- Главная

- Сообщество

- Опытные трейдеры

- Low time frame trading vs. High time frame trading.

Advertisement

Edit Your Comment

Low time frame trading vs. High time frame trading.

Участник с Nov 19, 2014

157 комментариев

Nov 16, 2015 at 09:39

(отредактировано Nov 16, 2015 at 09:54)

Участник с Nov 19, 2014

157 комментариев

OC_Trader...I couldnt agree with you more and I apologize for dragging this on with HolyGrail ...so this is my final response to him/her..

HolyGrail..clearly English is not your first language..or if it is you clearly do not know how to read and understand...so this is my final attempt to explain myself...

1. You arent even a paid student of mine, so why I must show you - a stranger - my Live Account? Is that a requirement of this thread? Have you shown us yours? Why havent you asked others to show theirs?

2. The Demo System reflects the trades made on my LIVE account. Same Trades. Same Trades. Same Results. Same Results.

3. The reason the LIVE account is not shown here is because it CANNOT be linked to myfxbook. JFOREX is used by Dukascopy which is NOT supported by Myfxbook. So that is why I used a DEMO account that CAN be tracked and verified to REFLECT what takes place on my LIVE account.

4. Less Stress because the more you trade the more stressful it can be. In all my 10 years of trading, I have never entered a trade and seen in it in the red by 100- 500 Pips immediately...maybe it happens but you are using something that rarely happens and generalizing. Usually it may be by 10, 20 Pips..but that is why I do not watch my trades as you would see in the picture of the PDF document that I showed in my previous response. Watching trades causes stress. If you are going to tell me that I should...thats another argument for another day/thread.

5. I am not here to promote myself. I mention Subscribers to give you an idea of how confident and accurate I NEED to be in my use of HTFs and Swing Trading. Doing it for yourself is one thing. Doing it with/for others shows a greater level of confidence.

6- 50 usd per month? lol.

In the future and for the sake of this thread, stop making assumptions and attacking people based on limited information your misunderstandings and your personal agenda/vendetta. Thats why many threads deteriorate here and elsewhere on the internet. Even on Facebook.

HolyGrail..clearly English is not your first language..or if it is you clearly do not know how to read and understand...so this is my final attempt to explain myself...

1. You arent even a paid student of mine, so why I must show you - a stranger - my Live Account? Is that a requirement of this thread? Have you shown us yours? Why havent you asked others to show theirs?

2. The Demo System reflects the trades made on my LIVE account. Same Trades. Same Trades. Same Results. Same Results.

3. The reason the LIVE account is not shown here is because it CANNOT be linked to myfxbook. JFOREX is used by Dukascopy which is NOT supported by Myfxbook. So that is why I used a DEMO account that CAN be tracked and verified to REFLECT what takes place on my LIVE account.

4. Less Stress because the more you trade the more stressful it can be. In all my 10 years of trading, I have never entered a trade and seen in it in the red by 100- 500 Pips immediately...maybe it happens but you are using something that rarely happens and generalizing. Usually it may be by 10, 20 Pips..but that is why I do not watch my trades as you would see in the picture of the PDF document that I showed in my previous response. Watching trades causes stress. If you are going to tell me that I should...thats another argument for another day/thread.

5. I am not here to promote myself. I mention Subscribers to give you an idea of how confident and accurate I NEED to be in my use of HTFs and Swing Trading. Doing it for yourself is one thing. Doing it with/for others shows a greater level of confidence.

6- 50 usd per month? lol.

In the future and for the sake of this thread, stop making assumptions and attacking people based on limited information your misunderstandings and your personal agenda/vendetta. Thats why many threads deteriorate here and elsewhere on the internet. Even on Facebook.

Trade Less, Earn More

Участник с Nov 01, 2015

98 комментариев

Nov 16, 2015 at 15:53

Участник с Nov 01, 2015

98 комментариев

DRFXTRADING posted:

OC_Trader...I couldnt agree with you more and I apologize for dragging this on with HolyGrail ...so this is my final response to him/her..

