LUX (By MarcellusLux )

| Прибыль : | +33148.17% |

| Просадка | 13.78% |

| Пипс: | 16679.7 |

| Сделки | 558 |

| Выигрыш: |

|

| Потери: |

|

| Тип: | Реальный |

| Кредитное плечо: | 1:500 |

| Трейдинг: | Неизвестно |

Edit Your Comment

LUX Обсуждение

Участник с Dec 29, 2021

2 комментариев

Участник с May 19, 2020

321 комментариев

Feb 18, 2022 at 10:05

Участник с May 19, 2020

321 комментариев

Today I analyze the trade with the highest profitability in my account. It was made on February 10 on pound yen pair and reached to 75.5 points. This is not the highest number of points per trade in my account, but due to the lot, it was a record profit of $ 128,857.85.

The MACD indicators on the 30 minute and hour charts showed a buy signal, while the general trend direction on the four hour chart was consistent with this data, but the MACD just started to cross the signal line. The position of the chart above the EMA 200 and 100 lines also indicated the continuation of the uptrend. I set my take profit below the key resistance level of 157.700 and the trade was closed at 157.435, although I could have taken more profit if I believed the trend was expanding and reaching 158.0.

I was too cautious in this situation, but nevertheless, I completed the trading task and made a profit.

The MACD indicators on the 30 minute and hour charts showed a buy signal, while the general trend direction on the four hour chart was consistent with this data, but the MACD just started to cross the signal line. The position of the chart above the EMA 200 and 100 lines also indicated the continuation of the uptrend. I set my take profit below the key resistance level of 157.700 and the trade was closed at 157.435, although I could have taken more profit if I believed the trend was expanding and reaching 158.0.

I was too cautious in this situation, but nevertheless, I completed the trading task and made a profit.

@Marcellus8610

Участник с Apr 18, 2022

1 комментариев

Apr 18, 2022 at 05:09

Участник с Apr 18, 2022

1 комментариев

hi, how to invest? new to myfxbook. can share any link?

Участник с May 19, 2020

321 комментариев

Apr 18, 2022 at 14:15

Участник с May 19, 2020

321 комментариев

marketsacksqd posted:

hi, how to invest? new to myfxbook. can share any link?

The link to my bio: https://www.myfxbook.com/members/MarcellusLux

email just added so all questions are welcome there

@Marcellus8610

Участник с Feb 18, 2010

82 комментариев

Apr 20, 2022 at 01:41

Участник с Feb 18, 2010

82 комментариев

MarcellusLux posted:

1.

– MACD signal

– EMA 200 breakout

– According to the trend.

The stop loss is set below the resistance level. There is an alternative to exit the market in case of resistance at the 1.18100

Nice simple system, I 'm gonna try it.

Seems you just traded these.

Участник с May 19, 2020

321 комментариев

Apr 22, 2022 at 18:03

Участник с May 19, 2020

321 комментариев

SwingTrader posted:MarcellusLux posted:

1.

– MACD signal

– EMA 200 breakout

– According to the trend.

The stop loss is set below the resistance level. There is an alternative to exit the market in case of resistance at the 1.18100

Nice simple system, I 'm gonna try it.

Seems you just traded these.

You are right about my trade. The indicators that I use in my technical analysis are very easy to use, these are the basis, MACD, EMA, RSI. The basic rules are trend patterns and key technical levels.

@Marcellus8610

Участник с Apr 04, 2022

19 комментариев

Apr 22, 2022 at 19:47

Участник с Apr 04, 2022

19 комментариев

I looked through trading systems and your trading impressed me with excellent risk distribution. I will follow your trading and will try to catch something useful.

A falling leaf does not try to influence the wind, it enjoys flying.

Участник с May 19, 2020

321 комментариев

Apr 27, 2022 at 09:34

Участник с May 19, 2020

321 комментариев

Ollie33 posted:

I looked through trading systems and your trading impressed me with excellent risk distribution. I will follow your trading and will try to catch something useful.

Thanks, it's important to me.

message me if you have questions and need information.

@Marcellus8610

Участник с Apr 04, 2022

19 комментариев

May 04, 2022 at 10:45

Участник с Apr 04, 2022

19 комментариев

MarcellusLux posted:Ollie33 posted:

I looked through trading systems and your trading impressed me with excellent risk distribution. I will follow your trading and will try to catch something useful.

Thanks, it's important to me.

message me if you have questions and need information.

I see that you have an open Buy trade for eur chf, but stop loss and take profit are not visible. I'm wondering what do you consider your limit now?

A falling leaf does not try to influence the wind, it enjoys flying.

