EBC Markets Briefing | The stake is high for Hong Kong stocks

The dollar is regaining its crown as one of the world's most appealing assets, defying talk of a "Sell America" trade that raised troubling questions about the outlook for the global reserve currency.

A simple strategy of borrowing in low-yielding currencies like the Japanese yen or the Swiss franc and putting your money in dollars, known as the carry trade, turned out be profitable, according to Bloomberg.

The appeal of dollar carry has been helped by a sharp drop in the greenbacks volatility, in part due to an extended period of government shutdown, which reduces the risk of unhedged dollar buying.

There is plenty of hope for dollar bulls looking to ramp up long-dollar carry strategies into 2026 as inflation remained well above the Fed's target in September amidst higher tariffs on goods imports.

That presumably dent the appeal of foreign assets in dollar terms. For instance, the CAC 40 has underperformed with a yearly gain of around 10%, but on a currency-adjusted basis, it trounced the Dow.

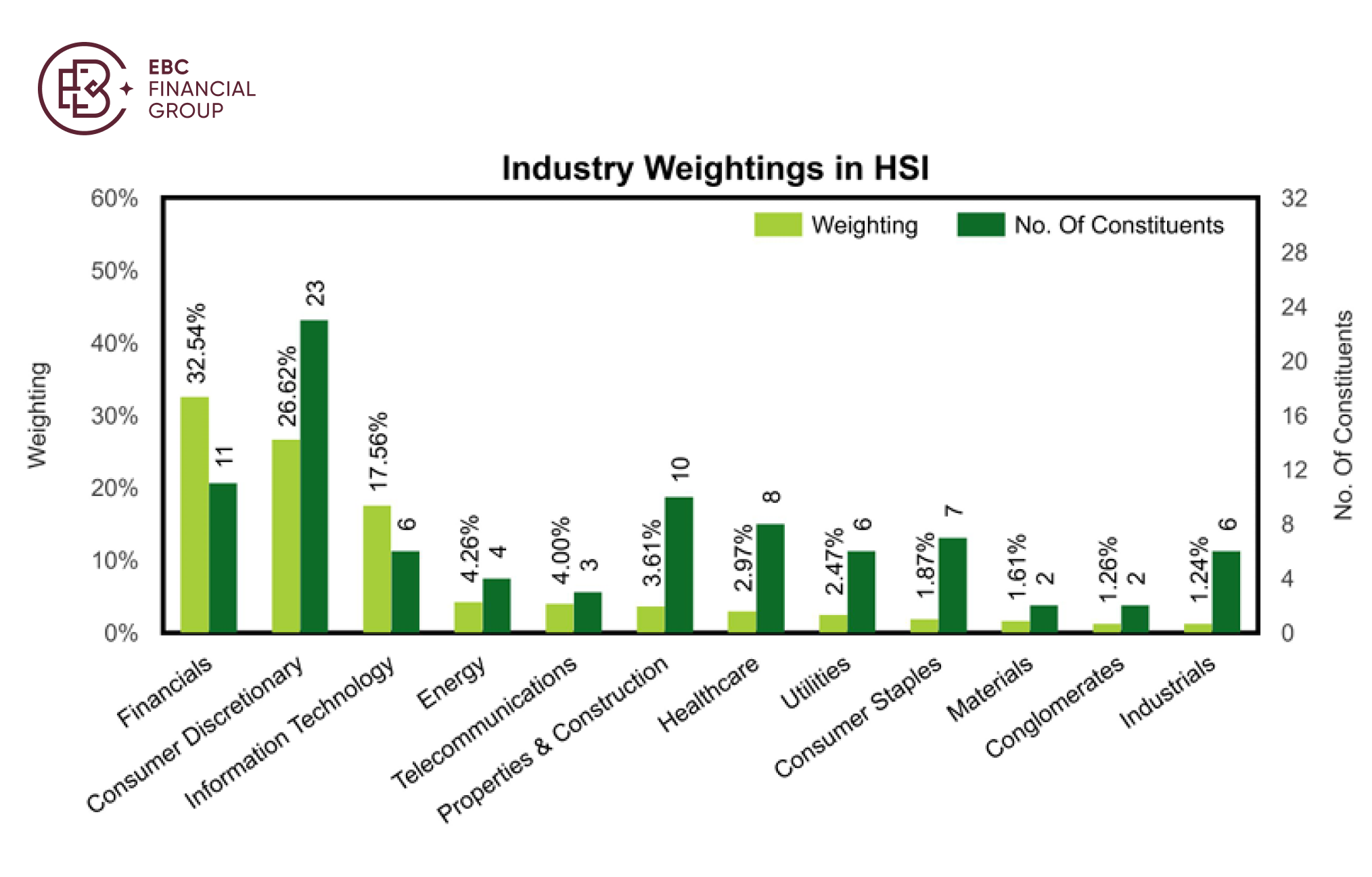

In particular, a strong dollar adds to downward pressures on the Hong Kong stock market which is susceptible to liquidity crunch. Also many index constituents earn yuan, so their earnings would be lower after converted into HKD.

