Cryptocurrencies wait for a signal

Market picture

Cryptocurrency market capitalisation fell 2% over the week to $1.12 trillion, mostly fluctuating between $1.11 trillion and $1.14 trillion. The market is in no hurry to pick a trend, bringing the cap back into its chosen range and moving on to news of the US debt ceiling and the Fed's next move.

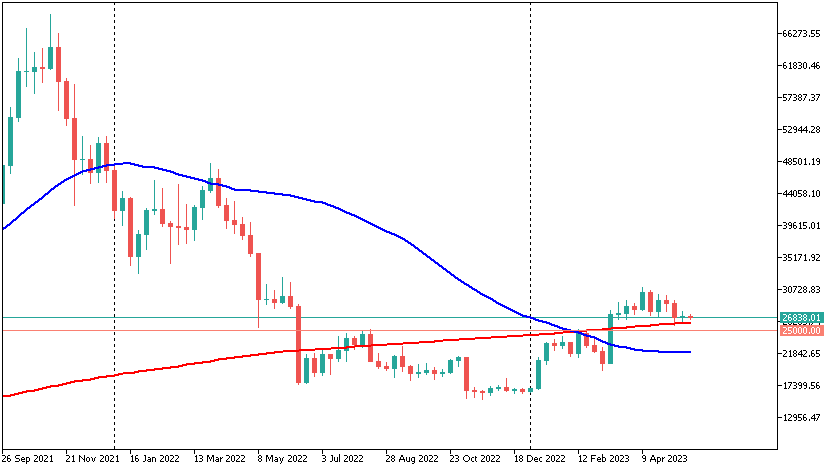

Bitcoin is back below $27K this new week, finding support from buyers on dips to the 200-week moving average, which is a notable indication the market still believes in the return of a long-term uptrend in Bitcoin. It is also a bullish signal for the cryptocurrency sector.

On the other hand, if Bitcoin fails to push back from this support soon, it will be an excuse for the bears to increase the pressure.

Ethereum has been treading water for around $1810 all last week, clearly waiting for an outside signal. Other top ten altcoins showed mixed dynamics, ranging from a 4.6% drop (Solana) to an 8.5% rise (XRP).

News background

Crypto whales could soon start selling Bitcoin, according to Lookonchain. Experts have highlighted the transfer of 1,750 BTC to the Binance exchange. The pressure will mount if other holders follow suit.

Robert Kennedy Jr, US presidential candidate who has consistently supported digital assets, called Bitcoin "an exercise in democracy". The politician has pledged to protect the rights of Bitcoin owners and miners if he is elected the next US president.

Heisenberg Capital founder Max Keiser agreed with SEC chief Gary Gensler that all crypto assets other than bitcoin should be considered securities. He cited the example of El Salvador, where BTC has been legalised, and this adoption model could become the standard.

MicroStrategy founder Michael Saylor said the company wants to use the Ordinals protocol to build applications. He believes that Bitcoin NFT technology has the potential to drive innovation in the digital asset market.

A 30% tax on cryptocurrency mining proposed by US President Joe Biden would force the industry offshore, said Marathon Digital CEO Fred Thiel.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)