Edit Your Comment

IC Markets

会员从Mar 26, 2014开始

18帖子

Jun 30, 2014 at 12:46

会员从Mar 26, 2014开始

18帖子

Surrealistik posted:

I have to admit, I held my judgement on this, but after seeing your website when it was pointed out to me, I kind of agree with cyberryder and Jon; there certainly seems to be an attempt to distinguish yourself from other IBs with a false veneer of exceptionality/exclusivity and official endorsement. It's not that you're trying to impersonate an employee of IC Markets, it's the misleading way you are representing your association with this broker.

Also did you get permission from Nick and Jeff to advertise their MAM, and associate your affiliate ID with it?

EDIT: Apparently you did not: http://www.donnaforex.com/forum/index.php?topic=10883.msg313905#msg313905

I strongly recommend you delete that page at once. I will also be speaking to Angus about any clients you illegitimately enrolled in this way.

The page has been removed.

Get 20% discount on IC Markets

会员从Apr 30, 2013开始

55帖子

Jul 08, 2014 at 18:51

会员从Apr 30, 2013开始

55帖子

About to start a MAM with IC Markets, and I'm already approved by them as they told me I have a good system and way of trading which is guaranteed to bring new clients in. They wanted to look at my trading account, and I sent them to my stats on MyFXbook.

The reason I am thinking of having my MAM at IC Markets is because of many good reviews as well as low spreads on pairs that I use. Anyone else can share experiences with their MAM as a MAM manager or as a trader? Thank you.

- Hans

The reason I am thinking of having my MAM at IC Markets is because of many good reviews as well as low spreads on pairs that I use. Anyone else can share experiences with their MAM as a MAM manager or as a trader? Thank you.

- Hans

会员从Apr 28, 2012开始

219帖子

Jul 09, 2014 at 21:01

会员从Apr 28, 2012开始

219帖子

Hi Hans,

I would recommend getting in touch with Nick at the Forex Signals forum here:

http://www.forexsignals.com/forum/forumdisplay.php/7-Nick-s-Forex-Journey

To my knowledge he's set up, or helped set up several MAMs at IC Markets and is in close contact with the traders that work with him, so I expect he would have some valuable feedback for you.

I would recommend getting in touch with Nick at the Forex Signals forum here:

http://www.forexsignals.com/forum/forumdisplay.php/7-Nick-s-Forex-Journey

To my knowledge he's set up, or helped set up several MAMs at IC Markets and is in close contact with the traders that work with him, so I expect he would have some valuable feedback for you.

Offering the best commission discounts for the best broker: $1.50 / RTL Global Prime:

会员从Apr 30, 2013开始

55帖子

Jul 09, 2014 at 23:11

会员从Apr 30, 2013开始

55帖子

Yea I know Nick and talked with him a few times before over Skype.

Currently I am busy setting up the MAM at IC Markets (so far so good, but in order to provide MAM, I need to become an IB first, and in order to become an IB, I need to open a normal trading account with IC Markets which all takes a bit of time) and I think I will put my signal also on ForexSignals of Nick as well somewhere next month.

- Hans

Currently I am busy setting up the MAM at IC Markets (so far so good, but in order to provide MAM, I need to become an IB first, and in order to become an IB, I need to open a normal trading account with IC Markets which all takes a bit of time) and I think I will put my signal also on ForexSignals of Nick as well somewhere next month.

- Hans

会员从Apr 24, 2014开始

209帖子

Jul 10, 2014 at 17:33

会员从Apr 24, 2014开始

209帖子

hansbowles posted:

Yea I know Nick and talked with him a few times before over Skype.

Currently I am busy setting up the MAM at IC Markets (so far so good, but in order to provide MAM, I need to become an IB first, and in order to become an IB, I need to open a normal trading account with IC Markets which all takes a bit of time) and I think I will put my signal also on ForexSignals of Nick as well somewhere next month.

- Hans

I will be watching you at Nick's goodluck

Get rich or just die

会员从Apr 30, 2013开始

55帖子

会员从Apr 24, 2014开始

209帖子

会员从Apr 30, 2013开始

55帖子

会员从Apr 24, 2014开始

209帖子

会员从Apr 28, 2012开始

219帖子

Jan 19, 2015 at 21:40

(已编辑 Jan 19, 2015 at 21:41)

会员从Apr 28, 2012开始

219帖子

Would like to wish a Happy New Year to all my clients and all goers of this fine forum!

That said, I'd like to post some important communications from IC Markets concerning the Swiss Franc depegging.