HolyGrail..clearly English is not your first language..or if it is you clearly do not know how to read and understand...so this is my final attempt to explain myself...

1. You arent even a paid student of mine, so why I must show you - a stranger - my Live Account? Is that a requirement of this thread? Have you shown us yours? Why havent you asked others to show theirs?

2. The Demo System reflects the trades made on my LIVE account. Same Trades. Same Trades. Same Results. Same Results.

3. The reason the LIVE account is not shown here is because it CANNOT be linked to myfxbook. JFOREX is used by Dukascopy which is NOT supported by Myfxbook. So that is why I used a DEMO account that CAN be tracked and verified to REFLECT what takes place on my LIVE account.

4. Less Stress because the more you trade the more stressful it can be. In all my 10 years of trading, I have never entered a trade and seen in it in the red by 100- 500 Pips immediately...maybe it happens but you are using something that rarely happens and generalizing. Usually it may be by 10, 20 Pips..but that is why I do not watch my trades as you would see in the picture of the PDF document that I showed in my previous response. Watching trades causes stress. If you are going to tell me that I should...thats another argument for another day/thread.

5. I am not here to promote myself. I mention Subscribers to give you an idea of how confident and accurate I NEED to be in my use of HTFs and Swing Trading. Doing it for yourself is one thing. Doing it with/for others shows a greater level of confidence.

6- 50 usd per month? lol.

In the future and for the sake of this thread, stop making assumptions and attacking people based on limited information your misunderstandings and your personal agenda/vendetta. Thats why many threads deteriorate here and elsewhere on the internet. Even on Facebook.

Honestly it doesn't make any sense to go back and forth with you. I think all you should do is admit that YOU are a horrible day-trader, and since you ARE a horrible day-trader, simply keep your comments to your family and stop generalizing it. Day-trading hasn't work out for you, and instead of identifying those reasons, you simply blame the entire method which isn't fair.

Участник с Oct 17, 2015

19 комментариев

Nov 17, 2015 at 08:19

Участник с Oct 17, 2015

19 комментариев

HolyGrailPTY posted:

@richadi36

The term "overtrading"is merely that; a term. There is no such thing as over trading such as their is no such thing as over bought or under sold. Those terms have been put out there based on bias and a justification to enter a position. Many people speak about "long term", yet we see that the market can take U-TURNS at a drop of time, thus wiping out profits in 1 - 2 days. Higher tf, is more profitable in pips, but it also leads to higher draw-downs. So my question to you is why not focus on accurate entries, instead of only focusing on just profit.

How many systems have we seen here on myfxbook, that have been both long and short term and fail sometime in the further? The reality is ALL! The best systems are the systems which can profit, and based on the trade history you can see consistency in the sl. Since you believe in overtrading, well UNDERTRADING also exsist. Undertrading exsist when swing trades don't hedge positions "both green and red"and allow them to end up turning to deeper red, or green positions which turn into BE or red!

Hi HolyGrailPTY,

I see no one wins in this argument. If you think that working on LTF is better for you and it suits you, it is OK. I think any trading system is evaluated by its profitability and longevity. If LTF trading is worth focusing on show your ONE YEAR or more results to public...

I am sure WE ALL COME TO FOREX (BUSINESS) TO MAKE PROFIT OR MONEY, dont we, NOT JUST TO TRADE. If your goal is just to make accurate entries (as you said) and to trade just go on doing so. Good luck!

Constant Stable Monthly Account Growth Makes You Successful

Участник с Nov 01, 2015

98 комментариев

Nov 17, 2015 at 13:57

Участник с Nov 01, 2015

98 комментариев

richadi36 posted:HolyGrailPTY posted:

@richadi36

The term "overtrading"is merely that; a term. There is no such thing as over trading such as their is no such thing as over bought or under sold. Those terms have been put out there based on bias and a justification to enter a position. Many people speak about "long term", yet we see that the market can take U-TURNS at a drop of time, thus wiping out profits in 1 - 2 days. Higher tf, is more profitable in pips, but it also leads to higher draw-downs. So my question to you is why not focus on accurate entries, instead of only focusing on just profit.

