Stalls as Trend Battle Reaches a Breaking Point

In this comprehensive analysis, Ultima Markets brings you an insightful breakdown of the NAS100 for November 18, 2025.

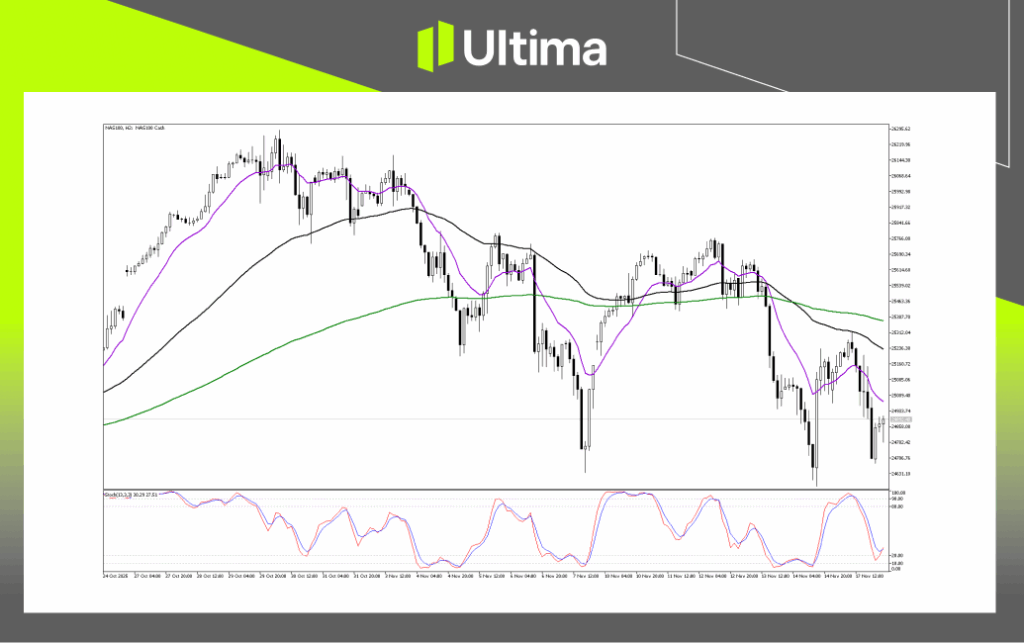

Nas100 Slips Into Danger Zone

The near-term bias currently leans bearish. Short-term momentum has tilted lower, with price slipping beneath the purple moving average and printing a lower high, both early signals of weakening strength. The Stochastic indicator has dipped below 20, indicating an oversold condition that may prompt a pause or minor rebound, though it doesn’t erase the prevailing downside pressure.

Key Levels:

The first major support to monitor sits at the black moving average near the 24,500–24,600 zone. This area is critical, as it underpins the broader medium-term uptrend. A decisive break beneath it would shift attention to the next significant support, the rising long-term green moving average, hovering around the 23,000 level.

