EBC Markets Briefing | Oil steadies on clash in Iraq

Oil prices were little changed on Friday after rising in the previous session as concerns about supply reduction in Iraq clashed with worries of potential demand declines amid US tariffs.

Three oil fields in Iraqi Kurdistan were targeted by explosive drones on Wednesday. The attacks came at a time when tensions between Baghdad and Erbil have escalated over oil exports.

Oil output in the semi-autonomous Kurdistan region has been slashed by between 140,000 and 150,000 bpd, energy officials said, more than half the normal output of about 280,000 bpd.

US crude inventories fell more than expected last week, government data showed. Oil output increases were not leading to higher inventories, which showed markets were thirsty for more oil.

The OPEC said it expects global trade tensions to ease in the coming weeks and kept its oil demand forecast unchanged as it continues to ramp up output.

Trump threatened on Monday to impose "secondary tariffs" on Russia's trade partners "at about 100%" if President Putin does not agree to a deal to end his invasion of Ukraine in 50 days.

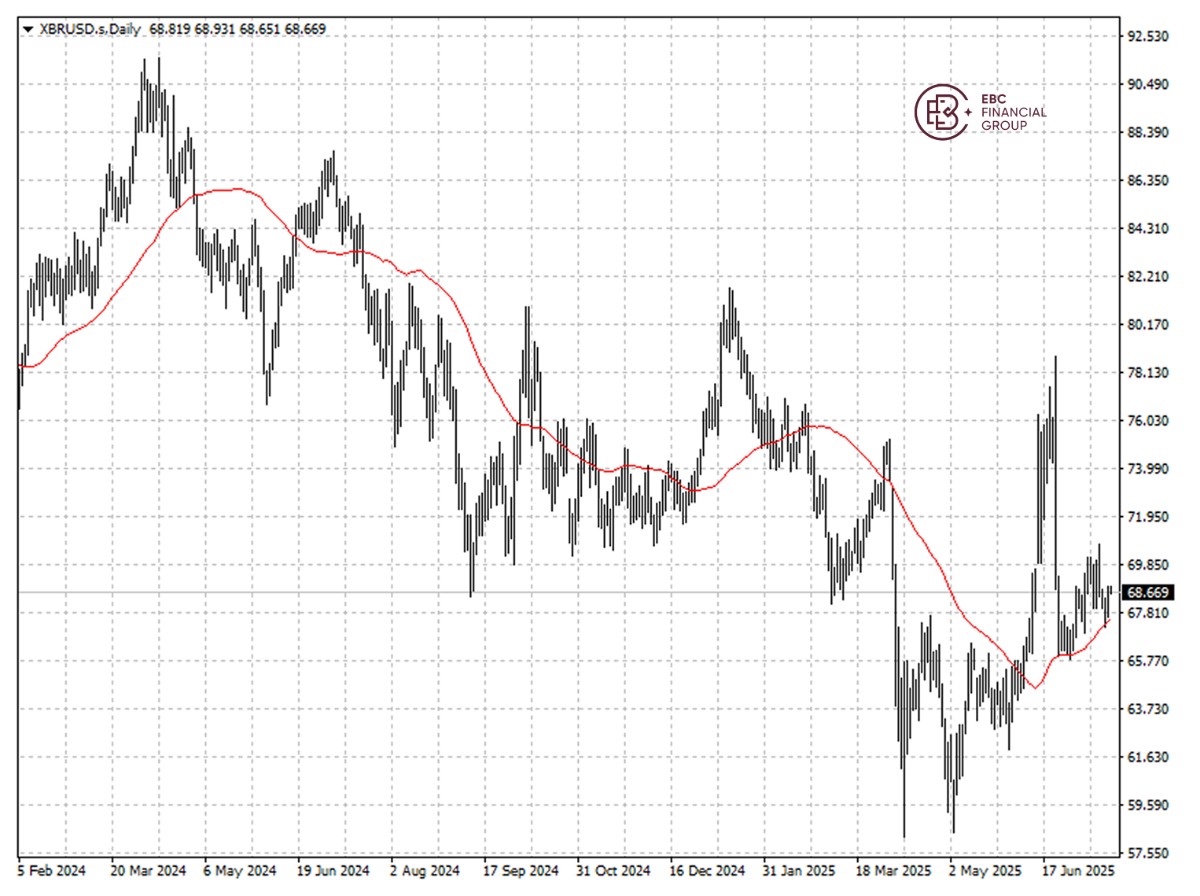

Brent crude looks bearish given double-top pattern. In the upcoming week, the price is set to ease to 50 SMA around $67.5

EBC Forex Market Analysis Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Industry In-depth Analysis or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.