Markets waiting for key interest rate updates

OVERNIGHT

Asian equity markets are predominantly lower this morning with some markets down by more than 2%. Reports suggest that concerns about China’s economic and geopolitical headwinds contributed to the falls. Just released UK public sector borrowing finance data for the last financial year showed an overall deficit (ex-banking groups) of £139.2bn, which is around £13bn below the Office for Budget Responsibility’s forecast made in March.

THE DAY AHEAD

The CBI industrial trends survey for April will today provide another timely update on the factory sector. Last week the April PMI survey showed UK manufacturing continuing to struggle even as service sector activity picked up, a contrast that seemed to be repeated across several other economies including the Eurozone. In the UK manufacturing output on the PMI measure fell to a three-month low and a slide in new orders suggests that a near-term pickup is unlikely.

The consensus expectation is that the CBI survey will also show a slide in orders. However, more positively, the survey is expected to confirm that inflationary pressures in the sector continue to ease. Today’s report will also include the results of the more detailed quarterly survey. That includes investment intentions after the previous update in January saw a rise in intentions regarding spending on plant and machinery but a fall regarding buildings.

In the US today’s Conference Board data for April consumer confidence will be provide further indications of the impact of the ongoing rise in interest rates. Confidence on this measure rose for the second month in a row in March but was still below its January level. A similar measure from the University of Michigan was up for April but the two series do not always move in tandem.

Also of interest in the US will be March new home sales. Those have now risen for three months in a row, although February’s level was still 19% below that of a year ago. A big question is whether this a sign that the market is levelling off as mortgage rates slide from their recent peaks?

Australia will release Q1 CPI inflation data early Wednesday. These are expected to see a fall in headline inflation but with core rates stickier. A higher-than-expected outturn will probably boost expectations that the Australian central bank may soon consider another interest rate hike, although current market pricing still points to policy remaining on hold.

MARKETS

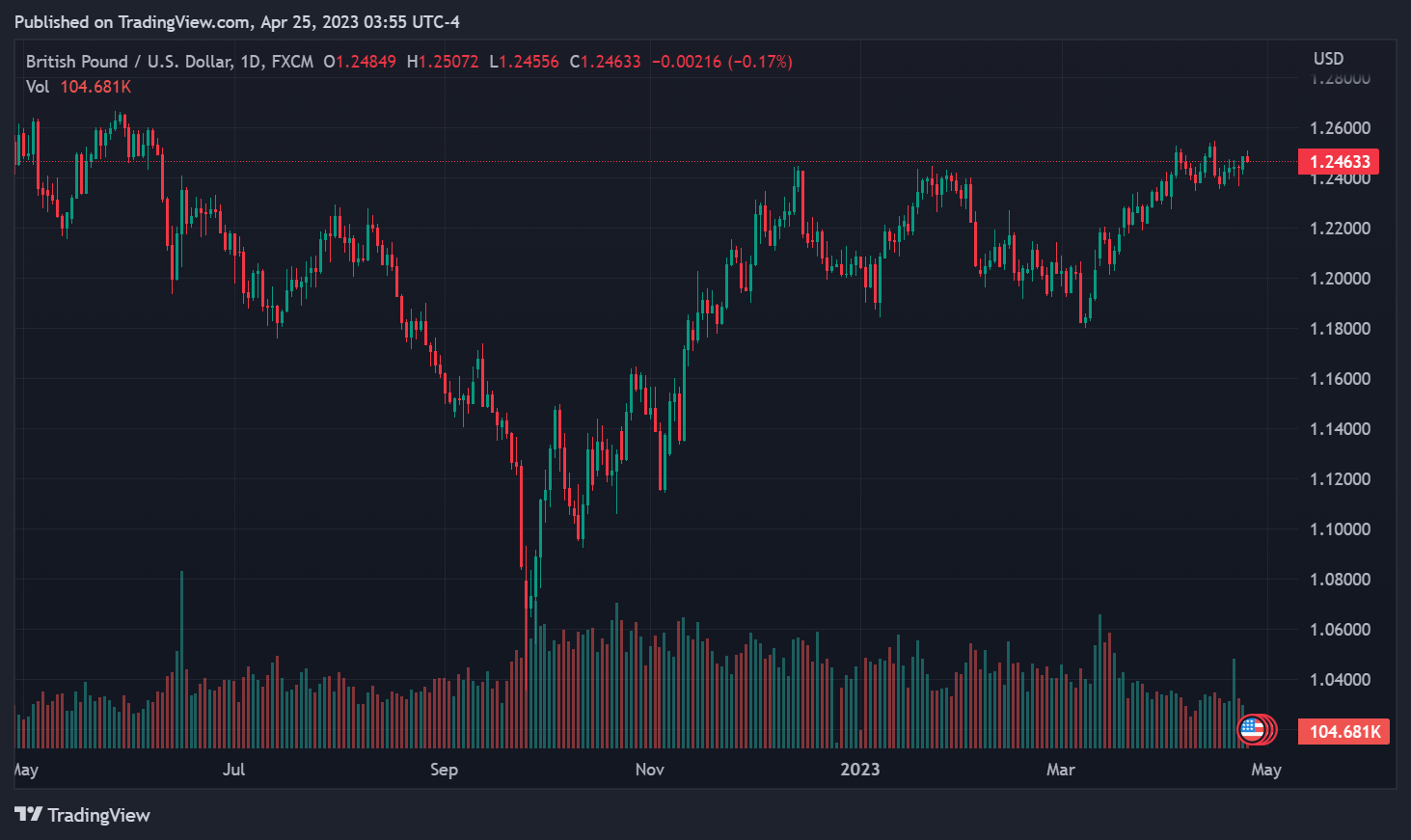

US Treasury yields fell yesterday but UK gilt yields rose as markets continue to speculate on the outcomes of the monetary policy updates due over the next two weeks. Today’s speech by Bank of England policymaker Broadbent may offer some last clues on policy intentions before the pre-announcement silent period begins. In currency markets the US dollar came under further pressure against both sterling and the euro.