How many systems have we seen here on myfxbook, that have been both long and short term and fail sometime in the further? The reality is ALL! The best systems are the systems which can profit, and based on the trade history you can see consistency in the sl. Since you believe in overtrading, well UNDERTRADING also exsist. Undertrading exsist when swing trades don't hedge positions "both green and red"and allow them to end up turning to deeper red, or green positions which turn into BE or red!

Hi HolyGrailPTY,

I see no one wins in this argument. If you think that working on LTF is better for you and it suits you, it is OK. I think any trading system is evaluated by its profitability and longevity. If LTF trading is worth focusing on show your ONE YEAR or more results to public...

I am sure WE ALL COME TO FOREX (BUSINESS) TO MAKE PROFIT OR MONEY, dont we, NOT JUST TO TRADE. If your goal is just to make accurate entries (as you said) and to trade just go on doing so. Good luck!

Accurate entries is how I decide to trade, as it allows me to earn money. Although I thank you for your response, the reality is you haven't provided any information which is deemed useful towards the argument at hand. As a scalper, I have a problem when people, who have failed in doing so mention that scalping is not profitable in the long run or it doesn't earn money. It is unfair to cast such a negative outlook on something because YOU have failed at it. That in turn, will cause people to shy away from scalping and head towards swing trading, which is a totally different monster. The reality is less then half a % of the accounts here make it past 1 year, and if they do it is because the manager has the ability to stick to his or her system ALL of the times.

Участник с Nov 16, 2015

708 комментариев

Nov 18, 2015 at 07:51

Участник с Nov 16, 2015

708 комментариев

richadi36 posted:

Hi all,

I'd like you guys to comment about the best time frame, in your opinion, to trade profitable over the long run?😱

Every time frame has it's pluses... With the longer time frames you rely on big profit from one positionq but in the short time frames you are searching for a minimal profits out of a big number of deals... A matter of a strategy.

Участник с Nov 19, 2014

157 комментариев

Nov 18, 2015 at 10:48

(отредактировано Nov 18, 2015 at 10:50)

Участник с Nov 19, 2014

157 комментариев

My opinion in summary...

Its a matter of which style gives you better results despite its disadvantages.

By results I mean at least equal to your 9-5 salary each month or some other monetary benchmark.

Success must be in dollar terms not just % (return, drawdown etc). After all, money is what you can take to the bank, supermarket, vacations etc--not fancy percentages.

Regards

Duane

DRFXSWINGTRADING

Its a matter of which style gives you better results despite its disadvantages.

By results I mean at least equal to your 9-5 salary each month or some other monetary benchmark.

Success must be in dollar terms not just % (return, drawdown etc). After all, money is what you can take to the bank, supermarket, vacations etc--not fancy percentages.

