Market Fundamental Context

Market RecapU.S. Dollar plunged after a much weaker-than-expected non-farm payrolls report (22k vs. 78k expected), with the unemployment rate rising to 4.3%, a near 4-year high.10-year Treasury yield fell below 4.1%, reflecting aggressive repricing of Fed policy expectations.Gold surged to record highs on safe-haven demand and collapsing real yields. Fed ExpectationsSeptember FOMC: 25bps cut is fully priced, with speculation of a possible 50bps cut if CPI next week is soft.October FOMC: Odds of another 25bps cut jumped above 75%, signaling belief that the Fed needs to act aggressively.Markets expect accelerated easing cycle, shifting narrative from “soft landing” to “insurance required.” Currency PerformanceDollar sliding toward the bottom of the weekly performance table; likely to end the week among the weakest.Canadian Dollar underperforms most after disappointing domestic jobs data.Euro leads gains, followed by Aussie and Sterling; Swiss Franc and Kiwi mid-pack.Yen remains weak but may recover slightly on risk sentiment. Other Key PointsGold thrives, supported by falling yields and USD weakness, and is approaching the $4,000 psychological mark.Global equities mixed: Initial optimism from easing hopes faded as growth concerns dominated.French political risk (Sept 8 confidence vote) flagged by Crédit Agricole as a potential EUR volatility driver.BofA notes USD is still modestly overvalued, but the weakness is now driven by structural concerns and policy shifts.

The big market mover from the weekend was the resignation of Japanese Prime Minister Ishiba, who stepped down under heavy pressure from his party after a historic election defeat. Ishiba, who came to power in October 2024, saw his coalition lose its majorities in both the lower and upper houses of parliament.

On the data front, revised GDP showed the economy expanding at a stronger-than-expected 2.2% annualised pace in Q2 (0.5% q/q), up from the 1.0% preliminary estimate. The upgrade reflected firmer private consumption and marked a fifth consecutive quarter of growth.

From China, August trade data revealed exports rising but missing expectations, with year-on-year growth the slowest since February. Shipments to the U.S. plunged 33% y/y, underscoring the drag from tariffs.

Dollar weakened broadly overnight and selling pressure persisted in Asia on Tuesday, with the greenback on the verge of breaking recent lows against Euro, Swiss Franc, and Aussie. The decline comes amid falling U.S. Treasury yields and growing conviction that the Fed will move toward faster easing.

With no major U.S. releases scheduled today and the Fed in blackout mode ahead of next week’s FOMC, traders are still appearing impatient. Thursday’s CPI looms large, but speculative selling has already picked up, raising the risk that Dollar’s decline becomes self-reinforcing if technical levels give way.

Whether the move extends into a broader selloff remains a key focus. A break of recent lows in multiple pairs could invite further technical selling, especially if Thursday’s CPI shows softening price momentum. While a 50bps Fed cut next week is still unlikely, markets are increasingly pricing a dovish dot plot and statement.

At the same time, Euro is struggling under its own weight. France’s Prime Minister François Bayrou lost a confidence vote on Monday, ending a turbulent nine months in office. His departure makes him the fourth prime minister to collapse under President Emmanuel Macron’s second term, highlighting the persistent instability in French politics.

France now faces yet another stretch of political drift and uncertainty. Macron must quickly find a candidate palatable enough to avoid being brought down immediately, but precedent suggests the process could drag on. This instability has weighed on Euro, particularly against the Swiss franc, with investors turning defensive.

For the week so far, Dollar sits at the bottom of performance table, followed by Loonie and Yen. Yen, however, is rebounding as Nikkei retreats from record high and falling U.S. yields offer support. At the other end, Kiwi leads, followed by Aussie and Swiss franc, with Sterling and Euro mixed in the middle.

BANK REPORTS

Credit Agricole sees upside risks to gold beyond their current forecasts. With Fed cuts, EM central bank buying, and de-dollarisation themes at play, XAU remains well supported in the months ahead.

Goldman Sachs argues the USD is in the midst of a structural repricing: weaker U.S. exceptionalism, a slowing labor market, and Fed cuts point to sustained Dollar weakness. Shifting hedging flows and CNY stability add to the case for underperformance, particularly against European and Asian currencies.

