Global markets go nowhere despite US inflation surprise

Traders dismiss US inflation surprise

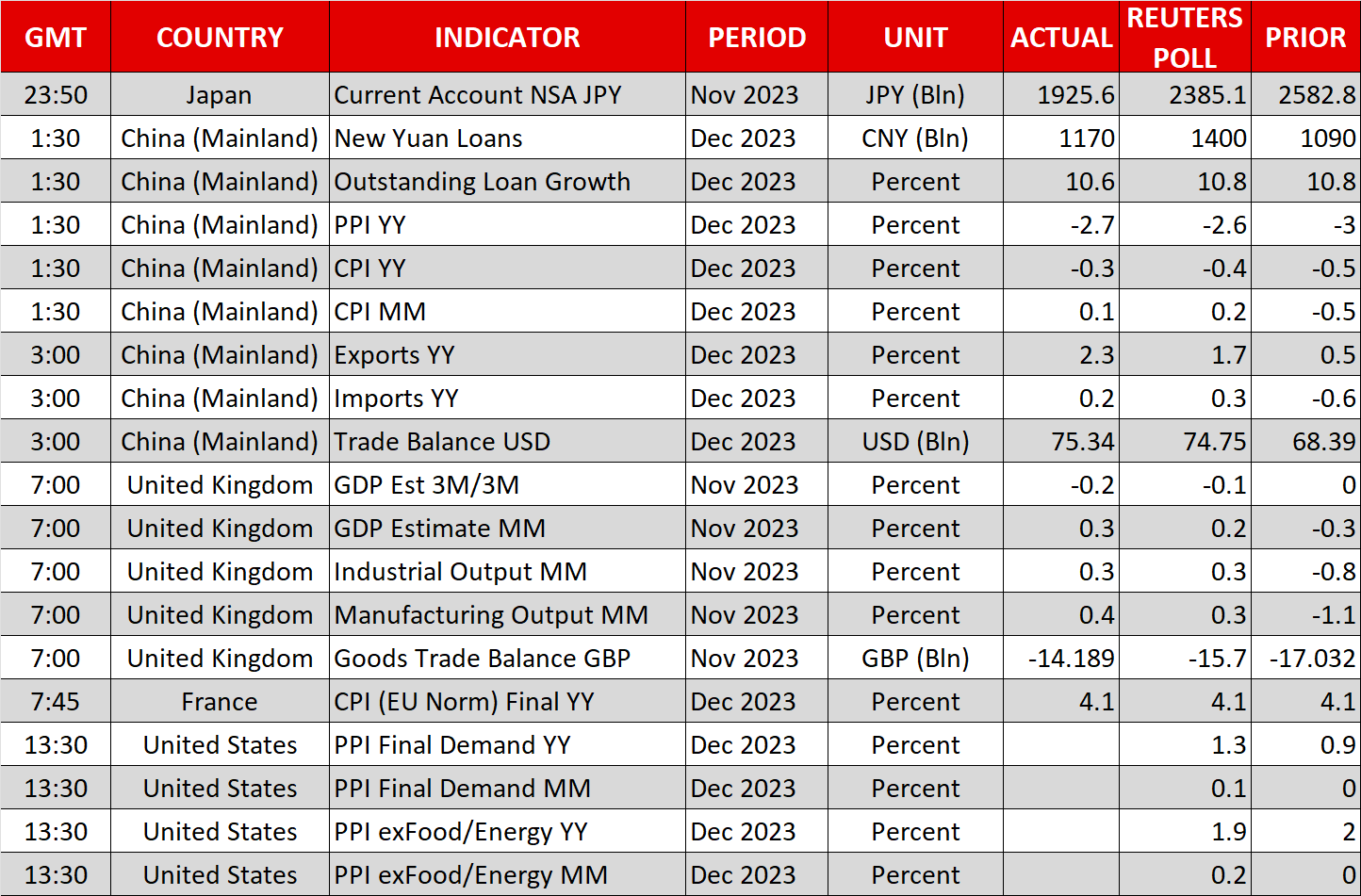

Global markets went on a rollercoaster ride on Thursday after the US inflation report, but ultimately ended exactly where they started. Inflation as measured by the consumer price index came in hotter than expected in December, clocking in at 3.4% on an annual basis, above the consensus estimate of 3.2%. The core rate was also a touch higher than economists had expected.