Regards

Duane

DRFXSWINGTRADING

Trade Less, Earn More

Участник с Nov 01, 2015

98 комментариев

Nov 18, 2015 at 12:34

Участник с Nov 01, 2015

98 комментариев

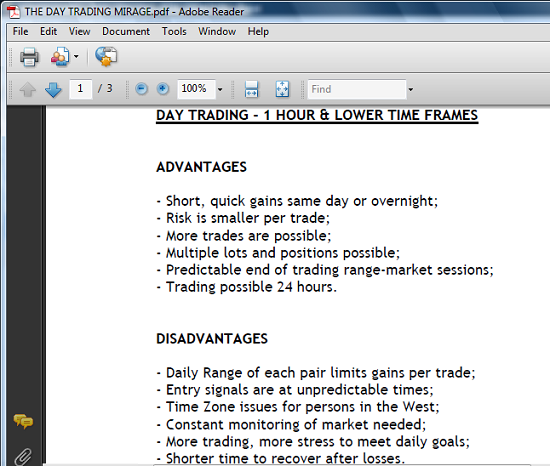

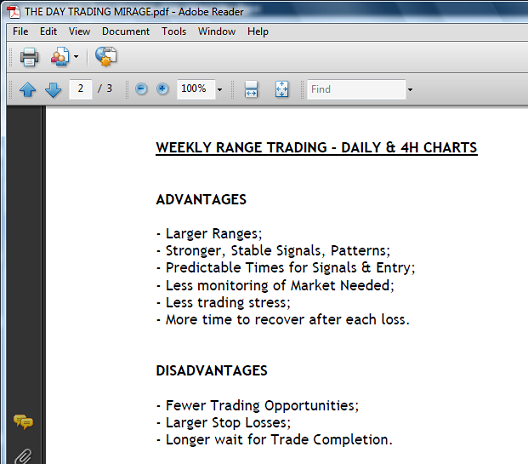

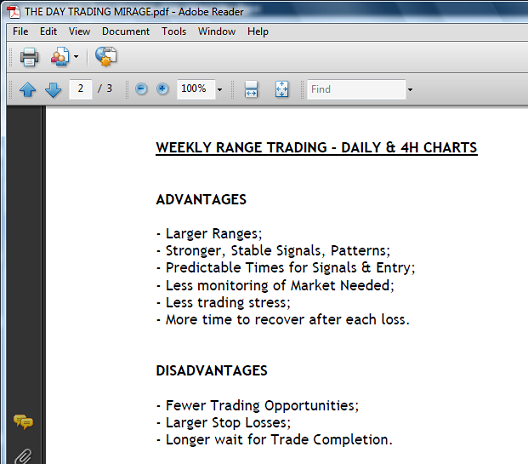

To add to the over-generalized PDF given above, Long term trading is based more upon "traders bias" and/or "fundamentals" compared to short term trading, which generally, is based on "Price action" and "countering herd trading". What is seen on the higher tf's simply was created by the price action on the lower tf.

Участник с Nov 01, 2015

98 комментариев

Nov 18, 2015 at 12:36

Участник с Nov 01, 2015

98 комментариев

DRFXTRADING posted:

My opinion in summary...

Its a matter of which style gives you better results despite its disadvantages.

By results I mean at least equal to your 9-5 salary each month or some other monetary benchmark.

Success must be in dollar terms not just % (return, drawdown etc). After all, money is what you can take to the bank, supermarket, vacations etc--not fancy percentages.

Regards

Duane

DRFXSWINGTRADING

After looking at https://www.myfxbook.com/members/DRFXTRADING/day-trading/1180103 Of your last 35 trades, you manage to lose 33. In which at one point you lost more then 20 in a row! I think your issue was, based on your stats, your system and nothing more. I have never seen anyone daytrading, and lose so many positions in a row.

Участник с Nov 19, 2014

157 комментариев

Dec 06, 2015 at 17:40

Участник с Nov 19, 2014

157 комментариев

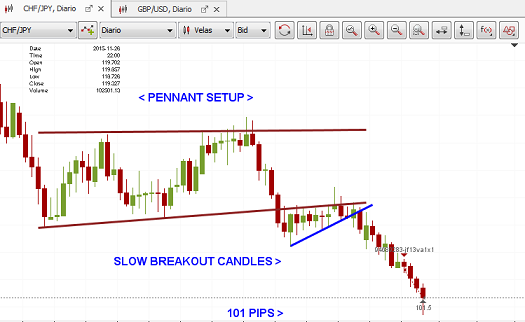

Higher Time Frames make you understand the larger picture of what is happening on the LTFs.