If you feel you've been adversely affected by an aberrant/erroneous spike or price at IC Markets due to this event, I definitely recommend getting in touch with IC Markets support ASAP: [email protected]

If you'd like my personal assistance I will also do my best to help you out; I can be reached via PMs here or at [email protected]

Direct correspondence from IC Markets on the matter is as follows:

"Dear Client,

This email is concerning the CHF position(s) on your trading account and the prices streamed across the CHF pairs that have affected you today.

Today at 11:30 platform time (GMT+2) the Swiss National Bank removed the floor at 1.20 on the EURCHF currency pair which caused extreme volatility in all CHF pairs and the market in general. Over this period we saw spreads widen significantly which in turn caused the activation of price filters to stop pricing. Once pricing stopped on our main Integral price feed our backup price feed from Currenex was allowed to price. It was at this time that some liquidity providers were able to stream erroneous prices to IC Markets and execute client trades at prices they shouldn’t have.

Today IC Markets will be amending the prices on trades done across the CHF pairs with our liquidity providers. Once we have had these trades amended we will begin the process of adjusting clients accounts. This may include but not be limited to the actions below:

• Reinstatement of positions where appropriate and possible

• Amendment of open/close prices on trades

• Assessment of client portfolios closed due to insufficient margin

• Adjusting client cash balances to reflect the actions above

IC Markets staff will be working as fast as possible to complete the above and restore trading accounts to their correct state. We appreciate your patience as we complete this.

Kind regards,

IC Markets Trade Desk"

Further, please note that there is no risk of IC Markets becoming insolvent as other brokerages had due to overleveraged clients; they have more than enough operating capital to sustain operations:

"Dear Traders,

In the wake of unprecedented market events caused recently due to actions of SNB, we would like to reassure you that our robust risk management processes has helped us to continue Business as usual.

Our operating capital has not been affected and we continue to hold capital well in excess of all ASIC regulatory requirements.

Trust and Transparency form the basis of IC Markets' core values, we hold all positive client equity and balances separately in segregated client trust accounts at top-tier Australian banks and do not use these funds for any purpose other than to facilitate clients trading activity.

At IC Markets, we will leave no stone unturned to fulfill our promise of providing our clients with the very best trading environment, Our Staff will be working as fast as possible to resolve all Client inquiries & requests. We appreciate your patience as we complete this.

If you have any further questions or require any assistance, please don't hesitate to contact one of our support team members via Live Chat, email:[email protected] or phone +61 (0)2 8014 4280.

Kind regards,

IC Markets Trade Desk"

That said, I'd like to post some important communications from IC Markets concerning the Swiss Franc depegging.

If you feel you've been adversely affected by an aberrant/erroneous spike or price at IC Markets due to this event, I definitely recommend getting in touch with IC Markets support ASAP: [email protected]

If you'd like my personal assistance I will also do my best to help you out; I can be reached via PMs here or at [email protected]

Direct correspondence from IC Markets on the matter is as follows:

"Dear Client,

This email is concerning the CHF position(s) on your trading account and the prices streamed across the CHF pairs that have affected you today.

Today at 11:30 platform time (GMT+2) the Swiss National Bank removed the floor at 1.20 on the EURCHF currency pair which caused extreme volatility in all CHF pairs and the market in general. Over this period we saw spreads widen significantly which in turn caused the activation of price filters to stop pricing. Once pricing stopped on our main Integral price feed our backup price feed from Currenex was allowed to price. It was at this time that some liquidity providers were able to stream erroneous prices to IC Markets and execute client trades at prices they shouldn’t have.

Today IC Markets will be amending the prices on trades done across the CHF pairs with our liquidity providers. Once we have had these trades amended we will begin the process of adjusting clients accounts. This may include but not be limited to the actions below:

• Reinstatement of positions where appropriate and possible

• Amendment of open/close prices on trades

• Assessment of client portfolios closed due to insufficient margin

• Adjusting client cash balances to reflect the actions above

IC Markets staff will be working as fast as possible to complete the above and restore trading accounts to their correct state. We appreciate your patience as we complete this.

Kind regards,

IC Markets Trade Desk"

Further, please note that there is no risk of IC Markets becoming insolvent as other brokerages had due to overleveraged clients; they have more than enough operating capital to sustain operations:

"Dear Traders,

In the wake of unprecedented market events caused recently due to actions of SNB, we would like to reassure you that our robust risk management processes has helped us to continue Business as usual.

