Help myfxbook calculator got my position size incorrect

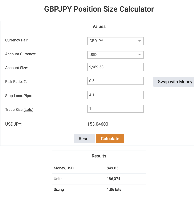

Hey All I am a new trader and I don't know where the error was here. My Prop account was at 9969.58 and I was risking 0.5% on a trade. I plugged the data including the stop loss size of 4.1 Pips into the calculator and it spit back out this information as shown in the image. The problem is when I opened the position with the information from the calculator for some reason I ended up risking WAYYYY More and I have no idea where Almost double. What was supposed to be a risk of $49.85 Turned into $75.00 and I have absolutely no clue as to what I may have done incorrectly.Prop firm: Equity EdgeAccount size at time of trade: 9969.58Stop loss: 4.1 pipsLot Size given: 1.86Risk in Dollars: $49.86Actual outcome $75.00 excluding commission.Please assist

Hey 👋 no worries, this happens to a lot of new traders.The issue likely comes from a pip/point mismatch — especially if you were trading gold or indices.

Most calculators treat 1 pip as 0.0001 (for forex pairs), but for gold, 1 pip = 0.10, not 0.01.So when you entered a 4.1 pip stop, the calculator saw it as much larger than it actually was, giving you a bigger lot size than intended.

Next time, double-check how your broker defines a pip for that instrument, and always include the spread in your stop size before calculating.

You’re doing great — everyone learns this the hard way at least once! 💪

It sounds like the position size calculation might have been affected by either the pip value difference between symbols (for example, USD pairs vs JPY or gold) or by spread widening or stop-loss distance misalignment when the trade was executed. Even a small mismatch in pip size or contract value can make your actual risk higher than expected.

To double-check such cases, you can use the Amillex Trade Calculator — it automatically adjusts for symbol type, pip value, and leverage to give an accurate position size based on your stop loss and risk %.

You are in a very volatile and violent pair, so even if you put a stop, it does not guarantee that you will lose only this money, and this is in the event that the price runs in the opposite direction, and therefore the execution is at the first price closest to the stop you put, and that is where the increased loss comes from. Check it out.