Morgan Stanley’s call is clear: the USD bear market has more room to run. Lower real yields, slowing US growth, and policy divergence with Europe and the UK all reinforce dollar downside risks. They highlight that investors underestimating these structural drivers may miss a significant phase of USD weakness.

Gold Algo here,

Geopolitical risks, monetary policy, government spending, and technical conditions have driven gold to continue its strong, record-breaking uptrend.

⭕️ This sharp rise in gold is mainly due to large-scale buying; yet the main factors behind gold’s rally include along side with the large scale buying are:

Expectations of Federal Reserve rate cuts, acting as a bullish catalystPolitical instability, which increases gold’s appeal as a safe-haven assetMajor buyers sustaining both physical demand and investment demandTrump’s attempts to control the Fed and push interest rates lower than they otherwise would beDisruptions in global trade order, raising economic risksDisruptions in global order related to military interventions (e.g., J.D. Vance’s comments about military action in Venezuela)Excessive government spending, putting pressure on the macroeconomic outlookTechnical analysis aligning with the bullish trend, pointing to continued parabolic movement

📌 The current trend suggests gold remains on a strong upward path, with investors closely watching major economic and political factors.

#Gold #Xauusd

The yen made a strong comeback today, topping the currency charts as traders jumped on rumors that the Bank of Japan might hike rates as early as October. A Bloomberg piece, citing unnamed sources, hinted that some officials want to move sooner, especially since concerns about economic growth have eased after the U.S.–Japan trade deal. The big question for policymakers is whether U.S. tariffs hit Japan’s economy harder than expected. If the impact stays manageable, the BoJ could argue it’s time to start normalizing rates again—even with the political drama in Tokyo.

That said, the story was based on anonymous sources and came with some mixed headlines. A lot of analysts think the recent resignation of Prime Minister Shigeru Ishiba and the upcoming LDP leadership race mean the BoJ will play it safe. They’re unlikely to tighten policy in the middle of such political uncertainty. Plus, the bank isn’t in a rush—they can easily wait until early next year for the next hike, keeping things steady and avoiding any sense of panic. For markets, this means rate expectations will probably keep swinging around as headlines change.

Over in Europe, the euro slipped across the board, with investors still reacting to the ousting of French Prime Minister François Bayrou on Monday. The government shake-up has added to concerns about political instability in France, though by itself it probably won’t push the euro much lower unless things spiral further. Still, the fact that France has gone through four prime ministers in two years is denting confidence. With President Emmanuel Macron now scrambling to find someone who can actually hold power in parliament, the euro is staying on the defensive.

BANK REPORTS

Despite the frustration of limited traction in recent months, GS argues that the macro backdrop—Fed easing, weaker US growth, and reduced hedging costs—supports further downside in USD/JPY. The trade remains one of their preferred ways to express USD weakness into year-end.

BofA frames this ECB meeting as a relatively muted FX event. A dovish press conference may weigh modestly on the Euro, but no major policy shifts are expected. The bank keeps its medium-term stance cautious on EUR crosses, particularly vs GBP, AUD, and Scandies, while acknowledging that market pricing still looks too hawkish relative to underlying risks.

Dollar sellers hit pause, with the greenback holding just above recent lows as traders locked in profits before two big U.S. inflation reports. Momentum cooled off while markets waited for fresh drivers — PPI today and CPI on Thursday. If price growth runs hotter than expected, fears of stagflation could flare up again, making the Fed’s job trickier as it considers rate cuts to support the softening labor market. On the flip side, if tariffs don’t turn out to be as inflationary as people feared, bets on faster rate cuts would likely pick up quickly.

Another storyline hanging over markets is Fed independence. A federal judge just blocked President Trump’s attempt to remove Fed Governor Lisa Cook. The ruling said the law’s “for cause” clause can’t be used to fire a governor over alleged actions before they took office. The case is expected to head to the Supreme Court and could set a big precedent for presidential power.

Cook, for her part, has denied any wrongdoing tied to Trump’s mortgage fraud claims. Judge Jia Cobb emphasized that protecting the Fed’s independence is in the public’s best interest — something investors see as key for keeping inflation policy credible.

