Dollar suffers as risk appetite takes hold

From bunk-busters to truce in just three days

Following Sunday’s events, when the US intervened in the Israel-Iran conflict by attacking three of Iran’s top nuclear facilities, and yesterday’s Iranian retaliation on US military bases in the Middle East, developments have taken an unexpected twist, as markets are waking up to news that Israel and Iran have agreed to a ceasefire after 12 days of hostilities.

Despite some last minute shenanigans from the Iranian side, which has arguably suffered the most casualties and damages, the Iranian Foreign Minister announced the start of the ceasefire. However, there is a decent probability that either side may not fully respect the agreement, potentially triggering another round of attacks.

Several questions arise from the latest events, ranging from the actual damage made on Iranian nuclear facilities on Sunday, to Russia's role in the ceasefire following the Iranian Foreign Minister’s visit to Moscow on Monday, and to Trump thanking Iran for the early notice regarding Monday’s attack on a US base in Qatar. Having said that, the latest developments are clearly risk-positive for markets.

Risk-on reaction in markets

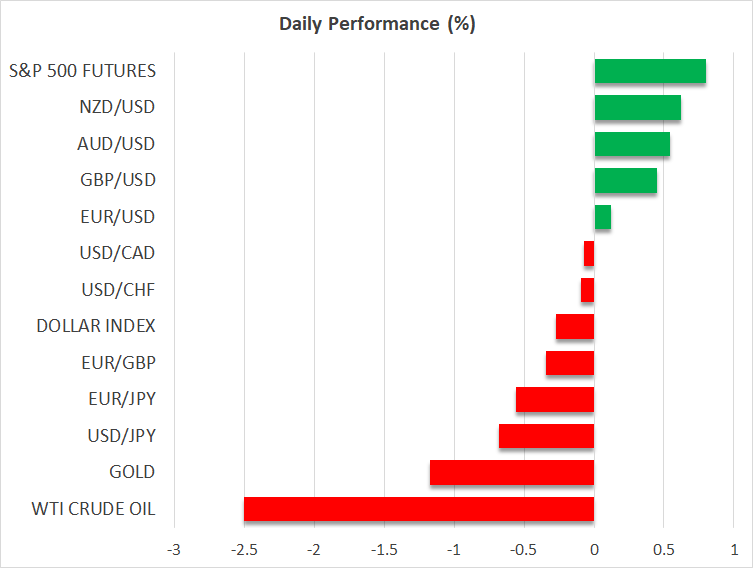

Expectations of a soft reaction from Iran to Sunday’s US attacks and the announcement of the ceasefire have boosted US stock indices, with the S&P 500 climbing comfortably to its highest level since February 21 and within touching distance of the all-time high of 6,147. Similarly, bitcoin is also in the green, hovering around the $105k level and pulling the cryptocurrency market higher.

Gold is suffering losses at the moment, edging towards the $3,220 area, despite having failed to gain during the 12 days of hostilities. Notably, oil is trading around $66.90 at the time of writing. It has erased its recent double-digit gains in just two sessions, with Monday’s 14% intraday drop being the biggest since March 2022.

Attention shifts to tariffs and the Fed

With the recent muted safe haven flows diminishing, the dollar has resumed its pre-Israel-Iran trend of underperformance. Euro/dollar has climbed above 1.16 again, fully erasing its recent correction, as the focus shifts to tariffs and central banks’ outlook, assuming the ceasefire holds.

After saving the world, Trump will be forced to deal with the lack of trade agreements, as there has been just one so far. With the July 9 deadline fast approaching, an extension appears to be almost a certainty.

