Dollar strength undermined by Trump’s Fed criticism

Tariffs and the Fed remain in the spotlight

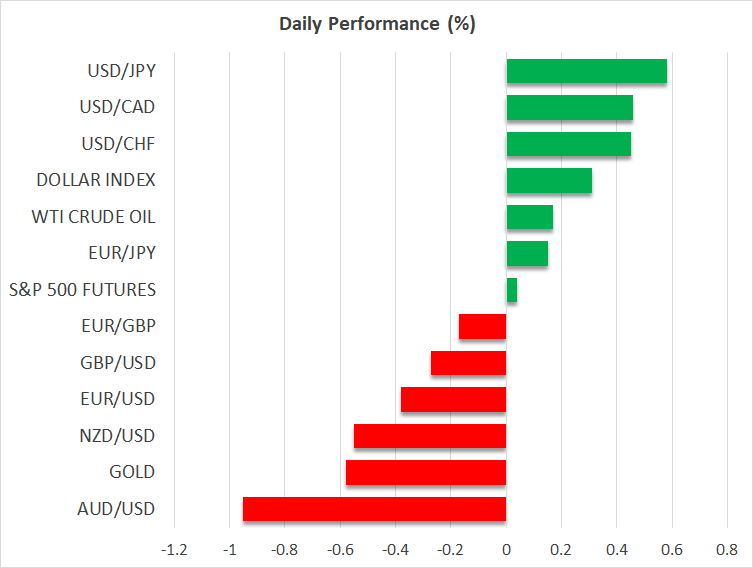

The US dollar started the day on the front foot, following an eventful session that saw it surrender most of its gains against the euro, as most investors remain preoccupied with both tariffs and the Fed’s outlook. The recent passage of the US budget bill has brought tariffs back in the spotlight, with US President Trump resuming his aggressive rhetoric but sounding relatively more upbeat about making new deals soon.

August 1 is the new deadline, with several countries rushing to reach agreements with the US administration, even if these deals prove to be light or incomplete. They hope that their willingness to accept Trump’s demands might save them from receiving another infamous tariff letter. However, this strategy appears to have flaws, as seen with the UK and its ongoing economic underperformance, despite being the first to secure a trade deal with the US.