Our operating capital has not been affected and we continue to hold capital well in excess of all ASIC regulatory requirements.

Trust and Transparency form the basis of IC Markets' core values, we hold all positive client equity and balances separately in segregated client trust accounts at top-tier Australian banks and do not use these funds for any purpose other than to facilitate clients trading activity.

At IC Markets, we will leave no stone unturned to fulfill our promise of providing our clients with the very best trading environment, Our Staff will be working as fast as possible to resolve all Client inquiries & requests. We appreciate your patience as we complete this.

If you have any further questions or require any assistance, please don't hesitate to contact one of our support team members via Live Chat, email:[email protected] or phone +61 (0)2 8014 4280.

Kind regards,

IC Markets Trade Desk"

Offering the best commission discounts for the best broker: $1.50 / RTL Global Prime:

会员从Mar 26, 2014开始

18帖子

Jan 20, 2015 at 11:46

(已编辑 Jan 20, 2015 at 11:47)

会员从Sep 19, 2011开始

84帖子

IC Markets Still Strong

Dear Trader,

The unexpected announcement by the Swiss National Bank (SNB) that it would withdraw the cap on the Swiss Franc’s value against the Euro took many in the industry by surprise and resulted in extreme volatility in the forex markets.

We were surprised by the extreme volatility after the announcement, however fortunately in December, 2014 we assessed the risks associated with this pair and reduced the leverage offered to clients. As a result of this pre-emptive measure we were able to minimise the impact of negative client equity and provide additional protection for our clients. Despite the significant volatility during the announcement we were able to maintain pricing during periods of low liquidity.

The new paradigm in the forex market could be characterized by periods of low volatility followed by extreme episodic volatility as we saw with the Russian Rouble in December and now the Swiss Franc last week. Two such events happening within a month of each other should be considered as a sign of the times. We are expecting more volatility like this although not of the same magnitude throughout 2015. We would like to assure you that we will continue to focus on pre-emptive risk management so that our clients remain unaffected by future volatility.

Our financial position remains strong and above our regulatory requirements with trading unaffected. As always client funds are held in segregated accounts with leading Australian banks NAB and Westpac.

If you have any questions or require any assistance, please contact one of our support team members via Live Chat, email: [email protected], or phone +61 (0)2 8014 4280.

Dear Trader,

The unexpected announcement by the Swiss National Bank (SNB) that it would withdraw the cap on the Swiss Franc’s value against the Euro took many in the industry by surprise and resulted in extreme volatility in the forex markets.

We were surprised by the extreme volatility after the announcement, however fortunately in December, 2014 we assessed the risks associated with this pair and reduced the leverage offered to clients. As a result of this pre-emptive measure we were able to minimise the impact of negative client equity and provide additional protection for our clients. Despite the significant volatility during the announcement we were able to maintain pricing during periods of low liquidity.

The new paradigm in the forex market could be characterized by periods of low volatility followed by extreme episodic volatility as we saw with the Russian Rouble in December and now the Swiss Franc last week. Two such events happening within a month of each other should be considered as a sign of the times. We are expecting more volatility like this although not of the same magnitude throughout 2015. We would like to assure you that we will continue to focus on pre-emptive risk management so that our clients remain unaffected by future volatility.

Our financial position remains strong and above our regulatory requirements with trading unaffected. As always client funds are held in segregated accounts with leading Australian banks NAB and Westpac.

If you have any questions or require any assistance, please contact one of our support team members via Live Chat, email: [email protected], or phone +61 (0)2 8014 4280.

Highest Forex broker rebates:

会员从Jan 20, 2015开始

5帖子

Feb 04, 2015 at 14:59

会员从Jan 20, 2015开始

5帖子

Hi Fellow Experienced Traders

I am fairly new to forex trading

Hence I really need your expertise & experience on this issue that I am facing with my broker

( Which is IC Markets )

Because somehow the ' answers ' that IC Markets gave so far

just do not sound RIGHT to me though !

I am very helpless at this point

Sincerely hope you guys can advise me accordingly

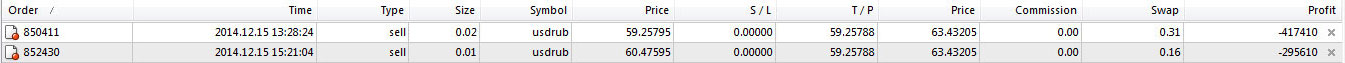

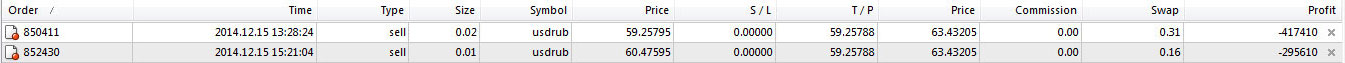

I Sell Short USDRUB positions on 15th DEC 2014

My TP = 59.25788 ( please refer screenshot 1 below )

On 16th DEC 2014

The ' Lowest ASK ' of the day actually hit 59.128

As indicated on the ' Tick Data ' sent from IC Markets itself !