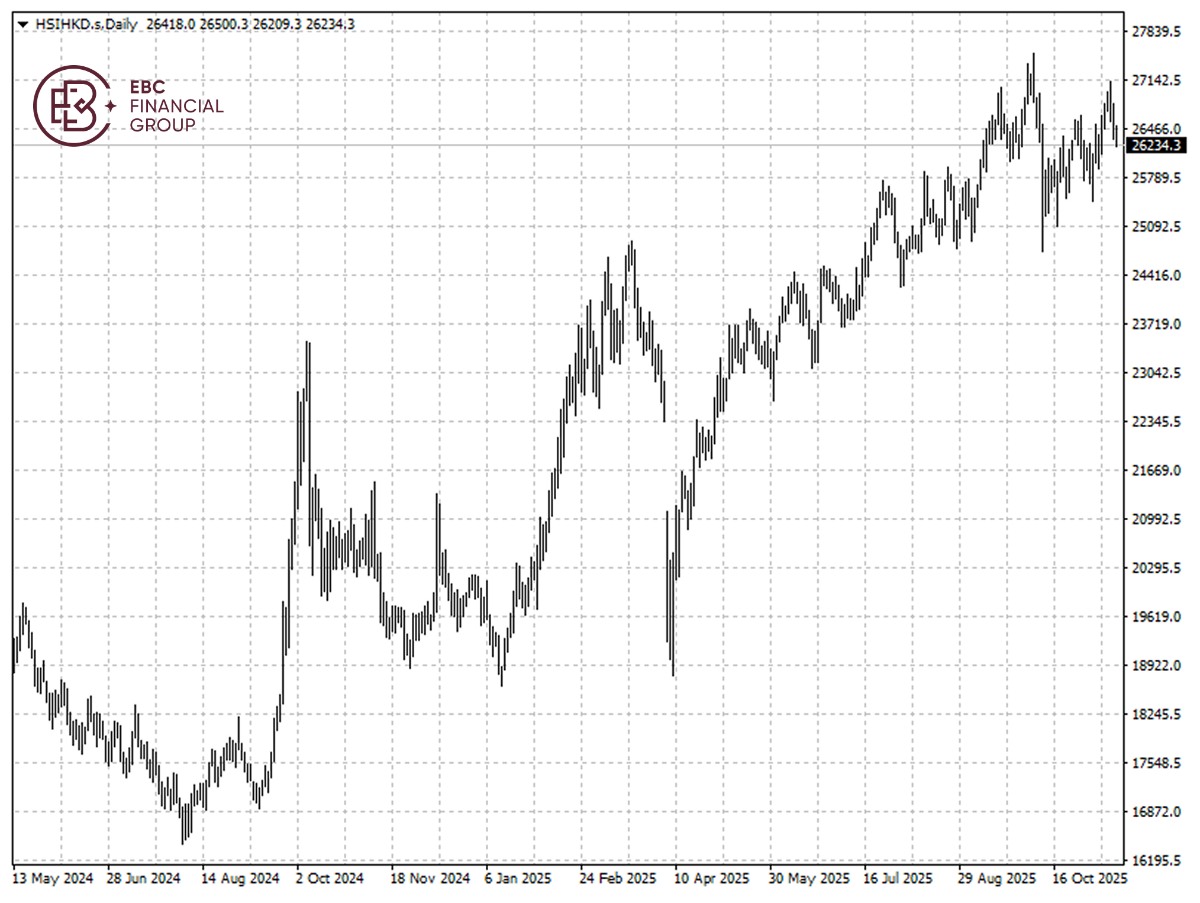

The Hang Seng index is one of the biggest winners of the year, thanks to global AI boom and depressed valuations. Despite that, it is remote from its all-time peak above 33,000 hit in 2018.

Canary in a coal mine

China's stocks will post moderate gains in 2026, maintaining momentum a, according to Morgan Stanley. The bank said its year-end target for the Hang Seng Index was 27,500, implying little room to the upside.

Morgan Stanley said that it would turn more bullish on Chinese stocks if the nation broke out of deflation earlier, if more tech breakthroughs emerged and if a more benign geopolitical situation took shape.