Участник с May 19, 2020

321 комментариев

May 13, 2022 at 12:07

Участник с May 19, 2020

321 комментариев

Ollie33 posted:MarcellusLux posted:Ollie33 posted:

I looked through trading systems and your trading impressed me with excellent risk distribution. I will follow your trading and will try to catch something useful.

Thanks, it's important to me.

message me if you have questions and need information.

I see that you have an open Buy trade for eur chf, but stop loss and take profit are not visible. I'm wondering what do you consider your limit now?

I set a take profit level of 1.03393, but this trade was closed by stop loss, with a profit of 19.0 pips.

@Marcellus8610

Участник с May 19, 2020

321 комментариев

May 13, 2022 at 12:10

Участник с May 19, 2020

321 комментариев

today, despite the fact that the average length of my trades is 19h 40m, the pound dollar trade reached a take profit in 1h 5m. This is what I have said in other threads when traders discussed trades duration. It is important to achieve a trading plan, not the duration of holding trades.

@Marcellus8610

Участник с May 19, 2020

321 комментариев

Jul 20, 2022 at 10:36

Участник с May 19, 2020

321 комментариев

Analysis of the mistake on July 12 Dollar Yen buy trade.

After a short-term decline on the 30-minute chart, I saw the possibility of a narrowing correction and further growth in line with the main trend. I planned to trade inside the correction and in case of breaking through its borders and the top of 137.750, hold the trade for maximum profit until the start of a new correction. Stop loss was set at 136.510, which was below the key level of 136.550. Thus, I saved trade against a trend reversal.

My very first mistake is the preference for indicator signals on smaller timeframes. My attention was focused on 30 minutes, while at 4 hours there was no clear position of indicators to buy, and on the hourly chart, there was a MACD in the sell at all.

The second mistake, which is quite controversial is the stop loss (usually controversial topic).

There are several options that could happen:

1. There is no stop loss, the trader chooses to hold the trade or not. There is a chance to get out of losses by showing patience and self-confidence and also chance to increase losses and .

2. There is a stop loss, but the trader sees that the market has reversed and closes the deal prematurely, without waiting for the stop loss, showing caution and self-confidence. (The one I chose)

3. There is a stop-loss, the trader waits until the last, until the trade reaches it or goes into profit. The trader shows confidence and patience.

On the chart, you can see that the touch of the stop-loss level was not clear and the market immediately reversed. This also leads to the conclusion that the stop-loss level is chosen with a slight inaccuracy. So setting a proper stop loss and holding the position without an early exit could have been profitable for me in the longer term, as you can see the market is already far higher.

In a conclusion I would like to note that even small inaccuracies can lead to losses, as well as the trader's behavior and confidence. It is important to find a balance between caution and confidence.

In my case, I made a choice in favor of caution, but further I worked through the mistakes and in the next trades I managed to achieve record high results.

Any trade, regardless of profit amount, brings you closer to success, because the most important thing is experience.

After a short-term decline on the 30-minute chart, I saw the possibility of a narrowing correction and further growth in line with the main trend. I planned to trade inside the correction and in case of breaking through its borders and the top of 137.750, hold the trade for maximum profit until the start of a new correction. Stop loss was set at 136.510, which was below the key level of 136.550. Thus, I saved trade against a trend reversal.

My very first mistake is the preference for indicator signals on smaller timeframes. My attention was focused on 30 minutes, while at 4 hours there was no clear position of indicators to buy, and on the hourly chart, there was a MACD in the sell at all.

The second mistake, which is quite controversial is the stop loss (usually controversial topic).

There are several options that could happen:

1. There is no stop loss, the trader chooses to hold the trade or not. There is a chance to get out of losses by showing patience and self-confidence and also chance to increase losses and .

2. There is a stop loss, but the trader sees that the market has reversed and closes the deal prematurely, without waiting for the stop loss, showing caution and self-confidence. (The one I chose)

3. There is a stop-loss, the trader waits until the last, until the trade reaches it or goes into profit. The trader shows confidence and patience.

On the chart, you can see that the touch of the stop-loss level was not clear and the market immediately reversed. This also leads to the conclusion that the stop-loss level is chosen with a slight inaccuracy. So setting a proper stop loss and holding the position without an early exit could have been profitable for me in the longer term, as you can see the market is already far higher.

In a conclusion I would like to note that even small inaccuracies can lead to losses, as well as the trader's behavior and confidence. It is important to find a balance between caution and confidence.

In my case, I made a choice in favor of caution, but further I worked through the mistakes and in the next trades I managed to achieve record high results.

Any trade, regardless of profit amount, brings you closer to success, because the most important thing is experience.