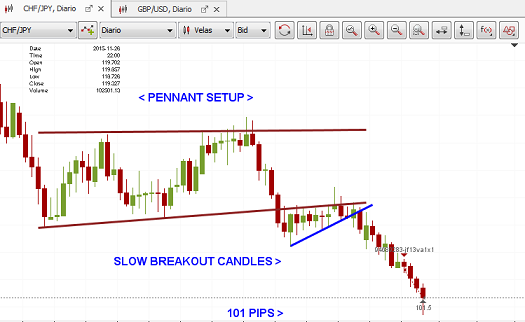

Take the recent spike in the CHF JPY on Thursday.

It may have seemed like a simple trend change with breaks of Downtrend Lines taking place on the 30 Minute Chart....

....but examining the Daily Chart, you can see a Large Consolidation being formed ..

...which is based on certain patterns of candles that generally lead to these Consolidations...

This means that the rally was always gonna to take place to form Support and most persons who saw this would have stopped selling in anticipation of this rally...

Duane

DRFXSWINGTRADING

Take the recent spike in the CHF JPY on Thursday.

It may have seemed like a simple trend change with breaks of Downtrend Lines taking place on the 30 Minute Chart....

....but examining the Daily Chart, you can see a Large Consolidation being formed ..

...which is based on certain patterns of candles that generally lead to these Consolidations...

This means that the rally was always gonna to take place to form Support and most persons who saw this would have stopped selling in anticipation of this rally...

Duane

DRFXSWINGTRADING

Trade Less, Earn More

Участник с Nov 01, 2015

98 комментариев

Dec 07, 2015 at 07:50

Участник с Nov 01, 2015

98 комментариев

DRFXTRADING posted:

Higher Time Frames make you understand the larger picture of what is happening on the LTFs.

Take the recent spike in the CHF JPY on Thursday.

It may have seemed like a simple trend change with breaks of Downtrend Lines taking place on the 30 Minute Chart....

....but examining the Daily Chart, you can see a Large Consolidation being formed ..

...which is based on certain patterns of candles that generally lead to these Consolidations...

This means that the rally was always gonna to take place to form Support and most persons who saw this would have stopped selling in anticipation of this rally...

Duane

DRFXSWINGTRADING

Yeah and trading on the higher tf now has people sitting on negative 400 pips on EU :) What it took EU 1 month to gain to the sell side, it lost it all in 3 hours.

Участник с Oct 11, 2013

769 комментариев

Dec 08, 2015 at 05:26

Участник с Oct 11, 2013

769 комментариев

All time frimes are important for all types of trading. One must learn to manage all time frames.

Участник с Oct 17, 2015

19 комментариев

Dec 10, 2015 at 08:02

Участник с Oct 17, 2015

19 комментариев

alexforex007 posted:

All time frimes are important for all types of trading. One must learn to manage all time frames.

Hi alexforex007,

What do you mean by "manage"? On what TF you're working, are you day trader? What 's your opinion about "low timeframes (under H1) gives more false signals"?

Constant Stable Monthly Account Growth Makes You Successful

Участник с Nov 19, 2014

157 комментариев

Dec 12, 2015 at 13:03

(отредактировано Dec 12, 2015 at 13:08)

Участник с Nov 19, 2014

157 комментариев

Hey all,

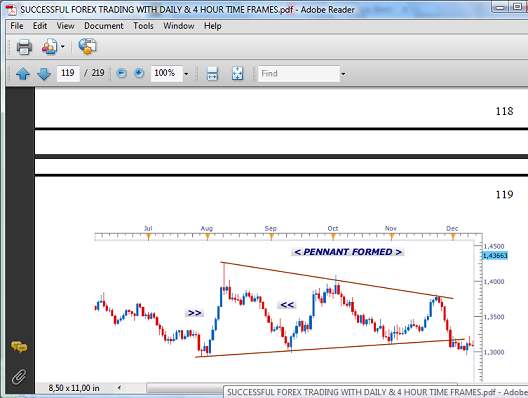

Highlighting another example of the power of the Larger Time Frames. This week, the CAD CHF decline completed the formation of the Consolidations setup that was predicted.....3 Months Ago...

In September this year, this was the forecast Pennant Consolidation on the Daily Chart. This was based on the types of Candlestick waves that had already taken place...