On trade, Trump called on the EU to slap tariffs of up to 100% on China and India over their Russian oil buys — saying the U.S. would match those moves. Washington has already hiked tariffs on Indian imports to as high as 50%, sparking protests from New Delhi. China, the top buyer of Russian oil, has been spared so far thanks to a tariff truce with the U.S.

Over in Europe, French President Emmanuel Macron named Sebastien Lecornu, a close ally, as Prime Minister. The 39-year-old will lead another minority government, expected to push ahead with Macron’s pro-business reforms while navigating political gridlock and debt worries.

Bank insights:

Morgan Stanley’s CPI preview suggests inflation risks are still tilted to the upside, especially from goods and tariffs. Services might give some temporary relief, but core goods inflation remains sticky, so the Fed will likely stay cautious and avoid rushing cuts in September.Credit Agricole thinks commodity currencies are undervalued against the dollar, with room to rebound as global equities and rates evolve. They see NZD as the standout near term, thanks to oil dynamics and equity ties, while AUD and CAD may need stronger commodity momentum to fully catch up.

Opposition groups in France are officially calling for the impeachment of President Emmanuel Macron. This comes after his prime minister was removed from office following a vote of no confidence.

This is another BLS scandal, and Trump was absolutely right to fire the BLS commissioner?😔

What this means:

1). There was virtually no job creation in the last year of the Biden admin.

2). The Fed should have started cutting in February.

3) 2 million jobs from the last 3 years of the Biden admin have now been revised away. This despite the biggest debt issuance spree on record.

The dollar slipped a bit earlier in the U.S. session while futures bounced back after producer price data showed inflation pressures cooling slightly. That gave traders more confidence the Fed might keep cutting rates. Odds of a 50bps cut next week ticked up to 10%, and chances of back-to-back cuts through October are back near 80%.

Still, no one’s going all-in ahead of Thursday’s CPI report. That number will be key for the Fed’s September decision and the bigger policy path. For now, markets are leaning dovish but staying cautious.

Looking at today’s moves, the dollar looks shaky. If CPI comes in softer than expected, selling could pick up fast and push the greenback lower across major currencies. In other words, Thursday’s inflation print could be the turning point.

In FX, the Aussie led the pack, helped by hopes that Fed easing could give China’s central bank more room to cut rates and support its sluggish economy. The Kiwi wasn’t far behind, and Sterling also firmed as risk sentiment improved.

On the commodities side, gold is still shining as a go-to hedge in a world of easy money, geopolitics, and heavy fiscal spending.

ANZ now sees gold hitting $3,800/oz by year-end and peaking near $4,000/oz by mid-2026, making dips look like buying chances. Silver, though choppier, is also expected to climb and add diversification upside.

Meanwhile, Goldman Sachs thinks August CPI will come in a bit hotter than forecasts, mainly due to tariffs. They still see long-term disinflation at play, but near-term inflation may stay sticky before easing again.

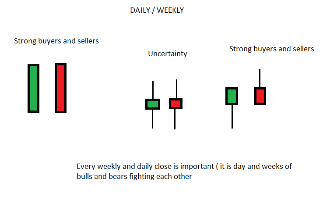

I will add a bit of technical price action knowledge here.

Price action really works on Daily and Weekly charts to be honest. All this lower timeframe is bullsh#t.

So first we should start from Daily and Weekly timeframes because big players trade them... Lower timeframes we can use as confirmation but nothing hard...

Traders usually don't care about the closing and opening of weekly and daily charts, even though this is very important. Every movement in the market means that someone voted with their money at some point, believing in something.

To open long positions on an asset, you need to buy it from sellers. To open short positions, you need buyers so that, through a special loan agreement and subsequent repurchase, you have an asset that you can sell. But without going into too much detail, we all know that there are long and short positions in trading.

Buyers accumulate positions at the expense of sellers, and sellers at the expense of buyers. Someone has to lose, but everyone wants to win.

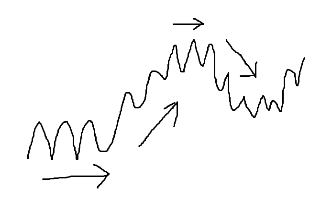

Markets move in two states: sideways and trends. Sideways movement is a kind of uncertainty. A trend, on the other hand, is general certainty.