@Marcellus8610

Участник с May 19, 2020

321 комментариев

Jul 29, 2022 at 16:22

Участник с May 19, 2020

321 комментариев

July showed me some important points to work on and I will make a post about it at the beginning of August, because post-trading analysis is very important for me and is a base process in improving a trading system.

The July result is 7.8%, which is certainly a natural recession after a long three-month period with an average profitability of 13%.

However, this month there were quite huge trades. So, one of the trades got into the top 6 by growth percentage per trade (10.74%)

The July result is 7.8%, which is certainly a natural recession after a long three-month period with an average profitability of 13%.

However, this month there were quite huge trades. So, one of the trades got into the top 6 by growth percentage per trade (10.74%)

@Marcellus8610

Участник с May 19, 2020

321 комментариев

Aug 01, 2022 at 14:00

Участник с May 19, 2020

321 комментариев

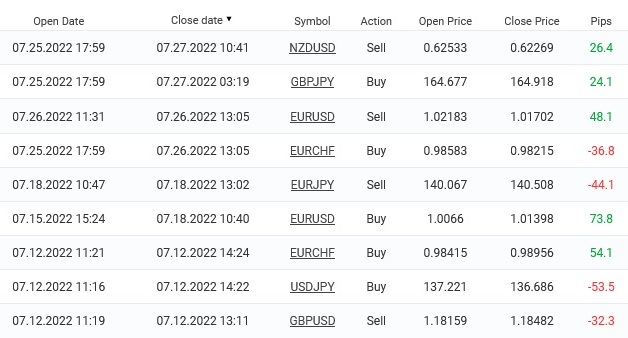

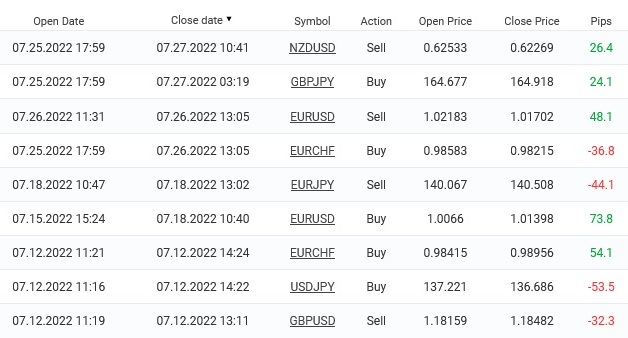

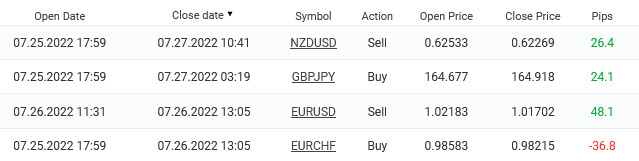

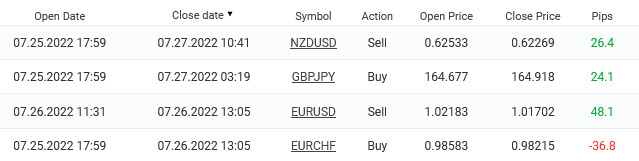

Trading profit / loss analysis of 4 latest trades

Analysing trades over the past week has shown some interesting facts that I would like to share. These trades showed the imperfection of the trading system, and also, will allow me to continue working on the mistakes that I managed to find.

The list of trades:

Euro Franc (buy 0.98583)

Pound Yen (buy 164.677)

New Zealand dollar US dollar (sell 0.62533)

Euro Dollar (sell 1.02183)