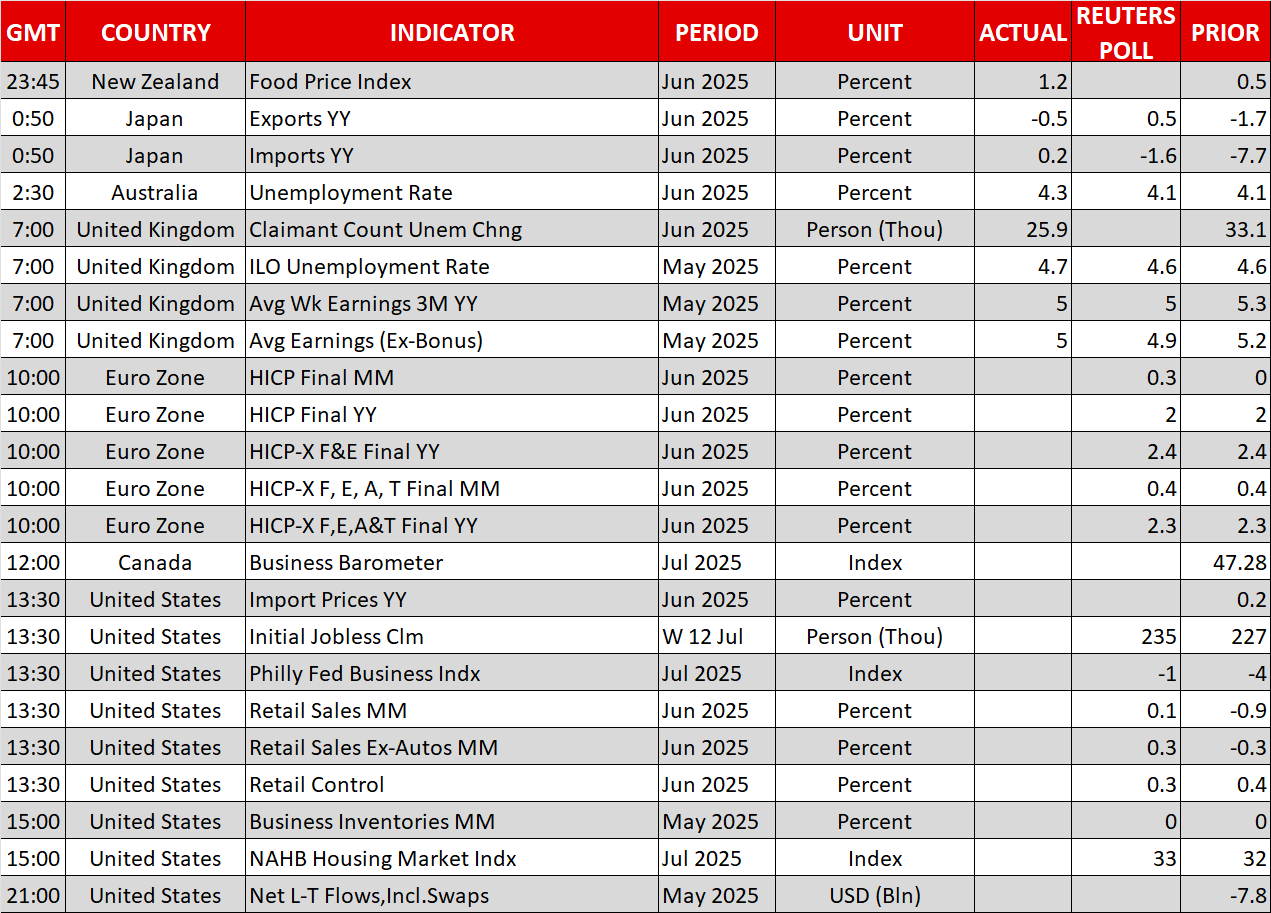

In the case of the Fed, the $1 million question remains if the FOMC will cut rates in 2025 and by how much. The market is currently pricing in 46bps of easing, down almost 20bps from early July. Data has played a key role in these dented rate cut expectations, with Tuesday’s hotter-than-expected CPI report most likely proving to be the final nail in the coffin for a July rate move.

Wednesday’s softer PPI report has provided a lifeline to Fed doves, but a series of weak data prints is necessary to put a rate cut firmly back on the table. Today’s weekly jobless claims and retail sales report, as well as Friday’s housing data and the usually market-moving University of Michigan consumer confidence index, could set the tone for more dovish Fedspeak going forward, in support of a Fed September rate cut.

But the impact of tariffs remains the biggest unknown, with regional Fed Presidents Bostic and Williams highlighting once again that the current state of the economy, as described in the latest Fed Beige Book, allows the Fed to wait before cutting rates, as the inflationary impact of tariffs has yet to materialize.

Trump does not forgive or forget

Feeling in control of domestic politics, the US President continues to target Fed Chair Powell. His comments yesterday during a meeting with GOP lawmakers about firing Powell sent shockwaves through markets, with the dollar surrendering its daily gains and US stocks immediately turning negative.

Trump quickly acknowledged that removing Powell will disrupt the markets, but the wheels appear to be in motion. Even if he does not dismiss Powell, the continued criticisms and name-calling will only erode the Fed’s ability to operate independently, potentially forcing Powell to resign in order to protect the Fed’s credibility.

While numerous key banking figures have highlighted the importance of the Fed’s independence, one would have expected stronger support from inside the FOMC for Powell. New York Fed President Williams, for example, commented on Wednesday that “the Fed remains focused on its mission regardless of political commentary”, a rather soft and measured response when asked about Trump’s obsession with Powell.

Perhaps Fed members are unwilling to go into the trenches alongside Powell, fearing repercussions. But, if they don’t put a fight now, how will they be able to stand up to the next Fed Chair that would most likely be controlled by Trump? Notably, bond yields are not taking the latest episode of the Fed saga lightly. The 30-year Treasury yield has climbed back above the 5% level and the 10-year yield is flirting with 4.5%.

UK data supports an August BoE rate cut

Despite Wednesday’s stronger-than-expected CPI report, markets continue to price in a 75% probability of a 25bps rate cut on August 7. Today’s mixed data releases, with average earnings excluding bonuses growing at 5% and both the claimant count change and unemployment rate pointing to a gradual softening of the UK labour market, have further confused investors. Oddly, euro/pound is slightly lower today, driven by a rejuvenated dollar, retesting the 1.1570 level against the euro.

.jpg)