USDJPY begins a healing process

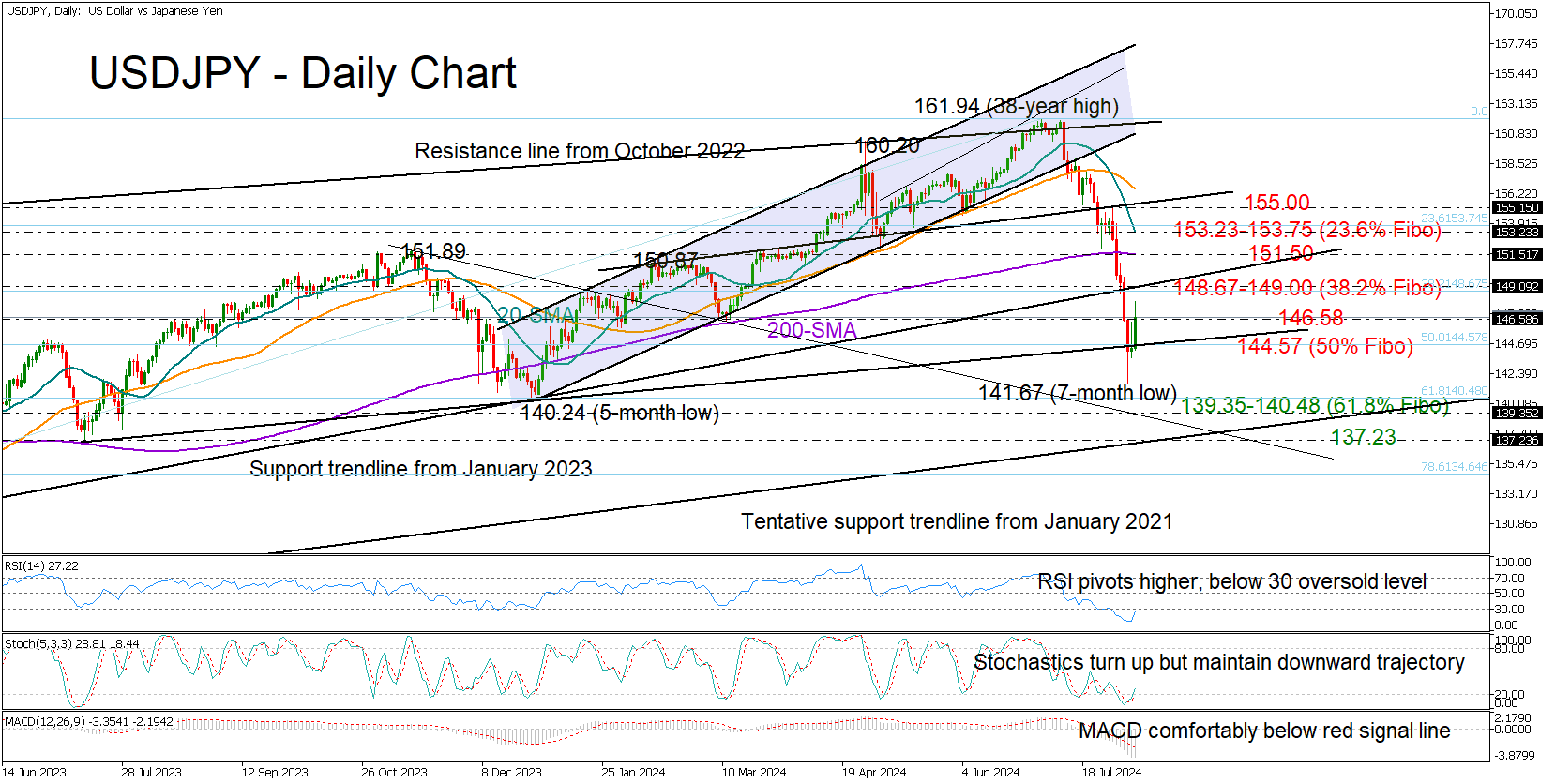

USDJPY showed signs of life on Wednesday, forcefully bouncing above the 144.57 bar that had limited Tuesday’s gains following the flash spike to 146.35.

There is still a chance for sellers to reverse today’s bull run since the RSI and stochastic oscillator have not moved out of the bearish area. However, with the indicators hovering within the oversold region, downward pressures might soon subside.

More importantly, if the pair manages to complete a bullish doji candlestick pattern by recouping Monday’s freefall above 146.58, the pair might receive fresh buying interest likely towards the 149.00 constraining zone. Even higher, the spotlight will fall on the 200-day simple moving average (SMA) at 151.50, a break of which could navigate the price straight to the 20-day SMA at 153.20.

On the downside, the key support trendline drawn from July 2023 will be closely watched along with the 50% Fibonacci retracement of the 2023-2024 uptrend at 144.57. If that base collapses, the price is expected to fall rapidly into the 139.35-140.48 zone formed by the descending constraining line from November 2023 and the 61.8% Fibonacci level. Another step lower could target the 2021 ascending trendline at 137.23.

Overall, it appears that the recent aggressive sell-off in USDJPY has reached a bottom. The bulls face a challenging task for a full recovery, but closing above 146.58 could give their recovery attempt a boost.

.jpg)