UK retail sales weak due to high prices

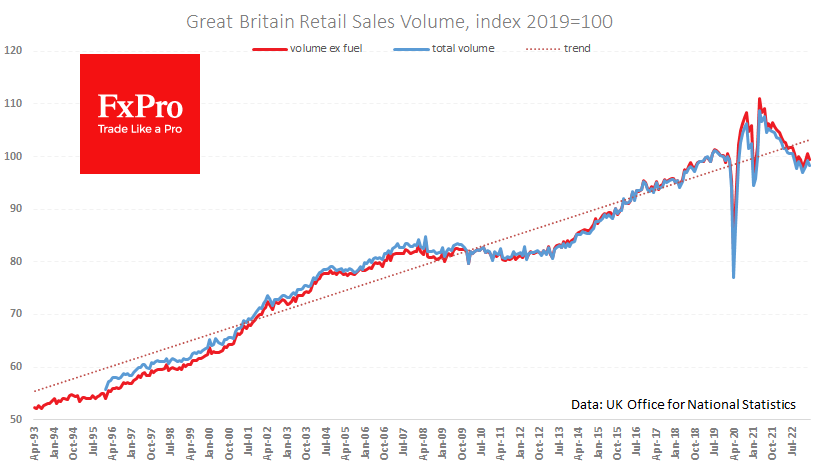

UK retail sales fell by 0.9% in March, or 1.0% excluding fuel. This compares with a fall of 3.1% year on year. More interestingly, the latest fall fits into a steady downward trend in the retail sales index, which peaked in April 2021 and has lost 9.5% since then.

At the start of this year, there were hopes that consumption had bottomed out, but the latest data cast doubt on this optimism. Conventional logic suggests that March's high inflation figures are due to a rebound in final demand at the point of sale. But we see the opposite trend. Price rises are more the result of producers and retailers passing on higher costs to consumers rather than the result of excess demand.

As a result, the British are opting for the economy. As a relatively affluent country, they have considerable room to save on unnecessary and premium goods. The positive effect is that weak retail sales work against inflation, allowing the central bank to ease pressure on interest rates. On the other hand, this consumer behaviour can easily trigger a self-perpetuating spiral of price and cost-cutting that will weigh on the economy.

This consumer behaviour regarding retail activity and fashion trends suggests a shift in the narrative from conspicuous consumption to cost rationalisation. An example of such consumer behaviour was after the First World War, which contributed to the Great Depression, along with the active use of tariff wars and the fragmentation of the global economy (another sign of the times).

By the FxPro analyst team

-11122024742.png)

-11122024742.png)