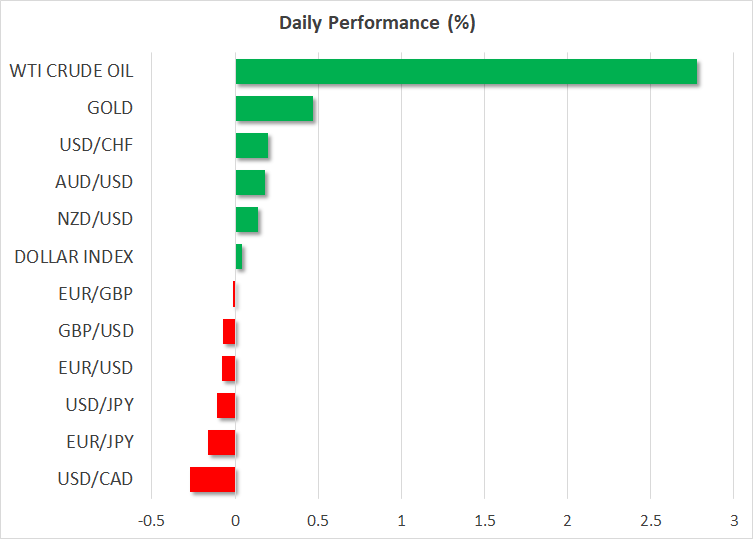

The initial market reaction was hawkish. The dollar spiked higher while equities and gold prices fell, as traders trimmed some bets on rapid-fire Fed rate cuts this year. However, these reactions soon faded, with all of these instruments reversing course to close the session almost unchanged. Hence, a lot of volatility but with nothing to show for it in the end.

In fact, the implied probability of a Fed rate cut in March rose slightly once the CPI dust settled. Sifting through the details of this report, investors seem to have concluded that the CPI print was not shocking enough to alter the trajectory of interest rates, as much of the overshoot reflected rising shelter costs that are considered a lagging component of inflation.

It’s crucial to highlight that the Fed pays more attention to the PCE price index, which puts far less weight on housing costs than the CPI does. Hence, there is a sense that the next PCE print will be much more favorable for the disinflation story, keeping the Fed on track to launch an easing cycle as early as March.

Airstrikes against Yemen boost oil and gold

In the geopolitical arena, the United States and Britain launched airstrikes against Iranian-backed Houthi militants in Yemen yesterday, in retaliation to attacks on commercial ships in the Red Sea in recent weeks.

With tensions in the Middle East already sky-high, this military strike fanned fears about a broader escalation in the region, which translated into a boost for oil and gold prices. That said, this conflict has had little direct impact on oil production so far, so it’s questionable whether such concerns will support prices for long without further escalation that actually takes some crude barrels offline.

Gold came under selling pressure yesterday following the hot CPI readings, but found fresh buy orders at its 50-day moving average and rebounded with force, as the airstrikes against Yemen fueled demand for safe haven instruments and pushed bond yields lower.

The next major test for gold prices will come in the form of US retail sales on Wednesday, which will be a key piece of the puzzle about whether the Fed will slash rates in March, something markets currently assign a 70% probability to.

UK GDP beats estimates, China stuck in deflation

The United Kingdom economy grew slightly more than anticipated in November according to GDP data released earlier today, calming some fears about a recession. Yet, the British pound was not impressed, because even though the UK might dodge a downturn, economic growth is still stagnant.

In China, figures for December showed that the world’s second-largest economy remained trapped in deflation for a third month running. On the bright side, the nation’s exports rose by more than expected, fueling optimism that global manufacturing demand is finally picking up steam.

As for today, the limelight will fall on the latest edition of US producer prices. Over the weekend, all eyes will turn to the election in Taiwan, which could have repercussions on the global stage considering the tensions between the island and China.

.jpg)