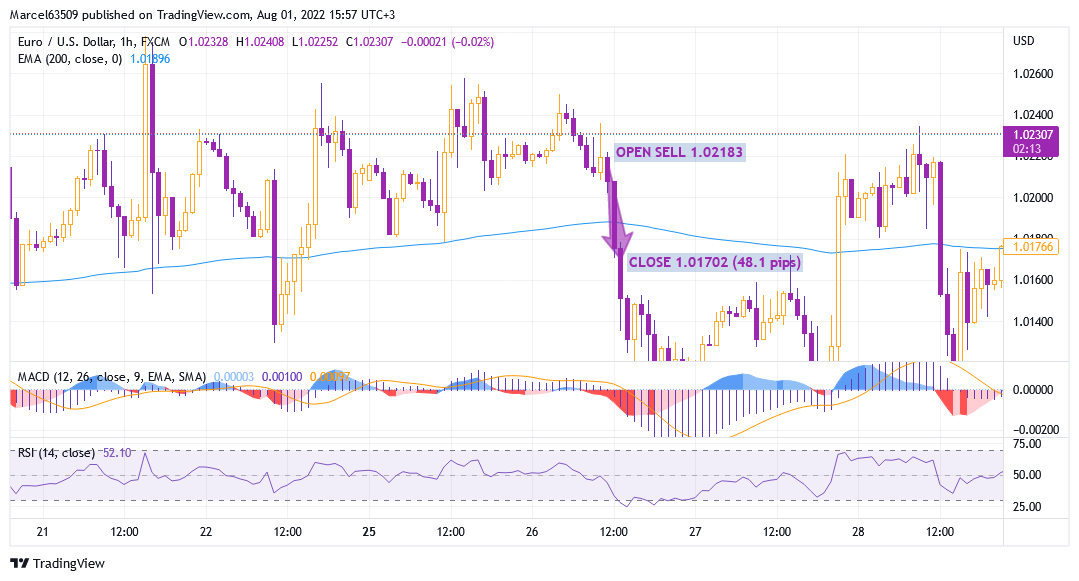

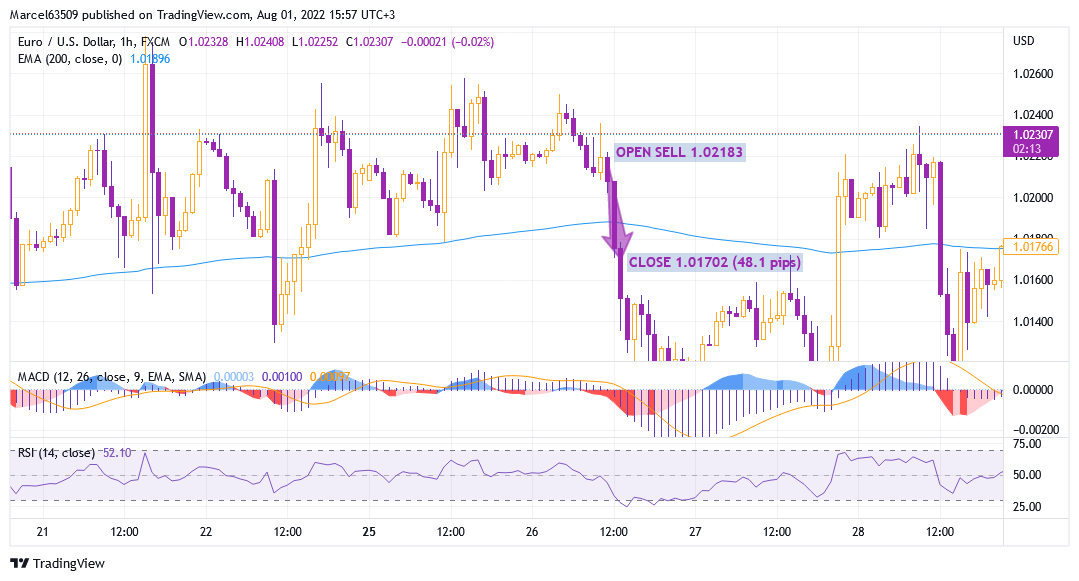

eur/usd sell trade was closed manually, at a price 1.01702.

Honestly, I regret that I closed the trade too early, because the EMA 100 and EMA 200 clearly showed a further fall, but I was afraid of a false break, as well as the impact of key support 1.01600 (which was also broken soon) and did not risk the funds that I have already been obtained. The opening of the trade was confirmed clearly according to the MACD data on the four-hour and hourly charts.

eur/chf buy was manually closed at 0.98215, although the stop loss was set lower at 0.98128.

I got MACD confirmation on the 4-hour chart, and there were no preconditions for a sell signal on the 1-hour chart. It was necessary to pay attention to the false breakdown of the EMA 200 on the hourly chart, although the EMA 100 was already below. Since I saw that the currency pair was going into a long fall according to the MACD, EMA and the formed down channel, I decided not to wait for the stop loss to be reached, which was the right decision, as you can see on the chart.

gbp/jpy buy was manually closed at 164.918 after a long drawdown that I had to wait out.

I opened a trade according to the MACD data, after breaking through the EMA 200 on the hourly and four-hour charts. If I had held during July 27, I could have taken profits around 166.00, but I decided not to take risks and closed the trade before the key resistance at 165.100. It was a hasty decision, due to some tension that had arisen during the drawdown earlier. The MACD and EMA provided clear enough data to trade further, but I didn’t use them.

nzd/usd sell manually closed at 0.62269.

