- Trang chủ

- Cộng đồng

- Thông tin chung

- Thesis: Utilizing Dynamic Bollinger Bands

Thesis: Utilizing Dynamic Bollinger Bands

AbstractThis thesis explores a trading strategy that enhances traditional Bollinger Bands by incorporating dynamic adjustments responsive to market conditions. Paired with an intelligent money management system, it aims to optimize risk and reward in the forex market. The analysis covers its key components, performance metrics, and the principles driving its effectiveness.

Introduction to a problemBollinger Bands, a staple in technical analysis, consist of a moving average flanked by two standard deviation lines forming upper and lower bands. These bands assist traders in identifying overbought or oversold conditions, gauging volatility, and predicting trend reversals. However, their fixed parameters can reduce effectiveness in volatile or rapidly shifting markets.

This strategy introduces dynamic adjustments to the bands and integrates a money management system that adapts position sizes to market conditions. The following sections detail how these enhancements improve performance and adaptability, offering insights into their mechanics.

Dynamic Bollinger Bands: A Technical BreakdownThe strategy modifies traditional Bollinger Bands with dynamic features that respond to market behavior. Key elements include:

Central Price Calculation: A central price is derived as the midpoint between ask and bid prices, serving as an accurate market reference.Volatility-Driven Spread: The spread is calculated using the logarithmic difference between a moving average and the price’s standard deviation, adjusting dynamically—widening in volatile periods and narrowing in stable ones.Flexible Band Calculation: Upper and lower bands are computed with formulas like (center + Offset) * MathExp(spread * Multiplication * DynMultShortMult) for the high band, with a corresponding equation for the low band. Multipliers (DynMultLongMult and DynMultShortMult) adjust based on trade outcomes, enabling the bands to adapt to market shifts.This adaptability allows the strategy to perform effectively across trending and ranging markets, minimizing false signals and enhancing trade precision.

Sell hit the upper BB, that has increased in value, it will slowly fall over the time

Intelligent Money Management: Optimizing Risk and RewardThe money management system adjusts position sizes based on market feedback, with the following features:

Trade-Triggered Adjustments: A sell signal occurs when the price crosses the upper band, increasing the DynMultShortMult multiplier for potential future shorts or exits. A buy signal triggers when the price drops below the lower band, raising DynMultLongMult. If no trade occurs, multipliers decrease, reducing exposure in uncertain conditions.Customizable Modes: Options like "Independent" (one multiplier increases while the other does not) and "Together" (both move in tandem) allow customization to suit different market environments. Or different trading styles.Risk Optimization: Position sizes scale up in favorable conditions and down during uncertainty, balancing risk and reward.This system aims to protect capital in adverse markets while capitalizing on profitable opportunities. Also system scales up by 0,01 lot size, meaning that it can be effectively copied.

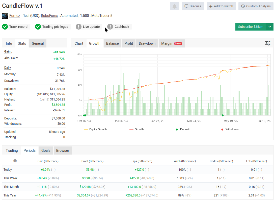

Performance: Evidence of Effectiveness

Consistent Profitability: It has shown steady gains across diverse market cycles. Low Drawdowns: Dynamic adjustments help limit losses during turbulent periods. Versatility: The strategy performs well in both trending and ranging conditions.

Results on MyFxBook

These outcomes highlight its potential to deliver reliable, risk-adjusted returns.

Why This Strategy Stands OutThe strategy’s strengths lie in:

Market Adaptability: Dynamic bands and money management adjust automatically to market changes.Risk Control: Exposure scales back in uncertain conditions and increases when conditions are favorable.Practical Complexity: While intricate, its internal logic simplifies use for traders.Replicating this strategy requires fine-tuning multipliers, managing real-time calculations, and selecting appropriate modes—tasks that add complexity to independent implementation. It is absolutely necessary to train a specific values for each market, and to periodically retrain them using built-in features like Genetic Algorithms in MT5, it is strongly recommended to use a custom criteria for finding the best configuration for a trading pair.

ConclusionCombining dynamic Bollinger Bands with intelligent money management, offers an advanced approach to trading. Its adaptability, risk optimization, and consistent performance distinguish it from static methods. Traders interested in robust, market-responsive tools may find this approach noteworthy.

MyFxbook : https://www.myfxbook.com/members/Forncz