Stocks hit new records on rate cut excitement

Party on Wall Street

It’s been a stellar year for stock markets. The Dow Jones and Nasdaq 100 both closed at fresh record highs yesterday, despite some pushback from Fed officials who warned that markets are getting ahead of themselves in pricing in such heavy rate cuts for next year.

Investors are raising their exposure to riskier assets at a breakneck pace, as fears about a recession have melted away and a soft landing for the US economy has become the dominant narrative. Speculation that the Fed will launch an easing campaign has also served as jet fuel for this rally, with markets currently pricing in six rate cuts in 2024.

The problem is that US equity valuations are historically stretched, while projections by analysts for 11% corporate earnings growth next year seem a little overoptimistic heading into a global macro slowdown. Uncertainty around the US presidential election could also act as a headwind for markets next year.

Therefore, equity markets are pricing in the best of all worlds - no recession, a cycle of Fed rate cuts, and a serious acceleration in corporate earnings growth next year. All this leaves scope for disappointment in case reality does not match these rosy expectations. As such, the risk/reward profile for US stocks does not appear very attractive here. The asset class is already priced for perfection.

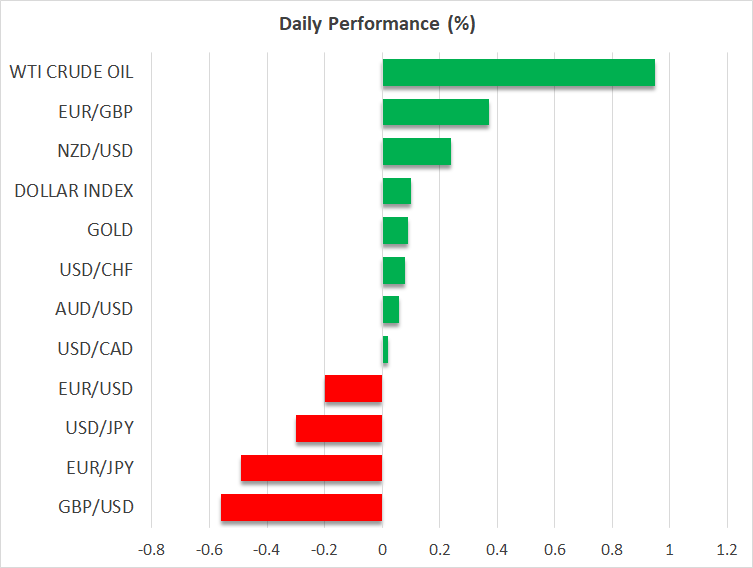

Sterling retreats, dollar ignores Fed commentary

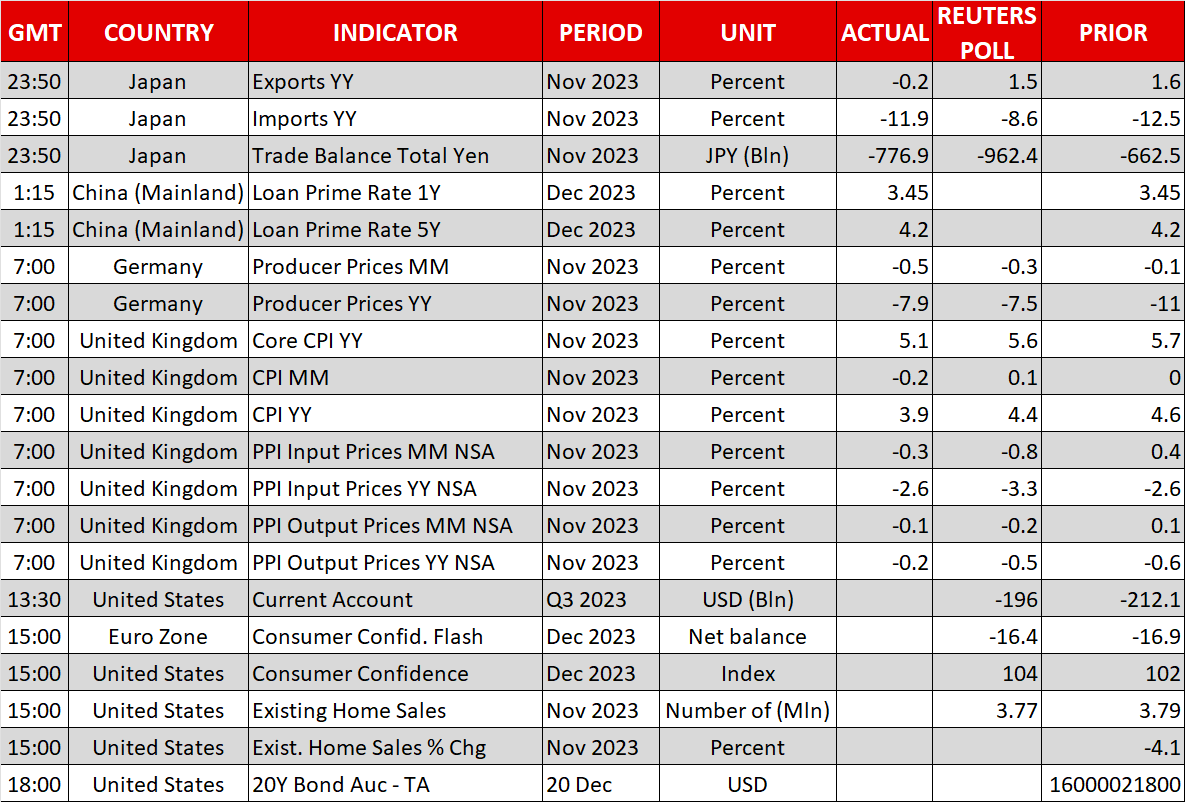

In the FX complex, the British pound came under fire today, following a larger-than-expected decline in the nation’s inflation rate. The data suggests that inflation momentum in the United Kingdom is finally losing steam, allowing the Bank of England to join the global rate cutting cycle next year, in order to prop up a stalled economy.

That said, UK wage growth remains extremely hot, so markets still think the BoE will be among the last central banks to push the easing button. This creates a favorable setup for the pound early next year, although it won’t be plain sailing, as investors might ultimately focus on the risk that a new Labour government will raise taxes, including on corporations.

Elsewhere, the dollar lost some ground yesterday, brushing aside some commentary from Fed officials who softly pushed back against excessive rate cut speculation and ignoring an upgrade in the Atlanta Fed GDPNow estimate for this quarter. Hence, it seems investors are not trading economics right now, and that year-end flows are in charge instead.

Meanwhile, the yen managed to stabilize, licking its wounds after the Bank of Japan dashed expectations for tighter monetary policy.

Supply concerns lift oil, gold inches higher

In the commodity sphere, oil prices seem to have found some solace from the missile attacks against commercial ships in the Red Sea, which threaten to disrupt global trade routes. Alas, it’s questionable whether such concerns will manage to keep oil prices supported for long, against the backdrop of slowing demand next year coupled with record-high US crude production.

Finally, gold prices enjoyed some upside yesterday, capitalizing on the pullback in the US dollar and the persistent retreat in Treasury yields. The precious metal is on track to end the year with gains of almost 12% and close to its record highs as investors appear to be favoring real assets heading into a regime of easier monetary policy.

.jpg)