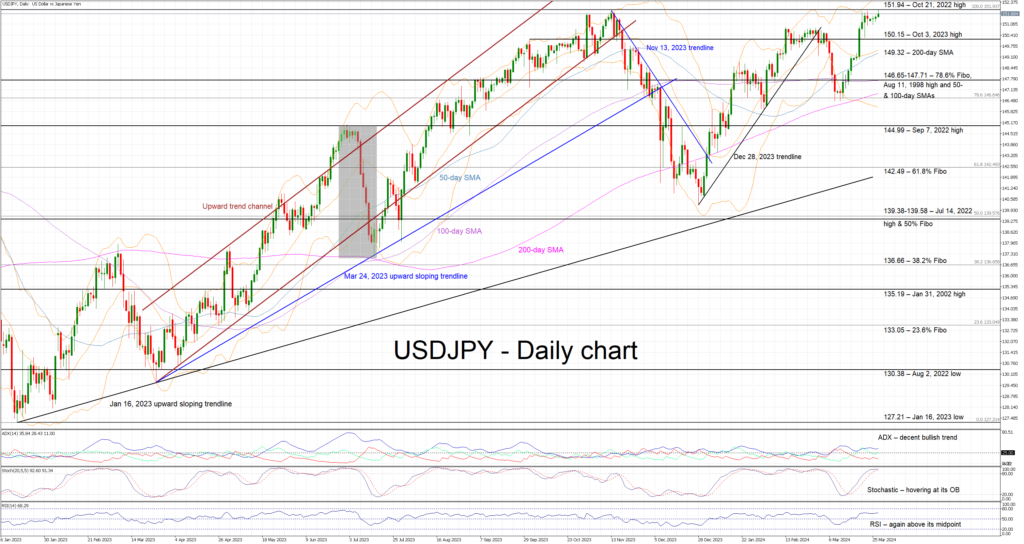

Are USD/JPY bulls ready for a new record high?

USD/JPY is continuing its journey north and it is now testing the October 21, 2022 high at 151.94 as last week’s events have probably invigorated the bulls. With the USD/JPY firmly above the 150 threshold, the intervention risk is rising although the Japanese authorities appear somewhat relaxed at this stage. Interestingly, lower liquidity this week due to the Easter break could offer a short-term breather to JPY.

In the meantime, the momentum indicators remain mostly supportive of the current rally. More specifically, the Average Directional Movement Index (ADX) is trading sideways, above the 25 threshold, and thus signalling a weak bullish trend in USD/JPY. Similarly, the RSI is comfortably above its 50-midpoint, but it appears unable to record a higher high. More importantly, the stochastic oscillator is hovering inside its overbought (OB) territory. It can stay there for a while before attempting a break below both its moving average and OB area.

Should the bulls remain confident, they could try to lead USD/JPY above October 21, 2022 high at 151.94 and record a new 34-year high. The next plausible target could be at the 155 area which will most likely provoke stronger commentary from Japanese officials and increase the chance for an actual market intervention.

On the flip side, the bears are keen to retake market control and push USD/JPY back below the October 3, 2023 high at 150.15 and towards the 200-day simple moving average (SMA) at 149.32. If successful, they could then have a go at testing the support set by the much busier and more important 146.65-147.71 range. This is populated by the 78.6% Fibonacci retracement of the October 21, 2022 - January 16, 2023 downtrend, the August 11, 1998 high, and the 50- and 100-day SMAs. Hence, a move below this range could prove significant from a momentum perspective.

To sum up, USD/JPY bulls are vying for a new higher high amidst lower liquidity and without provoking a strong response from the Japanese authorities.