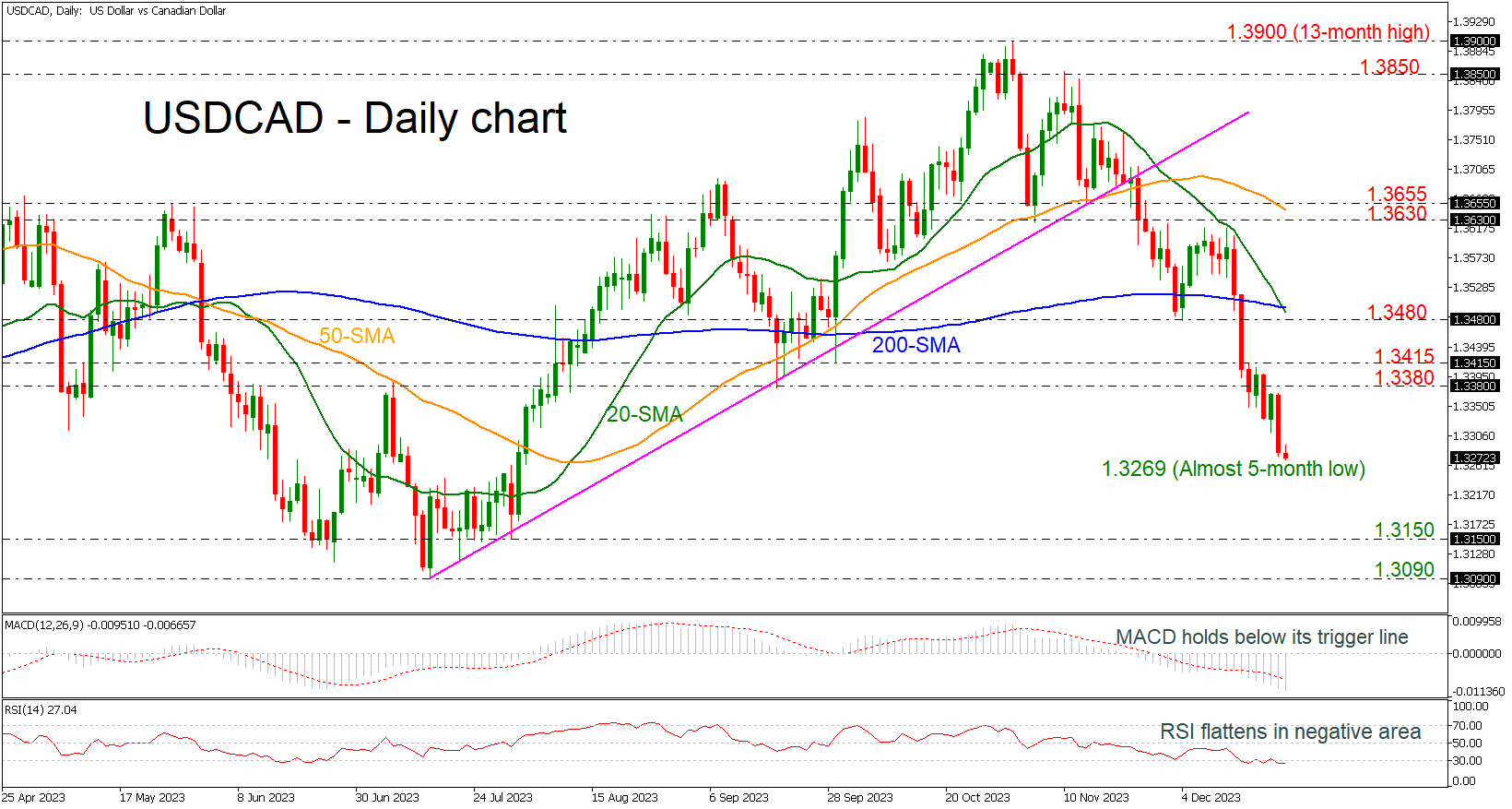

USDCAD slips to almost 5-month low

· USDCAD continues the sell-off in short-term

· 20- and 200-day SMAs post death cross

USDCAD plummeted to a fresh almost five-month low earlier today, continuing the sharp selling interest that started from the 13-month high of 1.3900.

Technically, the 20- and the 200-day simple moving averages (SMAs) posted death cross, confirming the latest bearish wave in market. The MACD oscillator is strengthening its negative momentum beneath its trigger and zero lines, while the RSI is flattening in the oversold area.

The pair has key levels underneath for protection against selling forces. The 1.3150 support level, achieved on July 31 is the first obstacle for traders to have in mind ahead of the 1.3090 barricade, taken from the lows on July 14.

In the event of an uptrend resumption above the 1.3380-1.3415 restrictive region, the bulls might take a breather near the bearish cross of the 20- and the 200-day SMAs around the 1.3480 resistance level. More gains could lead the market towards the 1.3630-1.3655 resistance area, which encapsulates the 50-day SMA.

In brief, USDCAD sellers are holding the upper hand, and the market is posting a strong bearish correction in the short-term timeframe. A close above the death cross may show some optimism for a potential upside recovery.

.jpg)