Crypto market: a bullish calm

Market picture

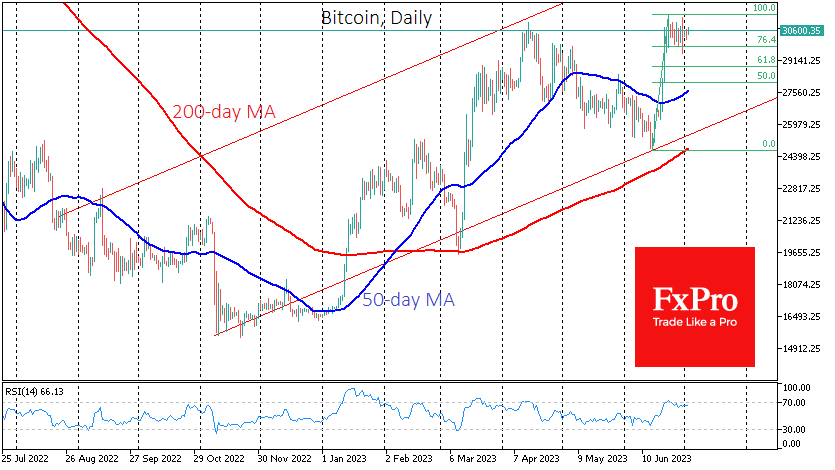

Bitcoin closed last week at zero, failing to move meaningfully away from the $30K level on good news about spot ETF bids or terrible news about SEC claims against it. As a result, the exchange rate is stomping around $30.6K on Monday. Ethereum has added 4.3% in seven days, to $1960. Other leading altcoins from the top 10 are adding between 0.5% (XRP) and 25% (Solana).

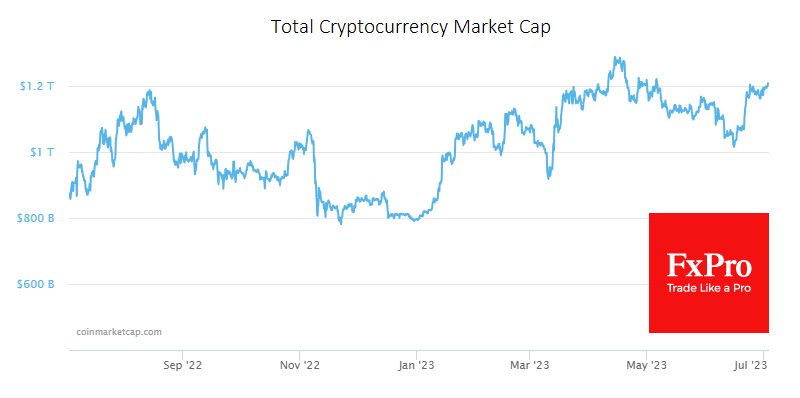

The total capitalisation of the crypto market, according to CoinMarketCap, rose 2.5% to $1.207 trillion for the week.

On the tech analysis side, Bitcoin has been consolidating in a sideways range for the past ten days, cooling off after jumping 5k up from local lows in June. Only a consolidation outside the $30-31K range would signal that the market has decided on a medium-term direction for a breakout. The long-term trend has been bullish since last November, within which severe drawdowns sometimes occur.

In terms of seasonality, July is considered quite successful for BTC. Over the past 12 years, bitcoin has ended the month up eight times and down four times. The average rise was 22.3%, and the average decline was 8.8%.

News background

Bitcoin rises predominantly during the US session thanks to institutional investors, K33 Research noted. It also expects growth to continue as BTC attracts major investors such as BlackRock, Fidelity, and Citadel. In addition, BTC has had little correlation with the stock market of late. The correlation has turned negative for the first time since January 2021.

Fred Thiel, CEO of mining company Marathon Digital, also noted the declining correlation between bitcoin and gold, which investors see as financial risk hedges.

Bids for spot bitcoin-ETFs from BlackRock, Fidelity and others have not been "clear and comprehensive" and have not included sufficient information regarding the so-called joint monitoring agreement or details of the mechanism; the SEC told the Nasdaq and CBOE exchanges, the Wall Street Journal reported citing sources. The CBOE plans to update and resubmit the documents.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)