Gold climbs to fresh record even as Fed rate cut bets ease

Rate cut bets pared back on hawkish Fed

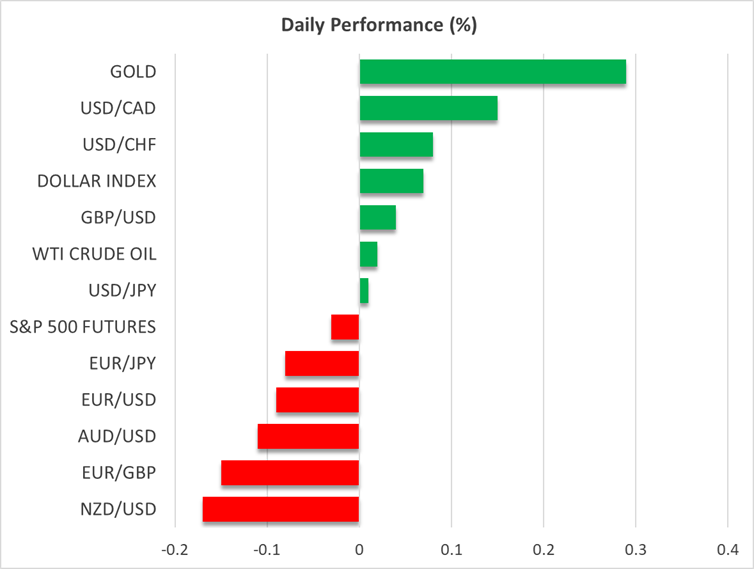

Equity markets remained buoyant on Tuesday as Wall Street notched up its third consecutive record close on Monday on the back of a rally in tech stocks. The US dollar pared some of its recent gains but is trading slightly firmer today amid some caution ahead of a speech by Fed Chair Jerome Powell later at 16:35 GMT. Despite the broadly positive sentiment following the Fed’s decision last week to resume its rate-cutting cycle, the safe-haven gold is back to setting fresh record highs.

Many investors are having a rethink about how aggressively the Fed will slash rates over the coming year, as inflation remains elevated and last week’s jobless claims figures eased fears that the labour market is headed towards a cliff-edge. More importantly, the Fed has pencilled in just one cut for the whole of 2026 and doesn’t see its easing crusade lasting much beyond this year.

However, given all the uncertainties surrounding the impact of President Trump’s tariffs on both inflation and the global economy, the outlook could easily change. Hence, investors will be watching Powell’s remarks for further clues on the likelihood of back-to-back rate cuts, as a third reduction this year is now only 70% priced in.

Friday’s PCE inflation numbers are also on traders’ radar, with rate cut bets potentially getting a boost or a fresh setback depending on which way the data surprises.

Techs lead the way

In the meantime, positive headlines for Nvidia and Oracle kept the upbeat momentum going on Wall Street, pushing all three main indices to all-time closing highs. Nvidia jumped after it was revealed that it will invest $100 billion in ChatGPT owner OpenAI, while Oracle was boosted from reports that the company will oversee TikTok’s US algorithm, as the White House tries to negotiate a deal with China for parent ByteDance to divest its popular social media platform.

Tesla was another strong performer, but US futures are trading flat today, suggesting the rally could be running out of steam. Stock markets elsewhere are mostly in positive territory, however, despite some mixed PMI indicators out of Europe today.