Let's consider the fruit and vegetable market as an example:Walking through the market, we see stalls and people selling and buying goods. Let's take apples as an example... If the demand for apples increases, sellers raise prices and, at the same time, due to the purchase of goods, the supply falls, which also pushes the price up. If the demand for apples falls, prices also fall, and the supply will increase.

We are small market participants... Now let's imagine that you are a large market participant and you need to buy a lot of apples, but if you openly shout that you are buying 10,000 apples, prices will immediately rise because sellers who hear this will want to sell their goods at a higher price, and other buyers will see the demand for apples and also start buying them.

Therefore, as a major player, you need to buy apples slowly in different places at a certain average price. This is essentially how sideways movements are formed in the markets. Only when a major player has purchased the required volume will they place a large open order to attract the crowd and show demand.

Large players accumulate their positions in sideways movements, which is why so many retail traders lose their money in intraday trading. Simply put, during the day and within small ranges, large players buy up everything they can in the direction of a more significant fundamental trend.

A large player can also accumulate their position through a reverse movement. That is, after a certain trend, we get a pullback without a sideways movement, and then continue moving in the fundamental direction.

Fundamental context

Asian markets were pretty mixed today, with trading staying quiet as investors waited for two big events: the ECB meeting and U.S. inflation data. Nobody seemed eager to make bold moves before getting some clarity.

The ECB decision probably won’t stir things up much — markets are fully expecting rates to stay at 2.00%. Christine Lagarde isn’t likely to give any strong guidance either, so the focus will mostly be on her tone and the new forecasts to see if policymakers think rate cuts are done for now.

On the other hand, U.S. CPI is the real market mover. The risks feel one-sided: if inflation comes in lower than expected, it could spark a much bigger reaction than if it’s hotter. A soft number would likely speed up the Fed-dovish narrative, pushing yields and the dollar down even further.

atlantictrade posted:Fundamental context

Asian markets were pretty mixed today, with trading staying quiet as investors waited for two big events: the ECB meeting and U.S. inflation data. Nobody seemed eager to make bold moves before getting some clarity.

The ECB decision probably won’t stir things up much — markets are fully expecting rates to stay at 2.00%. Christine Lagarde isn’t likely to give any strong guidance either, so the focus will mostly be on her tone and the new forecasts to see if policymakers think rate cuts are done for now.

On the other hand, U.S. CPI is the real market mover. The risks feel one-sided: if inflation comes in lower than expected, it could spark a much bigger reaction than if it’s hotter. A soft number would likely speed up the Fed-dovish narrative, pushing yields and the dollar down even further.

How do you think gold reacts to today's CPI?

GoldAlgo posted:atlantictrade posted:Fundamental context

Asian markets were pretty mixed today, with trading staying quiet as investors waited for two big events: the ECB meeting and U.S. inflation data. Nobody seemed eager to make bold moves before getting some clarity.

The ECB decision probably won’t stir things up much — markets are fully expecting rates to stay at 2.00%. Christine Lagarde isn’t likely to give any strong guidance either, so the focus will mostly be on her tone and the new forecasts to see if policymakers think rate cuts are done for now.

On the other hand, U.S. CPI is the real market mover. The risks feel one-sided: if inflation comes in lower than expected, it could spark a much bigger reaction than if it’s hotter. A soft number would likely speed up the Fed-dovish narrative, pushing yields and the dollar down even further.

How do you think gold reacts to today's CPI?

Gold have best situation right now cause if we have lower print = rate cuts = gold bullish

If we get higher inflation = less rate cuts = but gold is hedge against inflation and stagflation

But i think we need some retracement on Gold

Recession Watch in the USAbout 3% of US states are already in recession, according to Moody’s Analytics.Even more worrying: states that make up a third of US GDP are either in recession or at high risk.

The good news? California, Texas, and New York are still holding up pretty well, which is helping stabilize the overall economy.

Japan’s Central Bank MovesMost economists think the Bank of Japan will hike its key interest rate by 0.25% or more in Q4 2025.

Here’s the risk: if the US tips further into recession while the BoJ keeps raising rates, the carry trade could unwind, leading to a potential sell-off of US assets.

