Progressive (由 mforce )

该用户已经删除了这个系统。

Edit Your Comment

Progressive讨论

Sep 17, 2020 at 12:14

会员从Jul 21, 2010开始

119帖子

Sep 17, 2020 at 13:07

会员从Feb 12, 2020开始

24帖子

I don't know what your link refers to (didn't want to open it, just a policy of mine, sorry). The reason for 0 second trades at strange prices are due to the fact that I use an ECN account (which in this case in practice means that the broker doesn't use a dealing desk but the account is directly connected to the liquidity provider and the markets through the ECN network).

As the broker doesn't have dealing desk, it might not be able to buy / sell positions at any given time (for example at unliquid time). In this system, it hasn't affect that much opening the positions, but closing positions yes. So when the EA tries closing a position, the broker's server might not be able to do that immediately, so if the position was for example a 0.05 lot position, it might close only a part of that position. But, in order to do that, the broker's server needs to "create new positions" that have a unique ID. Fundamentally those positions are the same as the originals, just partially closed - but they have a unique ID and therefore they appear separately in the account history. Those positions might be open just not even for a second (therefore it seems the positions were open for 0 seconds), just long enough until the broker's server finds the liquidity to close the rest of the position. Also the opening and sometimes closing prices of those positions look really weird, because they usually have the opening price of the original position (which is, of course, not the price that is really available at the market at the time).

Don't ask me why my broker does that technically in a "weird way" of creating those positions with unique ID, and don't ask me if other brokers do that (I haven't seen that on my accounts on other brokers, but that doesn't mean it couldn't happen), but with this particular strategy it's been happening quite a bit lately.

Hope this helps!

As the broker doesn't have dealing desk, it might not be able to buy / sell positions at any given time (for example at unliquid time). In this system, it hasn't affect that much opening the positions, but closing positions yes. So when the EA tries closing a position, the broker's server might not be able to do that immediately, so if the position was for example a 0.05 lot position, it might close only a part of that position. But, in order to do that, the broker's server needs to "create new positions" that have a unique ID. Fundamentally those positions are the same as the originals, just partially closed - but they have a unique ID and therefore they appear separately in the account history. Those positions might be open just not even for a second (therefore it seems the positions were open for 0 seconds), just long enough until the broker's server finds the liquidity to close the rest of the position. Also the opening and sometimes closing prices of those positions look really weird, because they usually have the opening price of the original position (which is, of course, not the price that is really available at the market at the time).

Don't ask me why my broker does that technically in a "weird way" of creating those positions with unique ID, and don't ask me if other brokers do that (I haven't seen that on my accounts on other brokers, but that doesn't mean it couldn't happen), but with this particular strategy it's been happening quite a bit lately.

Hope this helps!

Sep 18, 2020 at 06:31

(已编辑 Sep 18, 2020 at 07:00)

会员从Jul 21, 2010开始

119帖子

Thanks for answer.

I understood, this explain a lot, I've seen this behaviour on huge accounts with big sizes to close (100 lots up), I never see it with small accounts like yours, thanks for the explanation.

I have this EA too, may I ask you what settings are you using? Are you using just the pre built Half Grid or did you do some modification to the settings?

What timeframe do you use for each pair? H4 or H1? and what risk setting? (0.2?)

Have you ever stopped the EA on some pair because of the market volatility or ever closed trades manually?

I understood, this explain a lot, I've seen this behaviour on huge accounts with big sizes to close (100 lots up), I never see it with small accounts like yours, thanks for the explanation.

I have this EA too, may I ask you what settings are you using? Are you using just the pre built Half Grid or did you do some modification to the settings?

What timeframe do you use for each pair? H4 or H1? and what risk setting? (0.2?)

Have you ever stopped the EA on some pair because of the market volatility or ever closed trades manually?

Sep 18, 2020 at 09:35

会员从Feb 12, 2020开始

24帖子

Hey,

Yea, I believe you are right, it should mainly happen in very big accounts that require much more liquidity. I am sometimes wondering why it happens with my account, is there something wrong with the liquidity provider of my broker or what - but I guess that's a question you don't get answered really easily, as I suppose it goes to the information that brokers & liquidity providers protect because it's so deep in their competitive edge in the market.

Yea, I believe you are right, it should mainly happen in very big accounts that require much more liquidity. I am sometimes wondering why it happens with my account, is there something wrong with the liquidity provider of my broker or what - but I guess that's a question you don't get answered really easily, as I suppose it goes to the information that brokers & liquidity providers protect because it's so deep in their competitive edge in the market.

Sep 18, 2020 at 09:37

会员从Feb 12, 2020开始

24帖子

My Half-Grid system is working in the default setting of Half Grid strategy that comes together with the latest stable version of Flex EA (4.66). When you install the EA on the chart and go to its input settings, you'll be able to choose from several different default strategies on a dropdown menu - and the strategy, 'Half-Grid', will be one of those in the menu. Beside that choice, I haven't changed a single thing in the settings. I'm running it on H4 timeframe. The MM risk setting is at 0.2.