/DEC_2_2015_CAD_CHF_ACTUAL_PENNANT.png" target="_blank" rel="noopener noreferrer nofollow"> /DEC_2_2015_CAD_CHF_ACTUAL_PENNANT.png"/>

/DEC_2_2015_CAD_CHF_ACTUAL_PENNANT.png"/>

Even if you swear by the Lower Time Frames, you HAVE to use the HTFs to spot the start of major moves that you can then trade on your LTF..

Duane

DRFXSWINGTRADING

Highlighting another example of the power of the Larger Time Frames. This week, the CAD CHF decline completed the formation of the Consolidations setup that was predicted.....3 Months Ago...

In September this year, this was the forecast Pennant Consolidation on the Daily Chart. This was based on the types of Candlestick waves that had already taken place...

/DEC_2_2015_CAD_CHF_ACTUAL_PENNANT.png" target="_blank" rel="noopener noreferrer nofollow">

Even if you swear by the Lower Time Frames, you HAVE to use the HTFs to spot the start of major moves that you can then trade on your LTF..

Duane

DRFXSWINGTRADING

Trade Less, Earn More

Участник с Jan 22, 2014

15 комментариев

Dec 16, 2015 at 09:34

Участник с Jan 22, 2014

15 комментариев

Four pages of complete bollucks!

It's horses for courses and there are advantages and disadvantages in both but there is one thing for sure, trading successfully, profitably and most importantly, consistently, will be the hardest thing you've ever done in your life and it will take 2-5 years to get it right and that's if you survive that long. If you do survive that long and have put in the effort and screen time then you'll either have built your own system or perfected something you've found, bought or come across and made it work. The argument is moot, time frames are irrelevant, it's all down to the individual and what floats their boat.

It's the same with all these maestros that think you need all these hundreds of pips, more bollucks. Compound 20 pips a day with 60%-70% winning days over 18 months and then tell me you need 500 pips a week and as far as subscriptions are concerned, I run like hell in the opposite direction. If you can trade, you do, if you can't, you teach!

It's horses for courses and there are advantages and disadvantages in both but there is one thing for sure, trading successfully, profitably and most importantly, consistently, will be the hardest thing you've ever done in your life and it will take 2-5 years to get it right and that's if you survive that long. If you do survive that long and have put in the effort and screen time then you'll either have built your own system or perfected something you've found, bought or come across and made it work. The argument is moot, time frames are irrelevant, it's all down to the individual and what floats their boat.

It's the same with all these maestros that think you need all these hundreds of pips, more bollucks. Compound 20 pips a day with 60%-70% winning days over 18 months and then tell me you need 500 pips a week and as far as subscriptions are concerned, I run like hell in the opposite direction. If you can trade, you do, if you can't, you teach!

Участник с Dec 11, 2015

1462 комментариев

Dec 30, 2015 at 11:09

Участник с Dec 11, 2015

1462 комментариев

I, personally, have found that the most reliable trading signals usually come from the 4-hour and daily time-frame, if you're planning on opening a more long-term position.The 15 and 30-minute time-frames also provide very decent signals for short-term positions.

Участник с Jan 14, 2010

2279 комментариев

Dec 31, 2015 at 20:32

(отредактировано Dec 31, 2015 at 20:34)

Участник с Jan 14, 2010

2279 комментариев

I am working on weekly TF trend following. I find it with proper trading size management it is the safest way to go and weekly trend is definitely the most reliable.