Inflation Forecasts

Goldman Sachs expects core CPI to rise 0.36% and overall inflation 0.37%, mainly from:

Food prices: +0.35%Energy prices: +0.6%JPMorgan is even more aggressive, forecasting a 0.4% jump — though some think that might be too high.

FX Strategy (Yen vs Dollar)Political noise in Japan has been stirring up volatility.Still, MUFG says the BoJ’s steady rate hikes support the yen.

Their call: stay short USD/JPY, aiming for 143.50 as downside momentum builds.

The euro slipped a bit after the ECB kept its deposit rate unchanged at 2.00% and rolled out fresh staff forecasts, but the dip didn’t last long. Markets noticed inflation—both headline and core—is now seen just under the 2% target by 2026–27, which leaves the door open for more easing later. Still, the ECB isn’t in any hurry, sticking to its “data-dependent” line. Unless the numbers get worse, no one’s betting on a near-term move, which kept the euro pretty steady overall.

Over in the U.S., CPI landed mostly as expected. Headline inflation rose 0.4% on the month, a touch hot, but the yearly 2.9% and a steady 3.1% core suggest tariffs aren’t causing a breakout in prices.

The real curveball came from jobless claims, which jumped to 263k—the highest since 2021. That’s a clear sign the labor market is softening, and with jobs being half of the Fed’s mandate, it’s pushing expectations for faster easing.

Next week’s FOMC meeting is still seen delivering a 25bp cut, with only about a 10% chance of a bigger 50bp move. But the odds of another cut in October have shot up to around 95%, showing markets are leaning hard toward back-to-back easing.

Morgan Stanley thinks the Fed will go with a measured 25bp in September, leaning dovish but not slamming the gas.

BofA, on the other hand, calls it a “hawkish cut,” expecting a knee-jerk USD bounce that they see as fade-worthy given the medium-term bearish trend.

Markets entered last week with elevated anticipated and left with even sharper convictions. Weak U.S. labor data tilted sentiment decisively toward faster Fed easing, while equity markets used that prospect as a springboard to yet another round of record highs.

Bond markets echoed that view. US 10-year yield broke briefly below 4%, sending a signal that investors are ready to front-load expectations for deeper easing. In the currency markets, Dollar failed to reclaim ground, leaving the stage open for other majors to shine.

At the front of the pack, Aussie surged ahead, powered additionally by strong regional risk-on sentiment. Kiwi followed closely, while Sterling also managed to climb, finding just enough support to offset the weight of ongoing fiscal worries.

orex trading was pretty quiet in Asia today. Major currency pairs barely budged, and regional stock markets also held steady. That calm comes even after another batch of weak Chinese economic data, which showed the slowdown there is spreading. Traders didn’t seem too rattled, though—the numbers mostly reinforced the idea that Beijing will need to roll out more stimulus soon. For now, the prospect of extra support from the government is helping keep risk sentiment from turning sour.

China’s policy outlook is still tied closely to the Fed. Once the Fed makes its rate-cut path clear, the PBoC will have more room to ease without sparking capital outflows. That’s keeping bets alive that China could cut rates again in the months ahead, especially with growth still softening.

But the real action this week comes from central banks. Four big ones are meeting: the Fed, the BoC, the BoE, and the BoJ. The Fed’s decision is the main event—a rate cut is widely expected, but there’s a lot of debate over how big it’ll be and how split the committee might be. Markets will also be parsing fresh economic projections. Meanwhile, a packed data calendar includes UK jobs, inflation, and retail sales; Germany’s ZEW survey; Australia’s jobs report; and New Zealand GDP.

Geopolitics is back in the mix too. High-level U.S.–China trade talks kicked off in Madrid on Sunday, bringing together senior U.S. and Chinese officials. The talks follow July’s meeting in Stockholm, which extended the 90-day tariff truce and reopened U.S. access to China’s rare-earth exports. Hopes for a breakthrough are low, though—another temporary extension looks like the most realistic outcome. Markets are also watching closely to see if Washington pushes back the Sept. 17 deadline for ByteDance to sell TikTok’s U.S. operations, or risk facing a ban.

On the FX side, the dollar sold off again today, with the pound and euro leading the charge higher. The greenback was the weakest major currency on the day, while the Kiwi also lagged. Traders are bracing for the Fed decision, and chatter picked up after SocGen joined Standard Chartered in calling for a bigger 50bps cut—though futures markets only give that about a 4% chance. More broadly, markets are fully pricing in a steady run of 25bps cuts through year-end. Economists largely agree: the Fed has ground to cover, and an easing cycle is well underway.