Flash PMIs provide little clarity, euro and pound lack direction

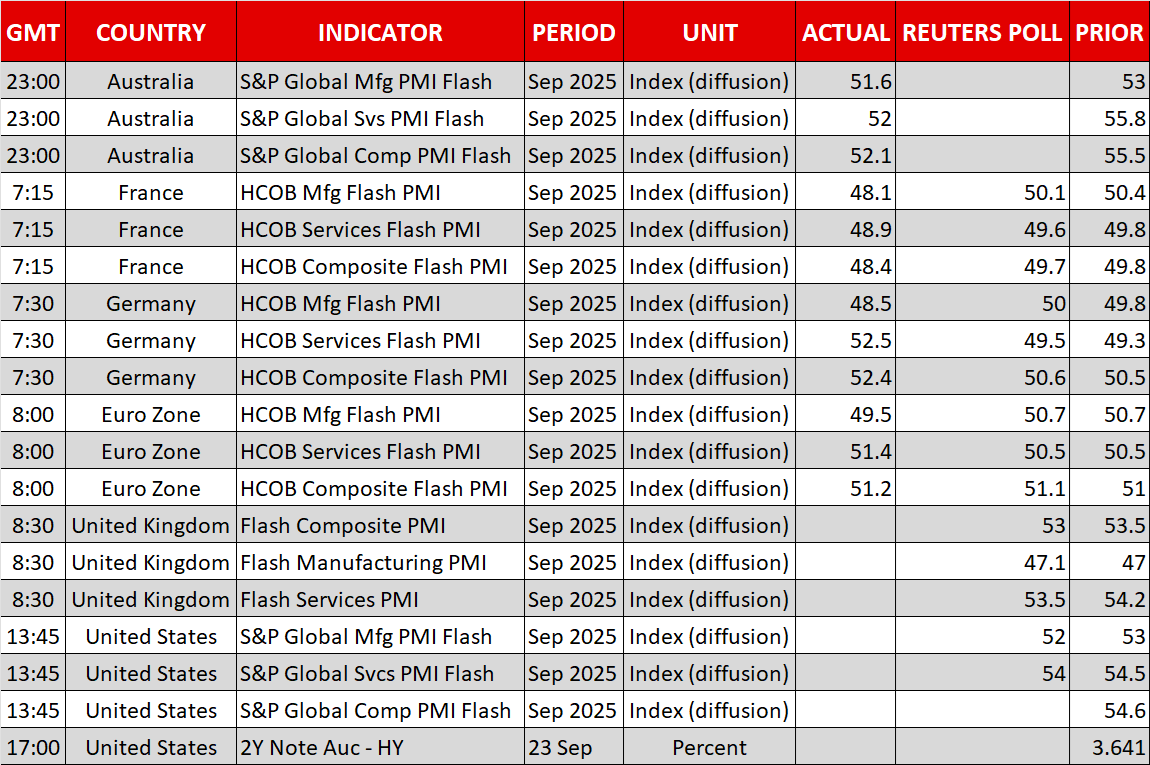

The euro was little changed after the PMI releases, which showed French services and manufacturing activity contracting in September, but Germany’s services sector rebounded unexpectedly.

The pound dipped slightly, however, on much weaker-than-expected flash PMIs for the UK. US PMIs will also be watched later in the day, with the dollar broadly firmer ahead of the key events, although it seems to be struggling against the yen.

The post-FOMC rebound in Treasury yields appears to be levelling off, so without any renewed hawkish signals from Powell, there’s a risk of a dollar pullback.

On the whole, investors don’t expect a major shift in the Fed’s current stance even after the appointment of ultra-dovish Stephen Miran as a new governor. Speaking yesterday, Miran argued for the Fed funds rate to be lowered by 200 basis points. This contrasts sharply with the views of other Fed policymakers such as Musalem, Bostic and Hammack, who all signalled that there’s limited room for further cuts.

No stopping gold, cryptos steadier

Nevertheless, gold continues to scale new all-time highs, reaching just under $3,775 during European trading. As the September 30 deadline approaches for the US Congress to pass a new funding bill, the risk of a government shutdown could also be supporting the precious metal. But a bigger market reaction is unlikely before Thursday when Trump is due to meet Democratic leaders Jeffries and Schumer to possibly pave the way for bipartisan talks.

Cryptos were steadier on Tuesday, following the surprise slump yesterday when Bitcoin lost more than 2% and Ether skidded by 6.6%, as the sector was hit by a sharp liquidation.

.jpg)