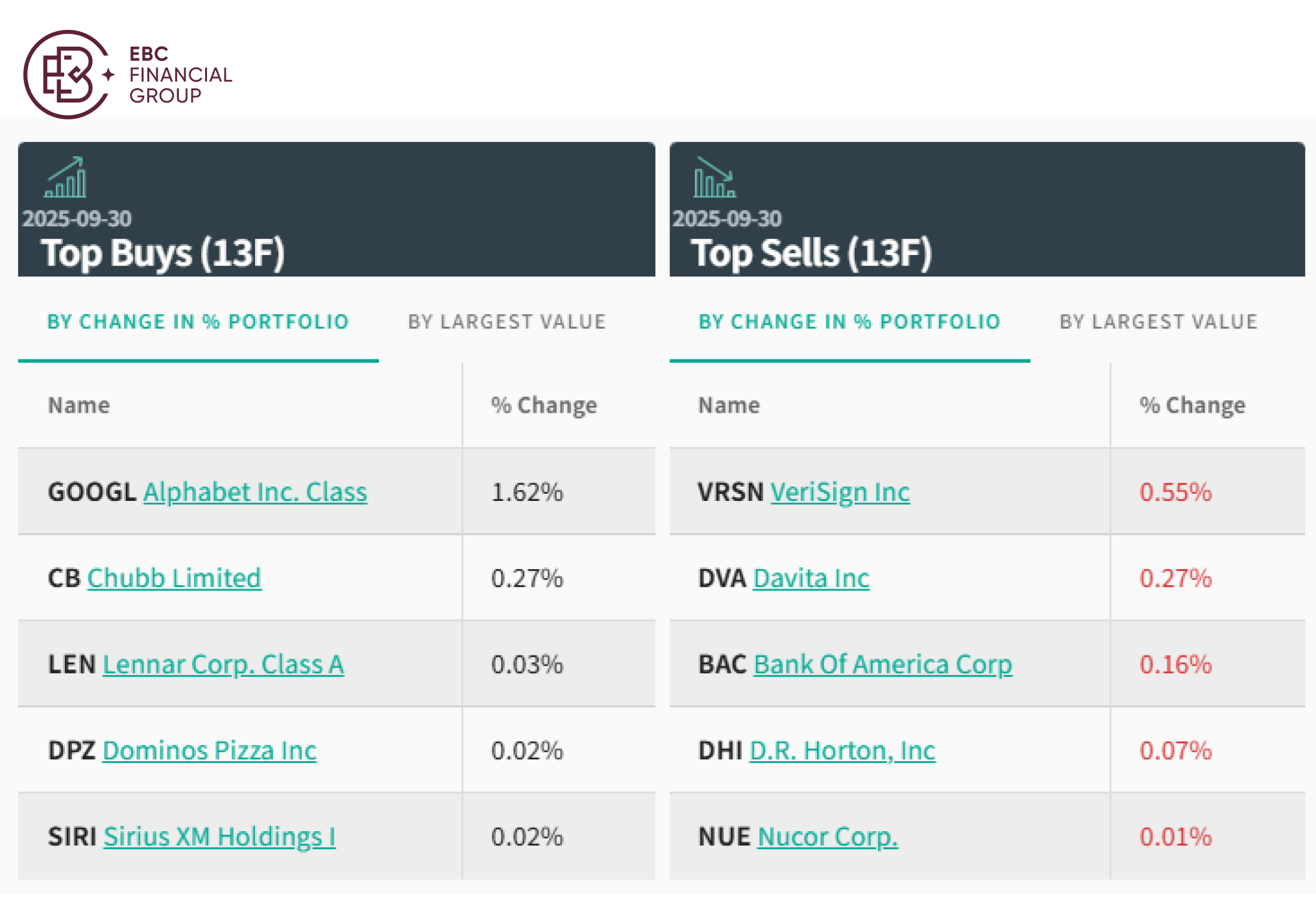

Berkshire Hathaway revealed late Friday that it purchased 17.8 million shares of Alphabet during Q3. The surprise sets off AI bubble debate flare-up, following tech sell-off over the past weeks.

AI mania has powered Wall Street's latest record run, creating trillions in market value. But the market may have already priced in most of the potential gains from the technology, wrote Goldman Sachs analysts in a note.

They warned investors often over-aggregate and over-extrapolate during major innovation booms. Another risk is that competition and new investment usually eat into those returns over time.

TSMC posted a 16.9% rise in sales for October, the slowest pace since February 2024 –a sign of cooling product demand. Notably, it can be viewed as a leading indicator of AI growth.

The chip powerhouses including South Korea and Taiwan could feel the pains first and most. Naturally AI service companies, the main contributor to Hong Kong shares' rally, will be facing the test.

A weak finish to 2025

China's factory output and retail sales grew at their weakest pace in over a year in October, piling pressure on policymakers to revamp economy as mounting supply and demand strains threaten to further curtail growth.

Surprisingly, car sales also snapped an 8-month growth streak, despite expectations that purchases would accelerate ahead of the phase-out of various tax breaks and government subsidies.

Japan's economy contracted an annualized 1.8% in Q3, the first fall in six quarters, due to a hit to exports from tariffs. The country is seeking to boost domestic demand to offset the declines in sales to the US.

The trajectory sheds a light on what may lie ahead for the world's second largest economy. Although Trump has agreed to slash the tariffs on China, the universal rate is still well above that on Japan.

A US-China trade deal is up in the air. Even as the truce appears to be holding, analysts caution that the détente remains fragile in a rivalry increasingly defined by strategic competition.

Slowing economic momentum and global easing cycle looms large for financial stocks including HSBC Holdings and AIA Group. The sector accounts for the largest weighting in the Hang Seng index.

Hong Kong bankers are signalling growing concern over the city's deepest real estate downturn since the Asian financial crisis. Some of the assessments from valuation providers have failed to reflect the slump.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.