Elsewhere in Europe, Fitch downgraded France’s rating to AA- last Friday, citing its growing debt. The euro shrugged it off and kept rallying.

Back on the trade front, the U.S.–China talks stretched into a second day. Treasury Secretary Scott Bessent said “good progress” had been made on technical issues and that TikTok was close to being resolved, though he stressed national security won’t be compromised. Chinese officials were less forthcoming.

Still, tensions aren’t easing much. Beijing opened an anti-monopoly probe into U.S. chipmaker Nvidia and hit back at Trump’s push for the EU to impose secondary tariffs on China over Russian oil. China’s Commerce Ministry called the move “unilateral bullying” and warned it would respond as needed.

Risk appetite stayed strong in the U.S. overnight, with both the S&P 500 and NASDAQ hitting fresh record highs. Traders piled further into equities and risk assets on growing conviction that the Fed will kick off its easing cycle this week. Sentiment got an extra boost from news that Washington and Beijing reached a “framework” agreement on TikTok — taking some heat out of U.S.–China tensions.

Fed in FocusMarkets are almost unanimous that the FOMC cuts rates this week. That view only firmed after Stephen Miran, Trump’s nominee, was confirmed to the Fed Board on Monday, meaning he’ll be in the room for this decision. At the same time, a U.S. appeals court ruled Trump can’t remove Governor Lisa Cook before the meeting — keeping her vote in play. Neither development changes the expected outcome: a cut is coming.

FX MovesThe dovish Fed narrative kept pressure on the dollar, with broad weakness across the board. That slide pushed Gold to another record high. Among majors, AUD and NZD lagged slightly, CAD outperformed, and JPY found support. European FX was more mixed, trading in the middle of the pack.

Trade FrontOn China, Treasury Secretary Scott Bessent confirmed the U.S. and Beijing reached a TikTok framework deal that could clear the way for U.S.-controlled ownership. China’s Li Chenggang acknowledged the agreement but warned Washington against continued pressure on Chinese firms.

What’s NextPlenty of data on deck today: UK jobs and Germany’s ZEW survey in Europe, then Canada’s CPI and U.S. retail sales later. Of those, U.K. employment and Canadian inflation look the most market-moving. Still, everything funnels back to the Fed — their guidance this week will set the tone for risk sentiment and currency trends into year-end.

Markets were mostly in wait-and-see mode today as traders braced for the Fed’s big policy decision. A 25bps cut is all but locked in, but the real action will come from the details: how split the vote is, what the new projections show, and Powell’s tone at the presser. That’s what’ll shape expectations on how quickly (and how far) this easing cycle goes.

The setup is tense. Stocks and Gold are already sitting at record highs, with room to push further if Powell leans dovish. Bond traders are glued to the 10-year yield, watching if it can crack below the 4% mark — a move that could ripple through global rates. Meanwhile, the Dollar is limping into the decision, and if the Fed hints at back-to-back cuts, the selloff could snowball fast.

It’s also decision day for the BoC, where a 25bps cut to 2.50% is widely expected. Markets will be combing through Macklem’s comments for signs of more easing down the road, especially with softer growth and jobs data backing that case. Tariff uncertainty has cooled, so the Loonie’s reaction hinges on whether the BoC keeps the door open for further moves.

Across the pond, UK inflation data lands just ahead of tomorrow’s BoE meeting. The bank is expected to stay put, but the numbers could swing expectations for a November cut. Stronger headline and services inflation would make another trim a tougher sell.

Currency-wise, the Dollar sits firmly at the bottom of the G10 pack, joined by Kiwi and Aussie. On the flip side, the Swiss Franc leads the charge, followed by Euro and Yen, while Sterling and Loonie hover in the middle.

On trade, Treasury Secretary Scott Bessent struck an upbeat note, saying a deal with China is “near.” With fresh tariffs looming in November, he flagged more talks before then and stressed progress in each round. He even said Beijing now “senses that a trade deal is possible” — a rare bit of optimism in what’s been a rocky backdrop.