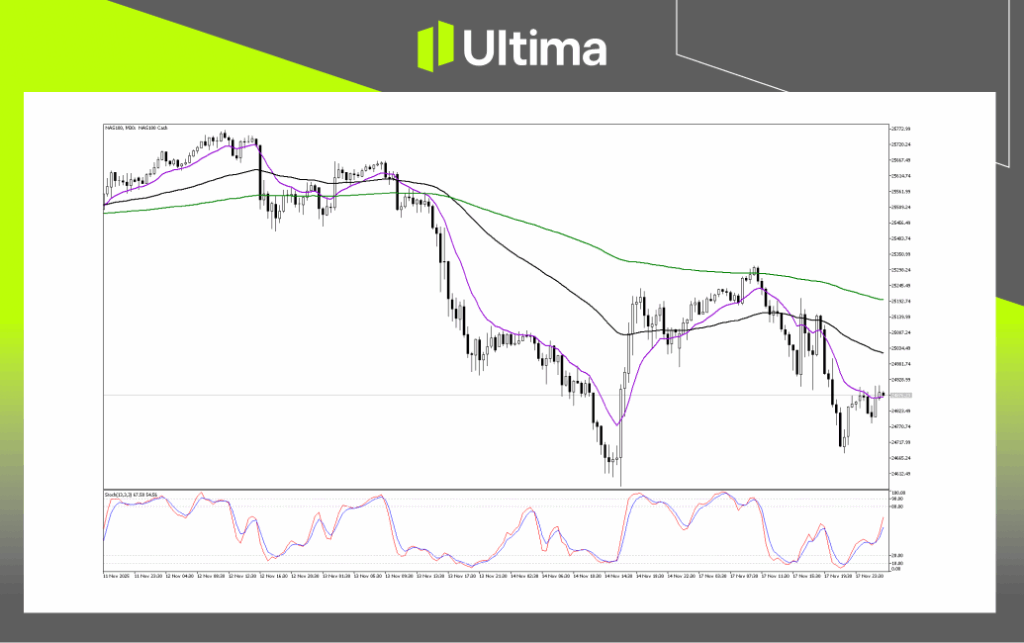

Nas100 Bears Take Over After Sharp Rejection

Recent movement shows a firm rejection at the 25,230 resistance area, which sparked a sharp pullback. The Stochastic indicator has rolled over aggressively after leaving overbought territory, reinforcing that sellers currently have the upper hand.

Breakout Scenarios:

For now, the market’s easier path appears to be to the downside. A clean break and close beneath the 24,800 support would confirm continued bearish follow-through, with the next key downside target sitting near 24,630.

On the flip side, any bullish recovery would require price to hold above 24,800 and carve out a higher low, then push through the 25,230 resistance, this would be the first hint of momentum shifting away from the bears. A full trend reversal, however, wouldn’t be validated until price decisively clears the major resistance band at 25,400–25,500, reclaiming all three moving averages.

Nas100 Trapped in a Tight Range After Selloff

After sliding sharply to 24,665, the market has shifted into a consolidation phase. Price action is now confined within a narrow band, repeatedly failing to break above the short-term purple moving average. Meanwhile, the Stochastic has lifted out of oversold levels and is trending upward, hinting that selling pressure has eased for the moment and a mild rebound could unfold.

Bearish Continuation (Breakdown):

Initial support sits at the lower boundary of the current range near 24,770. The more critical level remains the recent swing low at 24,665, if sellers manage to drive price below this point, it would confirm a continuation of the downtrend.

Bullish Corrective Bounce (Breakout):

A near-term bullish break would require price to clear the 24,880–24,900 resistance band. Such a move would signal a stronger corrective bounce and could pave the way for a retest of the next resistance at 25,100, aligned with the black moving average. However, this recovery would still be viewed as counter-trend unless buyers can push decisively above the key 25,300 resistance zone.

Navigating the Forex Market with Ultima Markets

Staying informed and making decisions based on solid data is essential, especially in areas like index trading, where momentum can shift quickly. Ultima Markets is committed to delivering clear, actionable insights to support your trading journey. If you’re looking for guidance tailored to your personal financial goals, our team is always ready to assist.

Join Ultima Markets and gain access to a full trading ecosystem designed to help you succeed, from advanced tools to market research. For deeper learning, UM Academy offers structured education to help you build confidence and sharpen your skills. Stay connected for more expert analysis and updates from the Ultima Markets team.

—–

Legal Documents

Trading leveraged derivative products carries a high level of risk and may not be suitable for all investors. Leverage can magnify both gains and losses, potentially resulting in rapid and substantial capital loss. Before trading, carefully assess your investment objectives, level of experience, and risk tolerance. If you are uncertain, seek advice from a licensed financial adviser. Leveraged products are not intended for inexperienced investors who do not fully understand the risks or who are unable to bear the possibility of significant losses.

Copyright © 2025 Ultima Markets Ltd. All rights reserved.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.