I've never stopped the EA, but I have planned to do so if the market went crazy one day again the way it did in the beginning of March this year. That would require all the markets, equities etc going crazy as well. I do monitor it closely, and I have certain criteria when I (rarely) close positions manually.

My understanding is that the broker you run it at matters to the success (however, I haven't tried it with different brokers so can't really give my personal perspective on it) - in my case FXOpen ECN account has worked super well, that environment works for the EA and the strategy very well, and the EA's entries and exits work always amazingly accurately & efficiently.

Additionally, I'm using one of the VPS services Steve, the father of Flex EA is recommending, the Hostwinds. I don't know if that affects the environment the EA does trading (it should mainly affect the latency, and so the impact should be minimal), but there's that as well.

Make sure you are also using it in the currency pairs Steve recommends as a default for all of Flex EA strategies (10 different pairs).

Hope this helps!

I've never stopped the EA, but I have planned to do so if the market went crazy one day again the way it did in the beginning of March this year. That would require all the markets, equities etc going crazy as well. I do monitor it closely, and I have certain criteria when I (rarely) close positions manually.

My understanding is that the broker you run it at matters to the success (however, I haven't tried it with different brokers so can't really give my personal perspective on it) - in my case FXOpen ECN account has worked super well, that environment works for the EA and the strategy very well, and the EA's entries and exits work always amazingly accurately & efficiently.

Additionally, I'm using one of the VPS services Steve, the father of Flex EA is recommending, the Hostwinds. I don't know if that affects the environment the EA does trading (it should mainly affect the latency, and so the impact should be minimal), but there's that as well.

Make sure you are also using it in the currency pairs Steve recommends as a default for all of Flex EA strategies (10 different pairs).

Hope this helps!

Sep 20, 2020 at 06:59

(已编辑 Sep 20, 2020 at 07:07)

会员从Feb 12, 2020开始

24帖子

togr posted:

It is a martingale

Though the results are stable

And the broker is well known

I think I know what you mean, although technically this is not martingale, as it's a grid strategy. Martingale is based on always doubling the position size in a losing bet - which this system or other grid strategies don't do and due to their technique can have the possibility for being more stable than martingale that isn't very systems intelligent. Definition of grid strategy: https://www.investopedia.com/terms/g/grid-trading.asp#:~:text=Grid%20trading%20is%20when%20orders,incrementally%20increasing%20and%20decreasing%20prices.&text=For%20example%2C%20a%20forex%20trader,15%20pips%20below%20that%20price.

By definition this strategy is an 'against-the-trend grid', with a virtual stop-loss set. Although it does vary the strategy in it's own way, the grid for example is not set evenly only by number of certain pips of movement, the entries (and exits) are very controlled and based on price action, indicators etc.

And martingale definition to compare: https://www.investopedia.com/articles/forex/06/martingale.asp

There are plenty of other similar averaging based strategies, Martingale is just one of those and has the so called "bad reputation"

Sep 22, 2020 at 20:18

会员从Sep 22, 2020开始

3帖子

The progress of your account looks impressive.. Hope all goes well for you. However im wondering to what virtual stop-loss you are referring to. The default Half-Grid strategy (except progressive) uses a stop loss of "DD_StoplossPct=100.0".. Which means if things go south the whole accounts capital is at risk. Also, on most set files for half-grid, the risk is 0.5. Is there something im missing here? Would appreaciate if you would shed some light into this. Thank you!

Sep 23, 2020 at 08:40

会员从Feb 12, 2020开始

24帖子

Lenny89 posted:

The progress of your account looks impressive.. Hope all goes well for you. However im wondering to what virtual stop-loss you are referring to. The default Half-Grid strategy (except progressive) uses a stop loss of "DD_StoplossPct=100.0".. Which means if things go south the whole accounts capital is at risk. Also, on most set files for half-grid, the risk is 0.5. Is there something im missing here? Would appreaciate if you would shed some light into this. Thank you!

Hi,

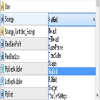

Yes, I can shed light on that. As said earlier, I have left the absolute default Half-Grid settings on. I have FlexEA version 4.66 (which was the last stable version when I started to use Flex - now it seems they might start calling some of the newer versions the 'stable version'). I am using the strategy settings that come with basic, default Half-Grid strategy when you don't load any set files but just with the default EA select it from the dropdown menu from the settings (see screenshot attached) - I'm not using any of the 'recommended settings' from the guide or anything like that. I'm not sure how those settings appear to you guys, but at least that's exactly how they appear to me. For those defaults were (and still are, see the screenshots attached) 'DD_StoplossPct=35.0' and 'Risk_=0.2'.