The main factor that pointed me in the direction of this trade was the divergence on the four hour chart. Also, I saw some consolidation in the EMA 200 area, which indicated that the market is not ready for a breakout and this is a sign of further uptrend correction. This is one of the few trades I have ever traded from the top of an uptrend knowing that it could be dangerous if the channel widened.

Analysing trades over the past week has shown some interesting facts that I would like to share. These trades showed the imperfection of the trading system, and also, will allow me to continue working on the mistakes that I managed to find.

The list of trades:

Euro Franc (buy 0.98583)

Pound Yen (buy 164.677)

New Zealand dollar US dollar (sell 0.62533)

Euro Dollar (sell 1.02183)

eur/usd sell trade was closed manually, at a price 1.01702.

Honestly, I regret that I closed the trade too early, because the EMA 100 and EMA 200 clearly showed a further fall, but I was afraid of a false break, as well as the impact of key support 1.01600 (which was also broken soon) and did not risk the funds that I have already been obtained. The opening of the trade was confirmed clearly according to the MACD data on the four-hour and hourly charts.

eur/chf buy was manually closed at 0.98215, although the stop loss was set lower at 0.98128.

I got MACD confirmation on the 4-hour chart, and there were no preconditions for a sell signal on the 1-hour chart. It was necessary to pay attention to the false breakdown of the EMA 200 on the hourly chart, although the EMA 100 was already below. Since I saw that the currency pair was going into a long fall according to the MACD, EMA and the formed down channel, I decided not to wait for the stop loss to be reached, which was the right decision, as you can see on the chart.

gbp/jpy buy was manually closed at 164.918 after a long drawdown that I had to wait out.

I opened a trade according to the MACD data, after breaking through the EMA 200 on the hourly and four-hour charts. If I had held during July 27, I could have taken profits around 166.00, but I decided not to take risks and closed the trade before the key resistance at 165.100. It was a hasty decision, due to some tension that had arisen during the drawdown earlier. The MACD and EMA provided clear enough data to trade further, but I didn’t use them.

nzd/usd sell manually closed at 0.62269.

The main factor that pointed me in the direction of this trade was the divergence on the four hour chart. Also, I saw some consolidation in the EMA 200 area, which indicated that the market is not ready for a breakout and this is a sign of further uptrend correction. This is one of the few trades I have ever traded from the top of an uptrend knowing that it could be dangerous if the channel widened.

@Marcellus8610

Участник с May 19, 2020

321 комментариев

Aug 17, 2022 at 12:31

Участник с May 19, 2020

321 комментариев

The first 2 trades in August with profit of 6.5%. This pace will fulfill this month's trading plan and possibly cover the lower figures in the previous one. Watch the information about the latest trades is on my website and on myfxbook monitoring page

@Marcellus8610

Участник с Aug 27, 2016

41 комментариев

Sep 02, 2022 at 12:28

Участник с Aug 27, 2016

41 комментариев

Dont you have other broker using the system?

Trade to live another day

Участник с Jan 14, 2019

32 комментариев

Sep 04, 2022 at 14:09

Участник с Jan 14, 2019

32 комментариев

he use only same broker like toni win and g dow ! same system

Участник с Aug 27, 2016

41 комментариев

Sep 06, 2022 at 14:49

Участник с Aug 27, 2016

41 комментариев

loui64 posted:

he use only same broker like toni win and g dow ! same system

same with ANTONY WINs yes. these brokers create their own fund managers and end up blowing later

Trade to live another day

Участник с May 19, 2020

321 комментариев

Sep 07, 2022 at 12:09

Участник с May 19, 2020

321 комментариев

TopRank,

I manage accounts when have time and resources and only accept offers from funds that can provide a balance at least 1 million.

I manage accounts when have time and resources and only accept offers from funds that can provide a balance at least 1 million.

@Marcellus8610

Участник с May 19, 2020

321 комментариев

Sep 07, 2022 at 12:23

Участник с May 19, 2020

321 комментариев

TopRank and loui64,

I have no idea and I don't want to understand what you are posting. If you have any questions for me, then you could ask them before you start writing nonsense.

watching by what you write on myfxbook, you look like affiliated persons.

I have no idea and I don't want to understand what you are posting. If you have any questions for me, then you could ask them before you start writing nonsense.

watching by what you write on myfxbook, you look like affiliated persons.

@Marcellus8610

*Коммерческое использование и спам не допускаются и могут привести к аннулированию аккаунта.

Совет: Размещенные изображения или ссылки на Youtube автоматически вставляются в ваше сообщение!

Совет: введите знак @ для автоматического заполнения имени пользователя, участвующего в этом обсуждении.

.png)

.jpg)

.png)

.png)

.png)

.png)

.png)

.jpg)