Bitcoin completes consolidation, but no FOMO on the horizon

Bitcoin completes consolidation, but no FOMO on the horizon

Market picture

Bitcoin has added 4.4% in the past 24 hours to $20.2K, with the primary growth momentum during the NY session. Interestingly, growth did not pick up in early trading in Asia as it does frequently. On the contrary, there was a trend of cautious profit-taking.

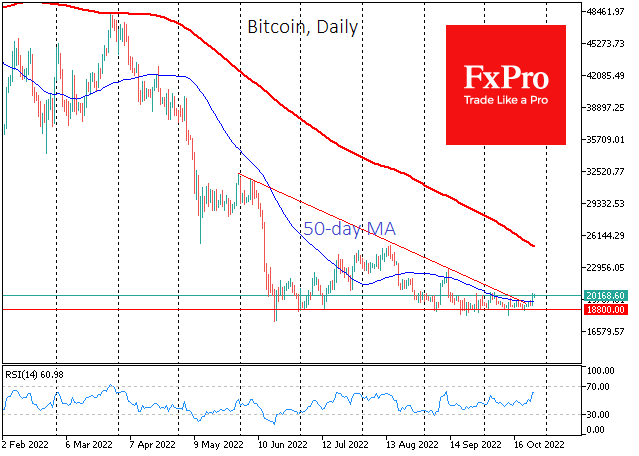

Now on the daily charts of BTCUSD, there is a bullish picture, which we warned about earlier. The descending triangle has resolved with a growth impulse on higher volumes. As a result, the price surpassed and closed the day above the 50-day moving average and previous local highs at $19.6K.

However, bulls should be aware that the current situation is more like February 2019, when the cyclical bottom has been passed. Still, a FOMO rally is not yet on the horizon, as it was in October 2020, the last time we saw the start of a broad bullish rally in cryptocurrencies.

News background

Michael van de Poppe – founder and CEO of Eight – believes bitcoin will rise to $30K as early as November. BTC's possible rise is also supported by the asset's exodus from centralised exchanges.

According to audit firm KPMG, 58% of family offices and high-net-worth investors in Hong Kong and Singapore intend to invest in cryptocurrencies. Despite the interest, large investors' investments in crypto assets remain relatively small (less than 5% of their portfolio).

Bank of America points to the increasing correlation between gold and bitcoin prices. The cryptocurrency's limited issuance creates an environment where demand for BTC will increase.

Cryptocurrency supporter Rishi Sunak became prime minister of the UK on Tuesday. In his previous role as Chancellor of the Exchequer, he is remembered for his benevolent attitude towards digital assets.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)