Участник с Nov 19, 2014

157 комментариев

Mar 02, 2016 at 16:34

Участник с Nov 19, 2014

157 комментариев

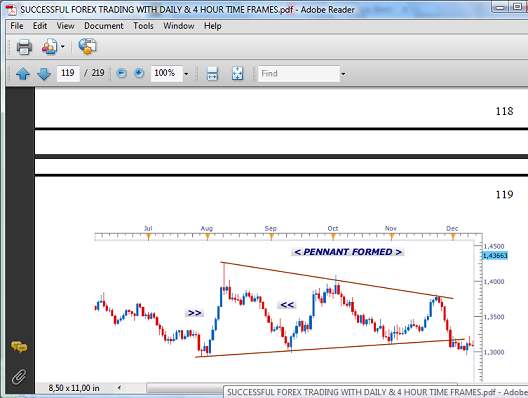

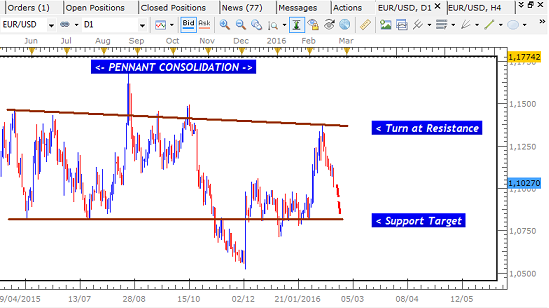

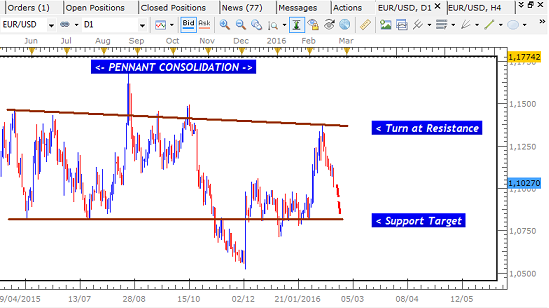

Hey all, latest trade got 149 Pips from EURO USD

This was the overall setup on the Daily Chart...

Entry took place on the 4 Hour Chart

After few days, target hit...

This trade shows how we can get larger Pip Gains from focusing on the Larger Charts, trading Stronger and more Reliable Signals.

The 4 Hour Chart offers strong Stop Loss placements so that we can stay away from temporary pullbacks.

With the smaller time frames, using smaller Stop Losses can easily cause us to be stopped out by these pullbacks, causing us to miss out on profitable trades.

Duane

DRFXSWINGTRADING

This was the overall setup on the Daily Chart...

Entry took place on the 4 Hour Chart

After few days, target hit...

This trade shows how we can get larger Pip Gains from focusing on the Larger Charts, trading Stronger and more Reliable Signals.

The 4 Hour Chart offers strong Stop Loss placements so that we can stay away from temporary pullbacks.

With the smaller time frames, using smaller Stop Losses can easily cause us to be stopped out by these pullbacks, causing us to miss out on profitable trades.

Duane

DRFXSWINGTRADING

Trade Less, Earn More

Участник с Dec 31, 2015

10 комментариев

Mar 03, 2016 at 01:46

Участник с Dec 31, 2015

10 комментариев

I'm still figuring this out myself, but I find that the lower TF are essential to comprehensively backtest EA's. I have found so far that I seem to achieve a better average profit:drawdown ratio (better entries) on higher timeframes.

Участник с Dec 11, 2015

1462 комментариев

Mar 04, 2016 at 08:48

Участник с Dec 11, 2015

1462 комментариев

In my opinion the 4-hour and daily time frames give the most reliable long-term signals, especially when it comes to reversals and the like. If one isn't as patient to wait for those, the 15-minute and the 30-minute time-frame can be used, I think, for relatively reliable short-term signals.

Участник с Dec 09, 2015

823 комментариев

Mar 20, 2016 at 08:56

Участник с Dec 09, 2015

823 комментариев

It all depends on your strategy. Some strategies use the longer time frames, others - the shorter ones. For example, if you're scalping you won't be using the daily time frame.

*Коммерческое использование и спам не допускаются и могут привести к аннулированию аккаунта.

Совет: Размещенные изображения или ссылки на Youtube автоматически вставляются в ваше сообщение!

Совет: введите знак @ для автоматического заполнения имени пользователя, участвующего в этом обсуждении.