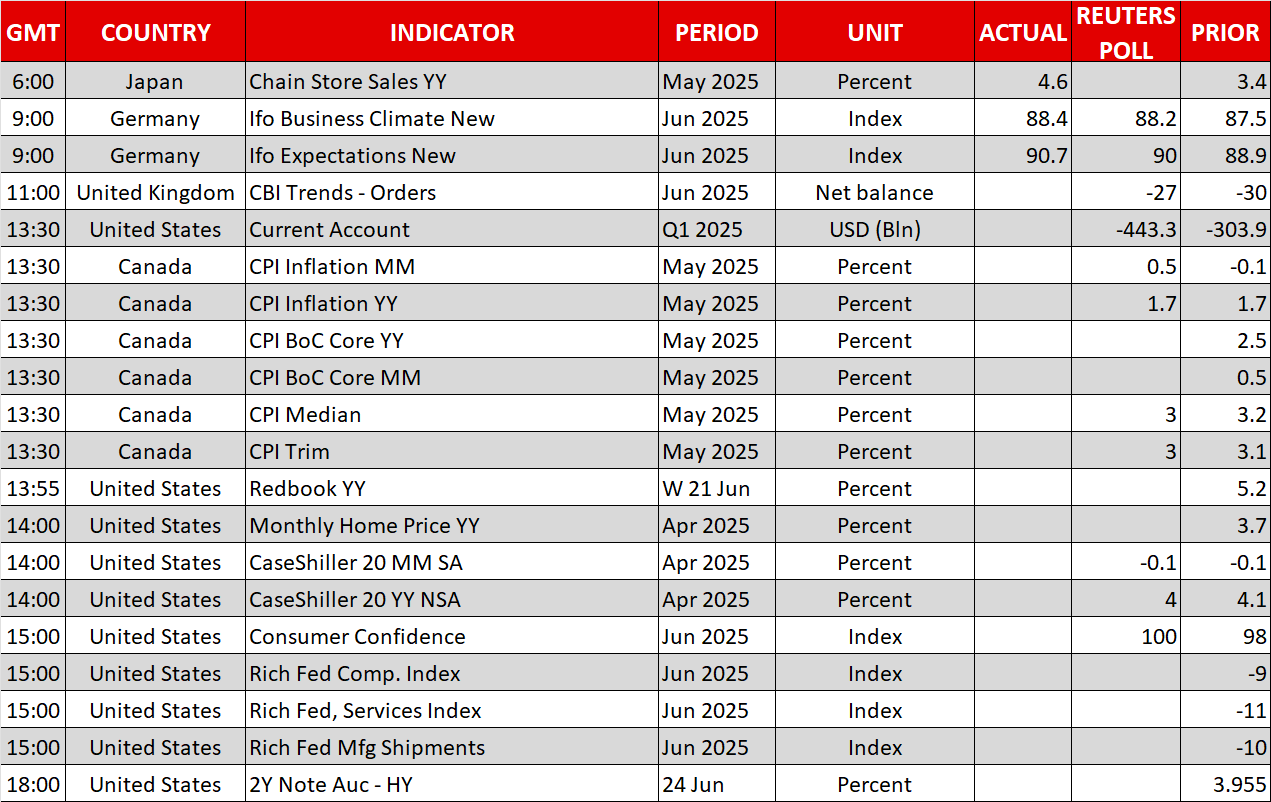

Interestingly, while four Fed members will be on wires today, investors will focus on Fed Chair Powell’s semi-annual monetary policy report testimony before the House Financial Services Committee today. A similar testimony at the Senate Banking Committee will take place on Wednesday.

Powell's testimony in focus

The last Fed meeting did not rock the boat, as the FOMC remains comfortable in keeping monetary policy steady over the summer until the tariff dust settles. However, a rift is developing within the Fed, with the more dovish members openly arguing in favour of rate cuts soon. Following Fed Governor Waller’s comment last Friday that “the Fed should cut rates as soon as its next meeting in July”, Fed Governor Bowman concurred on Monday, stating that she “would support a cut in July if inflation remains subdued”.

With Trump continuing to both name-call and blame Powell for the increased interest rate costs faced by the US administration, tensions within the Fed could rise further going forward. Powell will most likely be asked about this emerging Fed rift and Trump’s stance at today’s testimony, but the Fed Chair is expected to remain focused on monetary policy analysis, though he might highlight the lack of progress on the tariff front clouding the Fed rate outlook.

.jpg)