All Eyes on Jerome Powell’s Speech

Upcoming Webinar: Live Market Insights: The Art of Copy Trading

15 November Wednesday at 2pm (GMT+2) | Register here: https://us06web.zoom.us/webinar/register/WN_m9F4fGY7R8SkZVzDHiMPMg

The VIX index, a key measure of fear in the U.S. equity market, plummeted by over 20% in November, indicating a rising risk-on sentiment among investors. However, market activity remained subdued recently as investors eagerly anticipated Jerome Powell's speech scheduled for later today. Against the backdrop of declining U.S. long-term treasury yields, market participants are keenly seeking hints about the Federal Reserve's future monetary policy decisions. Oil prices continued to experience downward pressure due to deteriorating demand from China coupled while oil supplies remain ample. Conversely, Bitcoin (BTC) prices surged to $36,000, reaching levels not seen since May, driven by optimistic expectations regarding the approval of a Spot BTC ETF application by the Securities and Exchange Commission (SEC).

Current rate hike bets on 13rd December Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (90.0%) VS 25 bps (10%)

Market Movements

DOLLAR_INDX, Daily

The US Dollar is in a consolidation phase as markets eagerly await Fed Chair Jerome Powell's statement. Following a significant selloff last week, the Greenback's appeal remains weak. Many economists anticipate a slowdown in the US economy for the fourth quarter, dampening hopes for further Fed rate hikes. Powell refrained from commenting on monetary policy in his recent speech, leaving investors on edge for any forthcoming signals from the Federal Reserve.

The Dollar Index is trading flat while currently testing the support level. MACD has illustrated diminishing bullish momentum, while RSI is at 46, suggesting the index might extend its losses after its breakout below the support level since the RSI stays below the midline.

Resistance level: 106.10, 106.75

Support level: 105.40, 104.80

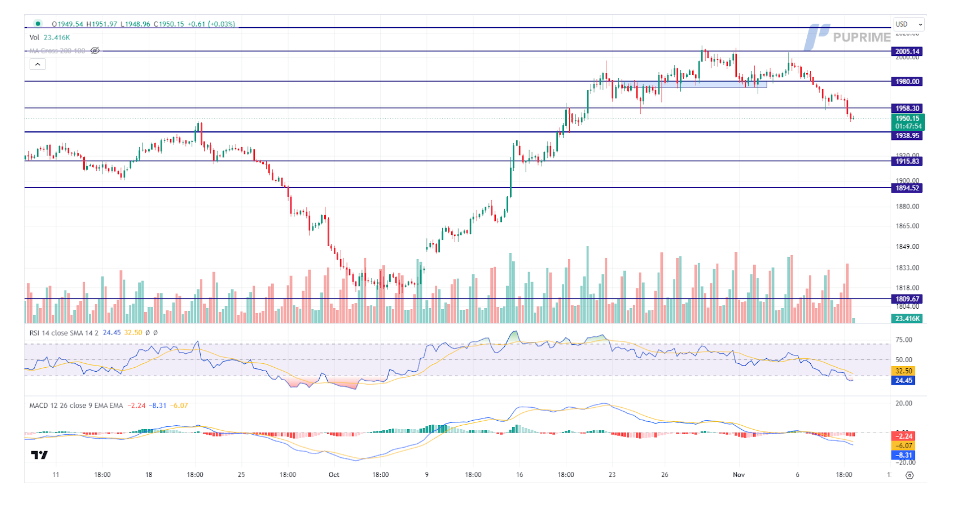

XAU/USD, H4

Gold prices continue to slide as a prevailing risk-on sentiment dominates global financial markets. Hopes for improved US-China relations have shifted sentiment toward higher-risk assets. Anticipation of a key meeting between US President Joe Biden and Chinese leader Xi Jinping at the Asia-Pacific Economic Cooperation summit in San Francisco has fostered optimism. Recent high-level meetings between the two nations have sent positive signals to the world.

Gold is trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum. However, RSI is at 24, suggesting the commodity might enter oversold territory.

Resistance level: 1960.00, 1980.00

Support level: 1940.00, 1915.00

Dow Jones,H4The US equity market continues its bullish run, although the pace has slowed. Investors are eagerly anticipating a clearer monetary policy statement from the Federal Reserve. This follows a notable retreat in US Treasury yields since late October when the 10-year Treasury yields touched 5%. The expectation that the central bank may be nearing the end of its rate-hike cycle gained momentum, fueled by comments from several Fed officials and softer labour data.

The Dow is trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 67, suggesting the index might enter overbought territory.

Resistance level: 34560.00, 35465.00

Support level: 33780.00, 32705.00

CL OIL, H4Oil prices have endured a second consecutive day of losses, sinking to four-month lows. This downturn is driven by a gloomy global economic outlook, with major nations like the US, UK, EU, and China contributing to a decreased appetite for oil. Delays in the release of weekly US inventory data by the Energy Information Administration, as they rework their data methodology, have added to the uncertainty. As the meantime, investors are digesting the American Petroleum Institute's inventory data, which revealed a staggering increase of nearly 12 million barrels, vastly exceeding expectations of 300,000 barrels

Oil prices are trading lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 26, suggesting the commodity might enter oversold territory.

Resistance level: 78.15, 80.75

Support level: 73.35, 69.90