Maybe I was lucky with the default settings, but they are just the perfect ones for my style and current risk-taking level. I would not use even a single bit more risk (in fact, I plan in the near future to create way lower risk versions in parallel to this system) nor would I set the 'DD_StoplossPct' any higher. Why? Because the strategy works in my opinion amazingly this way. With 35% I give (more than) enough 'room' for the strategy to breathe. It's a grid based strategy, so its 'weakness' is that eventually it's going to hit that 35% DD, it just will, it's a statistical fact. I don't expect that to happen (hopefully) not even every year, but it will - eventually. It's vital that at that point you don't blow your account, and 35% is just the right number for me, because it's coverable, and the strategy just works so well, that at least with the current market conditions. With how the strategy works right now, that 35% loss would be recovered in 2,5 months. If for some reason the DD happened on two currency pairs at the same time (even more rare I'd estimate, or even 'ALMOST never happens' kind of thing), the recovery time from 70% DD would be 7 months. However, the whole idea of making "parallel, way lower risk versions" of this strategy would be to run the strategy on a bigger account, minimizing the recovery times.

There doesn't exist a "perfect strategy", but there do exist many "good enough" strategies. I believe this is one of them.

Hope this helps!

Sep 23, 2020 at 22:22

会员从Sep 22, 2020开始

3帖子

Thank you very much for the transparency and the insight.. I agree with you about the risk tolerance and i wouldnt want it to be any higher as well. I hope you re right about the fact that a stop out happens very rarely to 2 pairs simultaneously, cause trading 10 pairs means also more exposure.. so im still a bit sceptical considering the facts. I also have high hopes for this EA and hope that we can all profit from it. Wish you good luck!

Sep 24, 2020 at 04:10

(已编辑 Sep 24, 2020 at 04:15)

会员从Feb 12, 2020开始

24帖子

Lenny89 posted:

Thank you very much for the transparency and the insight.. I agree with you about the risk tolerance and i wouldnt want it to be any higher as well. I hope you re right about the fact that a stop out happens very rarely to 2 pairs simultaneously, cause trading 10 pairs means also more exposure.. so im still a bit sceptical considering the facts. I also have high hopes for this EA and hope that we can all profit from it. Wish you good luck!

10 pairs means more exposure, but with those settings, the EA won't trade more than two pairs from each currency at a time (for example, only two USD pairs allowed at the same time. Of course mathematically that two is enough of course for that two pair stop). If you wanted to reduce exposure to correlating pairs your could set that setting to one, but you'd also be meddling with risk reward ratio and might change the system fundamentally - I haven't tried so I wouldn't know for sure).

I know that how it's trading with my account I'm pretty confident (I was going to say I'm sure but there's nothing sure in Forex is there) the system has a long-term edge even if it did stop out - however, I do see it as a medium to long-term move for myself to "tweak" a version out of it that trades with 40% position size of it the current version and add it to the portfolio with the current version - and then as a long-term move to get a 13% version of it (these versions are only possible with a trade copier, the settings I think don't allow that natively). These versions also have much better recovery times even if a stop out in two pairs did happen. They are also "better for your stomach", meaning they would let you sleep in the night even if they stopped out on two pairs. The truth is that there are plenty of systems that can make anyone rich (if that's the goal) long-term, but most of them are too much for the most people psychologically (too large drawdowns). Ironic, isn't it? :)

Sep 24, 2020 at 11:07

会员从Sep 22, 2020开始

3帖子

Yes you re right about that 2 pairs max filter but a stop out could also occur with 2 completely unrelated pairs, but lets hope that this happens very rarely.

A trade copier would definitely be a nice solution for what you re planning, but 13% of Flexes minimum risk would also mean way less profit right? But i guess, better be safe than sorry :D

A trade copier would definitely be a nice solution for what you re planning, but 13% of Flexes minimum risk would also mean way less profit right? But i guess, better be safe than sorry :D

Sep 24, 2020 at 11:33

(已编辑 Sep 24, 2020 at 11:33)

会员从Feb 12, 2020开始

24帖子

Lenny89 posted:

A trade copier would definitely be a nice solution for what you re planning, but 13% of Flexes minimum risk would also mean way less profit right? But i guess, better be safe than sorry :D

Yes, so the whole thing is to create something for a bigger active portfolio, where you just don't want to risk 35-70% of your portfolio anymore, and you want something more stable. Because this is not a "get rich fast" game but "build a consistently profitable system" game, right? And the whole idea is to spread the risk of a portfolio between those three accounts. Getting a 19% monthly return on your whole portfolio in the long-term is just not realistic, is it? Even the best professional traders in the world are in reality doing something like max 30-50% ROI per year. I think essentially having those three versions and spreading the risk between them would mean around 7% ROI / month, which is still way more than most.

会员从Mar 31, 2016开始

1帖子

Nov 11, 2020 at 11:47

会员从Feb 12, 2020开始

24帖子

1V1MIking posted:

How many pairs do you apply this to method to?

So far its been consistent the monthly ROI is 20% thats great

Do you leave it set at 6 or do you do more pairs?

Hi!

If you read this discussion chain completely, you'll have the answer to all of your questions (and more). Hope this helps!

*商业用途和垃圾邮件将不被容忍,并可能导致账户终止。

提示:发布图片/YouTube网址会自动嵌入到您的帖子中!

提示:键入@符号,自动完成参与此讨论的用户名。