USDMXN Exchange Rate

US Dollar vs Mexican Peso Exchange Rate (USD to MXN)

-0.76% -1272.8 pips

Bid/Ask:

16.7896/16.9169

Daily range:

16.7683 - 16.9619

1 minute range

5 minutes range

15 minutes range

30 minutes range

1 Hour range

4 Hours range

Daily range

Weekly range

Monthly range

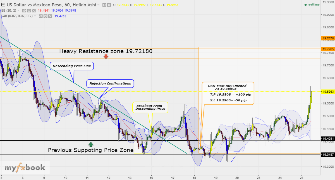

USDMXN Live Price Chart

Upcoming Events for USD and MXN

|

Event

|

Prev.

|

Cons.

|

|||

|---|---|---|---|---|---|

|

2d

Low

|

USD | $568.72M |

$240M

|

||

|

2d

Med

|

USD | ||||

|

2d

Med

|

USD | ||||

|

2d

Low

|

USD | 3% |

3.1%

|

||

|

2d

Low

|

USD | 5.155% | |||

|

2d

Low

|

USD | 5.25% | |||

|

3d

Low

|

USD | 88.5 |

88.1

|

||

|

3d

Low

|

USD | 143.7 |

143.9

|

||

|

3d

High

|

USD | 0.2% |

0.2%

|

||

|

3d

Med

|

USD | 0.2% |

0.2%

|

FRB and BREMS Interest Rates

| Country | Central Bank | Current Rate | Previous Rate | Next Meeting |

|---|---|---|---|---|

| United States | Federal Reserve | 5.5% | 5.5% | 32 days |

| Mexico | Banco de México | 11.0% | 11.0% | 47 days |

Latest USDMXN News

U.S. Consumer Sentiment Tumbles To Six-Month Low In May

A report released by the University of Michigan on Friday showed a substantial deterioration in U.S. consumer sentiment in the month of May. The University of Michigan said its consumer sentiment index plunged to 67.4 in May from 77.2 in April. Economists had expected the index to edge down to 76.0.

RTTNews

|

15h 15min ago

U.S. Weekly Jobless Claims Climb To Highest Level Since August

First-time claims for U.S. unemployment benefits rose by much more than expected in the week ended May 4th, according to a report released by the Labor Department on Thursday. The report said initial jobless claims climbed to 231,000, an increase of 22,000 from the previous week's revised level of 209,000. Economists had expected jobless claims to inch up to 210,000.

RTTNews

|

1 day ago

U.S. Weekly Jobless Claims Climb To 231,000

First-time claims for U.S. unemployment benefits rose by much more than expected in the week ended May 4th, according to a report released by the Labor Department on Thursday.

RTTNews

|

1 day ago

U.S. Wholesale Inventories Decrease 0.4% In March, In Line With Estimates

The Commerce Department released a report on Wednesday showing a pullback by U.S. wholesale inventories in the month of March. The report said wholesale inventories fell by 0.4 percent in March after rising by 0.2 percent in February. The decrease by wholesale inventories matched economist estimates.

RTTNews

|

2 days ago

Analysis for USDMXN

Keep Holding the USD Longs

The ongoing US Treasury sell-off persists, creating a sense that a significant development is on the horizon. Increased volatility across various markets and broader credit spreads strongly encourages a cautious approach. In the present economic climate, this translates to maintaining a strong position in the US dollar.

ACY Securities

|

218 days ago

FED to pause this week

The forex market had a calm start to the week but still a very busy week ahead, anticipating policy updates from the Fed (Wed), ECB (Thurs), and BoJ (Fri) in the upcoming days.

ACY Securities

|

332 days ago

Is it time to buy EURUSD?

Late cycle dollar strength meets the carry trade. I see two key themes driving FX markets in the near term. The first is central banks continuing to battle inflation, yield curves staying inverted, and the dollar continuing to hold gains. The second is cross-market volatility continuing to sink - generating greater interest in the carry trade. Expect these trends to hold into Fed, ECB and BoJ meet

ACY Securities

|

336 days ago

RBNZ to Hike 25bps

FX markets seem rather non-plussed about the threat of a US debt default. Instead, traded levels of volatility are sinking back to pre-Ukraine invasion levels.

ACY Securities

|

352 days ago

USDMXN Exchange Rates Analysis

USDMXN Historical Data - Historical USDMXN data selectable by date range and timeframe.

USDMXN Volatility - USDMXN real time currency volatility analysis.

USDMXN Correlation - USDMXN real time currency correlation analysis.

USDMXN Indicators - USDMXN real time indicators.

USDMXN Patterns - USDMXN real time price patterns.

USDMXN Technical Analysis

Technical Summary:

Sell

| Pattern | Buy (6) | Sell (8) |

|---|---|---|

| Belt-hold |

m5

|

|

| Engulfing Pattern |

m15

|

|

| Hammer |

m30

|

|

| High-Wave |

d1

|

|

| Hikkake |

w1

|

|

| Long Line |

mn

|

|

| Matching Low |

m1

|

|

| Short Line |

h4

|

m1, m15, m30, h1

|

| Spinning Top |

d1

|

w1

|

| Upside-Downside Gap Three Methods |

mn

|

|

Legend:

Buy

Sell

Neutral

Live Spreads

| Brokers | USD/MXN |

|---|---|

Open Account

Open Account

|

- |

.jpg) Open Account

Open Account

|

- |

Open Account

Open Account

|

- |

Open Account

Open Account

|

- |

Open Account

Open Account

|

- |

Open Account

Open Account

|

- |

Open Account

Open Account

|

- |

Open Account

Open Account

|

- |

Open Account

Open Account

|

- |

Open Account

Open Account

|

- |

Charts Activity

-

USDMXN,M30 by bsannik Oct 12, 2021 at 11:42

-

USDMXN,H4 by Remmy Sep 21, 2019 at 19:54

-

USDMXN,H1 by Remmy Sep 16, 2019 at 13:30

-

USDMXN,M30 by seke79 Mar 14, 2019 at 11:43

-

USDMXN,W1 by fxsniper333 Jun 20, 2018 at 15:44