XAUUSD Chart Analysis

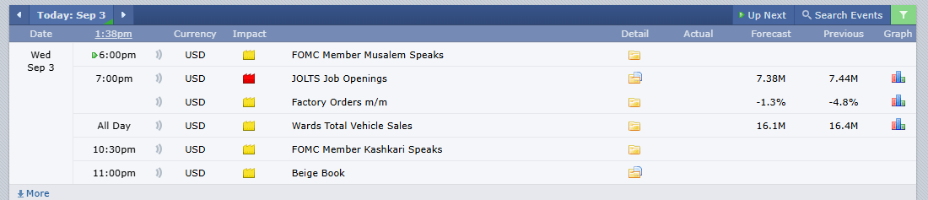

The current market outlook for XAUUSD (Gold) is bullish, with the price hovering around $3,447.43. Here's a breakdown of the market situation ¹:Key Factors Influencing Gold Prices:Federal Reserve Policy: Expectations of a rate cut in September are supporting gold prices. A dovish Fed stance could lead to lower interest rates, making gold more attractive.Geopolitical Tensions: Escalating conflicts in the Middle East and US-China trade tensions are driving safe-haven demand for gold.US Economic Data: Upcoming releases, such as the PCE Price Index and Nonfarm Payrolls, will be crucial in determining the Fed's policy outlook and gold price direction ² ³.Technical Outlook:Resistance Levels: $3,425 (upper boundary of Bollinger Band), $3,439 (high of July 23), and $3,500 (psychological level).Support Levels: $3,373 (low of August 27), $3,351 (low of August 26), and $3,310 (lower limit of Bollinger Band).Relative Strength Index (RSI): Currently at 38, indicating lingering bearish momentum, but oversold conditions could attract dip buyers ² ³.Market Sentiment:Trader Positioning: 72% of traders are shorting XAUUSD, while 28% are going long, indicating a bearish sentiment.Average Price Levels: Short positions are averaging $3,318.22, while long positions are averaging $3,354.48 ⁴.Forecast:Short-term: Gold may hold above $3,340, targeting $3,359-$3,382 if buyers return.Medium-term: Continued global policy easing, a recovering Chinese economy, or escalating geopolitical conflicts could boost safe-haven flows into gold ³ ².

Reply to Meta AI…

The current market overview for XAU/USD (Gold spot US Dollar) is as follows ¹:Current Price: $3,475.72Open Price: $3,445.43High Price: $3,489.84Low Price: $3,437.03Previous Close Price: $3,447.43Change: $28.29Percent Change: 0.82%Gold prices have been rising, driven by ²:Weaker US Dollar: A decline in the US Dollar's value makes gold more attractive to buyers holding other currencies.Fed Rate Cut Expectations: Traders are pricing in nearly an 85% possibility of a quarter-point Fed rate cut next month, which could reduce the opportunity cost of holding gold.Safe-Haven Demand: Geopolitical tensions and trade uncertainty have increased demand for safe-haven assets like gold.

Gold resumed its growth at the beginning of the week, reaching five-month highs around $3480 amid declining risk appetite and expectations of Fed policy easing. Trading activity remains low due to holidays in the US and Canada.Key drivers: Weak Asian markets and uncertainty surrounding Trump's trade policy are supporting interest in gold. The probability of a rate cut in September is estimated at 90% after last week's PCE data.Overall, the market maintains its momentum towards record levels ($3500), but low liquidity may increase volatility.Technically, gold is strongly bullish. The price is striving to test the ATH - 3500. Before that, consolidation or a retest of the 3469-3460 zone may form. The dollar is weak at the moment and continues to trend downward, which generally supports gold.

Resistance levels: 3500.8, 3520Support levels: 3469.5, 3460