( please refer TickData CSV attached )

When 59.128 ASK Price occurred

My SELL SHORT USDRUB positions should be ' out ' of the market .....right ?

But IC Markets said there's ' no liquidity from provider ' !

Is it that I have to SUCK it up and accept that ?

Can't do anything else at all ?

:(

Please advise

I am fairly new to forex trading

Hence I really need your expertise & experience on this issue that I am facing with my broker

( Which is IC Markets )

Because somehow the ' answers ' that IC Markets gave so far

just do not sound RIGHT to me though !

I am very helpless at this point

Sincerely hope you guys can advise me accordingly

I Sell Short USDRUB positions on 15th DEC 2014

My TP = 59.25788 ( please refer screenshot 1 below )

On 16th DEC 2014

The ' Lowest ASK ' of the day actually hit 59.128

As indicated on the ' Tick Data ' sent from IC Markets itself !

( please refer TickData CSV attached )

When 59.128 ASK Price occurred

My SELL SHORT USDRUB positions should be ' out ' of the market .....right ?

But IC Markets said there's ' no liquidity from provider ' !

Is it that I have to SUCK it up and accept that ?

Can't do anything else at all ?

:(

Please advise

会员从Mar 26, 2014开始

18帖子

会员从Jan 20, 2015开始

5帖子

会员从Oct 23, 2013开始

38帖子

Feb 17, 2015 at 20:17

会员从Oct 23, 2013开始

38帖子

wanttosucceed, trade size does not matter if they are stp. The price feed could be a 500k feed meaning each tic is 500k in volume . So when your trade hits the liquidity provider it will get filled the same weather its .03 lots or 5 lots because this is the volume per tic on the feed. Even if they are clearing the volume, the price is still based off 500k tics( more or less)

会员从Jan 20, 2015开始

5帖子

会员从Feb 19, 2015开始

3帖子

Mar 08, 2015 at 07:44

会员从Mar 08, 2015开始

3帖子

wanttosucceed,

I have experienced similar trade dispointments with other brokers including large ones like dukascopy bank.

It is a risk in forex trading of super volatile price moves that occasionally the price quoted doesnt have any available volume, and hence isnt really there, at that price.

The alternatives I can see if you are interested in continuing to trade super volatile trade times/markets are a guaranteed-stops broker (you will generally pay more in commissions/spread for them, its like they are being your insurance policy) though stops may not have helped you since it looks like you didnt have any set in this trade.

The other option is to trade on a futures exchange platform, though you generally need more funds than a forex broker minimum since they give less leverage, and the instruments are quite different than on forex and the commissions are higher, the advantage is that you are trading actual futures contracts and the volumes and prices are real.

You can still miss an exit or entry if someone got in before you on any market, but that goes without saying unless people never thought about the fact that you can only trade if someone else is willing to trade the opposite direction as you with the same or larger volume.

Just my experience

Dean

I have experienced similar trade dispointments with other brokers including large ones like dukascopy bank.

It is a risk in forex trading of super volatile price moves that occasionally the price quoted doesnt have any available volume, and hence isnt really there, at that price.

The alternatives I can see if you are interested in continuing to trade super volatile trade times/markets are a guaranteed-stops broker (you will generally pay more in commissions/spread for them, its like they are being your insurance policy) though stops may not have helped you since it looks like you didnt have any set in this trade.

The other option is to trade on a futures exchange platform, though you generally need more funds than a forex broker minimum since they give less leverage, and the instruments are quite different than on forex and the commissions are higher, the advantage is that you are trading actual futures contracts and the volumes and prices are real.

You can still miss an exit or entry if someone got in before you on any market, but that goes without saying unless people never thought about the fact that you can only trade if someone else is willing to trade the opposite direction as you with the same or larger volume.

Just my experience

Dean

*商业用途和垃圾邮件将不被容忍,并可能导致账户终止。

提示:发布图片/YouTube网址会自动嵌入到您的帖子中!

提示:键入@符号,自动完成参与此讨论的用户名。